Crisis Alpha

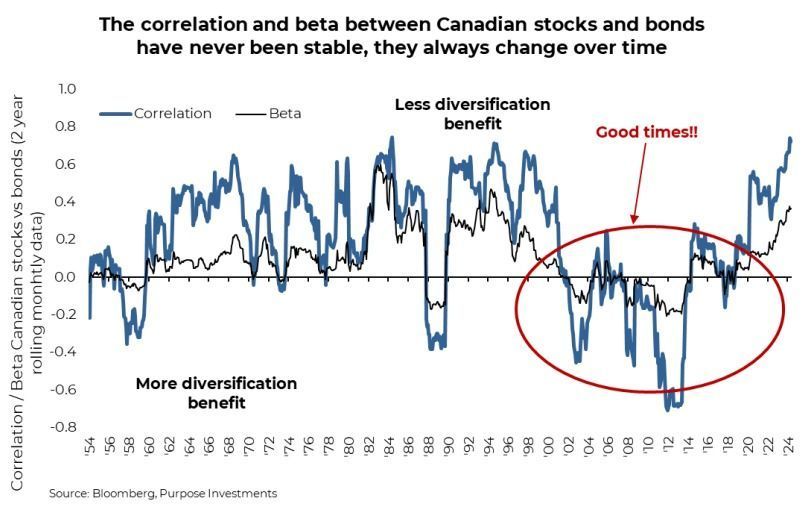

One challenge is that while portfolio construction is often based on as long a historical time period as possible, things never remain static. Markets evolve and change over time, relationships change, and the available tools in the portfolio construction toolbox also change over time. One recent change that has been a challenge is the bond/stock correlation. After a couple of decades of very low or even negative correlations between these two core building blocks, correlations are back to being positive.

The following chart shows the 2-year monthly correlation between Canadian equities and bonds. It looks rather similar for the U.S. and global markets, but we just thought some Canadian content would be nice. The higher correlation means that, more often, equities and bonds are moving in the same direction. Nobody complains when both are moving higher, like in the past 12 months, but when they move lower together, everyone starts getting grumpy, like in 2022. The 2nd line, beta, measures not just the direction of the two asset classes but the magnitude of the relative move.

This higher correlation has many portfolio construction practitioners looking for different sources of diversification. Of course, the proliferation of different tools has augmented this behaviour as well. Many have lower correlations, but we would caution this as the main driver of a decision.

Why do we care about correlation? In 2022, you couldn’t go a day or two without seeing an article talking about the 60/40 being dead due to higher correlations between bonds and stocks. And yet, the correlation is higher today and much fewer articles. That’s because nobody cares when equities and bonds are moving higher in unison, only when moving lower together. So, maybe we need some additional measures to augment correlations.

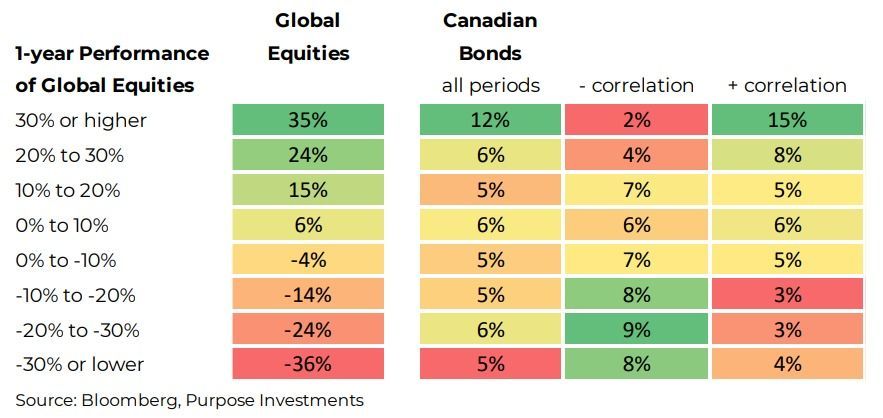

Here is a good lens. Using data back to the 1950s, we looked at the one-year returns for global equities and broke them down into return range buckets. Truthfully, who cares what their bonds are doing when stocks are up 20 or 30%? But we do care much more when stocks are down -20 or -30%. More impactful – bond returns were further split from periods with negative bond/equity correlations and those with a positive correlation (last two columns).

No denying periods with a negative bond/equity correlation that bonds are a better stabilizer during down markets. Eyeballing it, one could argue twice as good. But even when positively correlated, bonds, on average, are a decent stabilizer. Of course, these are averages that can hide a lot of information. There were 103 instances in which global equities were down on a 1-year basis simultaneously when the bond/equity correlation was positive. Bonds were higher in 77% of those instances. That hit rate moves up to 86% if you include periods when bonds were down minimally (less than -2.5%). Bonds, not broken.

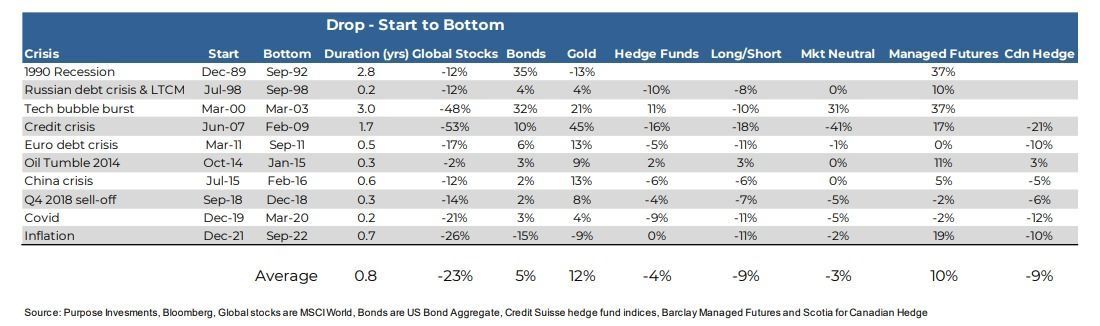

Another useful lens is ‘Crisis Alpha.’ This is looking at an asset class or strategy’s performance during periods of stress in the market. Could be a short-term correction or a longer-term bear market. If you can add value during these periods, or at least stability, that has positive attributes for portfolio construction.

Based on this, one could make a case for managed futures, more market neutral, and a splash of gold to better diversify a portfolio. But don’t forget these are crisis periods, and there is a whole lot of time between crises. Global stocks suffer, yet over the past 20 years, they have compounded around +8%. That market neutral index has only grown at a 0.8% annualized pace over the past two decades. And the managed futures index is a bit better at 3.6%. Defence often comes at a cost.

Final Thoughts

Investors should start to think differently about portfolio construction and diversification. We do believe correlations may remain elevated for some time (a future edition will tackle this), and looking to expand sources of diversification appears prudent. Call it diversifying your diversification.

But don’t get too carried away. The simple fact is when correlations are higher, it is harder to reduce portfolio volatility. Something we may have to live with. If you go too far in trying to smooth out the ride, you may sacrifice long-term returns. Would be a bit of a pyrrhic victory to enjoy a vol of 5% if the end nest egg is smaller.

Everything in moderation – bonds still work, and some defensive diversification is clearly warranted in a more positively correlated world.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Share this post