Alternative Minimum Tax Changes – What You Need to Know

Under the existing AMT rules, the most common situations where AMT could apply is where you have large capital gains and especially if the lifetime capital gains exemption was used on a sale of qualified small business corporation shares or qualified farm and fishing property.

What is AMT?

The AMT was introduced in 1986 as a parallel tax to the regular tax system and applies to individuals, but not to corporations. In general, individuals are required to pay the higher of AMT or regular tax. To calculate the difference, first regular tax is calculated (at progressive tax rates). The next step is to calculate taxable income for AMT which is determined by adding back certain “preference” items into your regular taxable income. There is an exemption amount that is deducted from the AMT taxable income of $40,000* and any excess income is taxed at a flat tax rate of 15%* and certain non-refundable tax credits are allowed to reduce the amount of tax owing. So if your taxable AMT income is under $40,000, AMT will not apply and just the regular tax will be payable. Any additional tax paid under the AMT can be carried forward as a credit to offset regular tax for seven years. (AMT does not apply in the year of death of a taxpayer.)What are the changes?

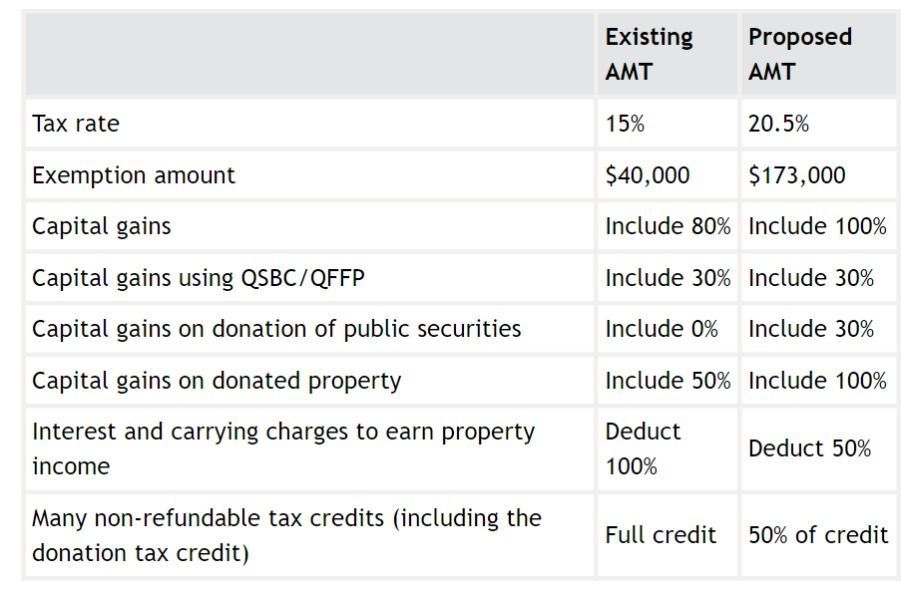

The 2023 Federal Budget has proposed changes to broaden the tax base subject to AMT, increasing the tax rate but also increasing the exemption amount. The following table highlights some of the proposed changes, but please reach out to us if you require more details.

What do you need to do?

These proposed changes could result in AMT applying if your taxable income (calculated for AMT purposes) is in excess of $173,000. In addition to being aware of the implications of AMT when there are large capital gains in a year (as well as planning for it), starting in 2024 you will also need to consider the implications of significant interest deductions (for example, if using a leveraging strategy) or large donations (especially gifts of capital property as these donations not only have the 50% limitation on the donation tax credit, but also 100% or 30% of the gain, depending on the type of property, could be included in taxable income for AMT).If you think AMT may apply to you, contact us to discuss planning options.

*$40,000 is the exemption amount as of the date of this article and the rate of tax is 15%.

Source: Charts are sourced to https://www.thelinkbetween.ca/

The contents of this publication were researched, written and produced by The Link Between (https://www.thelinkbetween.ca/) and are used by Echelon Wealth Partners Inc. for information purposes only.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates.

Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Share this post