Weekly Economics Report - April 14, 2025

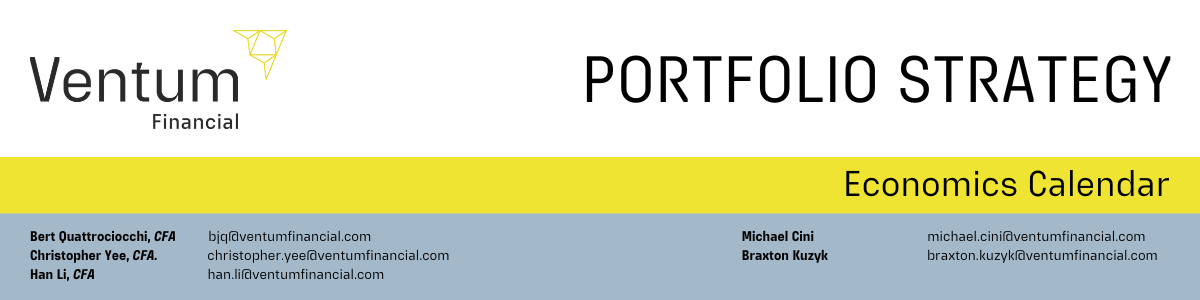

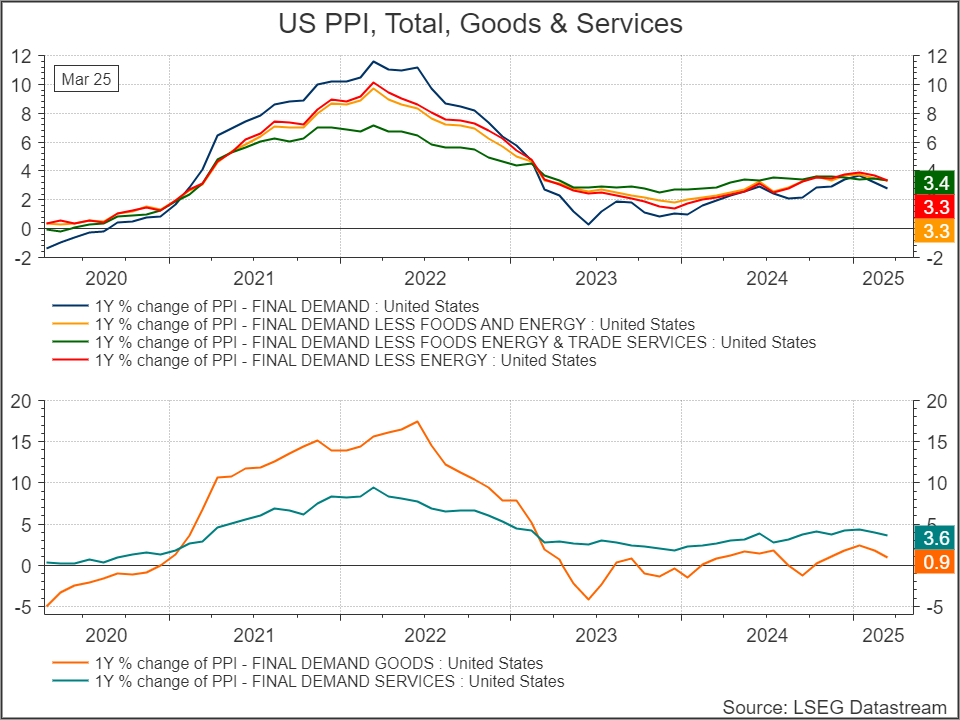

US monthly producer prices decline in March

WASHINGTON, April 11 (Reuters) - U.S. monthly producer prices unexpectedly fell in March amid a sharp decline in the cost of energy products, but tariffs on imports are expected to drive inflation higher in the coming months.

The producer price index for final demand dropped 0.4% last month after an upwardly revised 0.1% gain in February, the Labor Department's Bureau of Labor Statistics said on Friday.

Economists polled by Reuters had forecast the PPI rising 0.2% after a previously reported unchanged reading in February.

In the 12 months through March, the PPI increased 2.7% after advancing 3.2% in February.

While President Donald Trump this week delayed reciprocal tariffs on trade partners for 90 days, he boosted duties on Chinese goods to 125%. Beijing on Friday hit back with a 125% tariff of its own. A 10% blanket duty on almost all U.S. imports remains in place as does a 25% tariff on motor vehicles, steel and aluminum.

The anticipated surge in inflation could, however, be tempered somewhat by softening domestic demand, evident in March's consumer price report that showed monthly declines in airline fares as well as hotel and motel room prices.

The tariffs, which have hammered financial markets and boosted consumers' inflation expectations, have raised the odds of a recession in the next 12 months. Consumer and business sentiment have also tanked.

Minutes of the Federal Reserve's March 18-19 meeting published on Wednesday showed policymakers were nearly unanimous that the economy faced risks of simultaneously higher inflation and slower growth.

Financial markets expect the U.S. central bank to resume cutting interest rates in June after pausing in January, and reduce its policy rate by 100 basis points this year. The Fed's benchmark overnight interest rate is currently in the 4.25%-4.50% range.

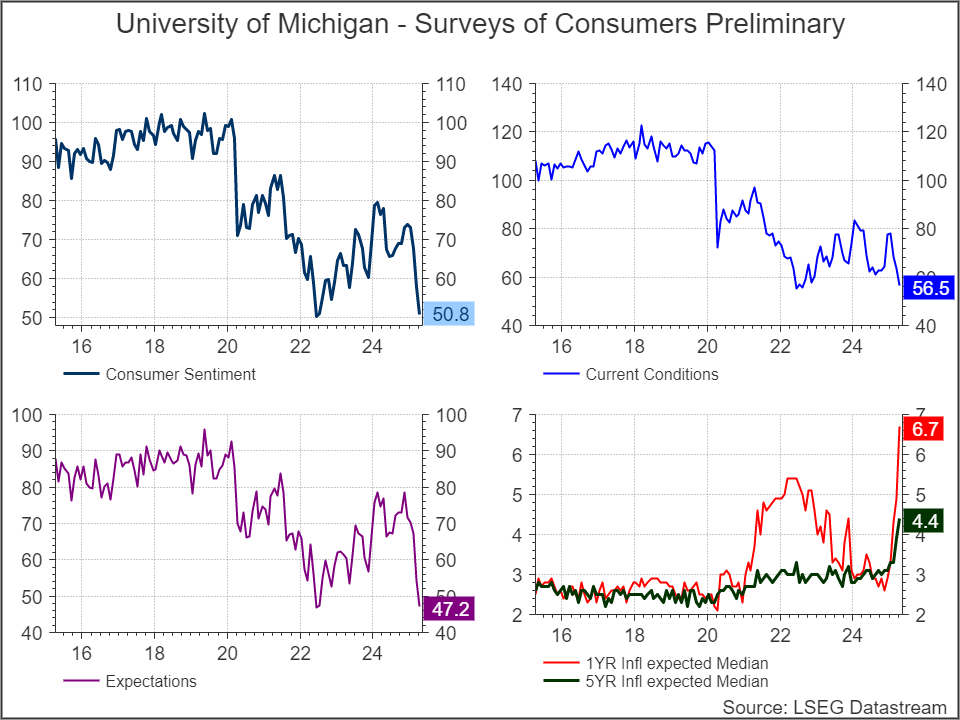

US Consumer Sentiment Falls Sharply

The University of Michigan consumer sentiment for the US plunged to 50.8 in April 2025, the lowest level since June 2022 from 57 in March, well below forecasts of 54.5, preliminary estimates showed.

Consumer sentiment fell for the fourth straight month, and has now lost more than 30% since December 2024 amid growing worries about trade war developments that have oscillated over the course of the year. Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month.

Source: Tradingeconomics.com

All about tariffs: Five questions for the ECB

LONDON, April 11 (Reuters) - The European Central Bank meets on April 17 with all focus on what tariff chaos means for how much further policymakers will need to cut rates.

U.S. President Donald Trump first announced reciprocal tariffs around the world, including 20% on the European Union, last week before suddenly dialling back those duties on Wednesday for a 90-day period,whipsawingfinancial markets. The resulting additional time to negotiate has barely relieved jittery markets and the outlook hasn't become any more certain. "It will be very interesting how they (the ECB) walk that fine line between acknowledging what needs to be acknowledged without putting too stressed a tone to it," said Morgan Stanley chief European economist Jens Eisenschmidt.

Here are five key questions for markets:

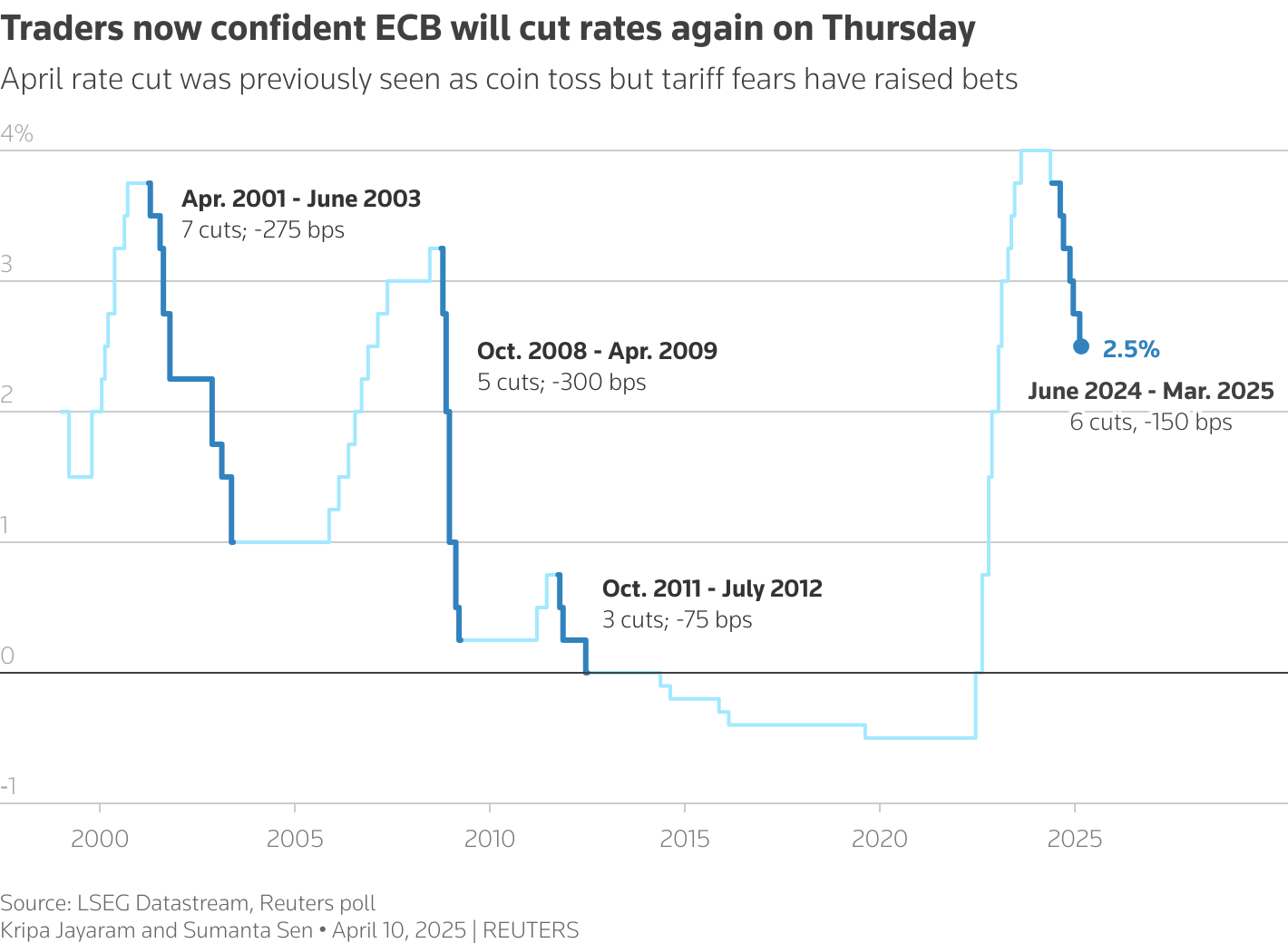

1/ Will the ECB cut rates next Thursday?

Most likely. Traders fully price a 25-basis-point cut, bringing the ECB's deposit rate to 2.25% next Thursday, a move they had seen as more of a coin toss before catching on that Trump's reciprocal tariffs were really on the way. Policymakers had previously looked more divided on an April cut, but several have since suggested that tariff developments have strengthened the case for a move.

2/ How will Trump's latest tariffs impact growth and inflation?

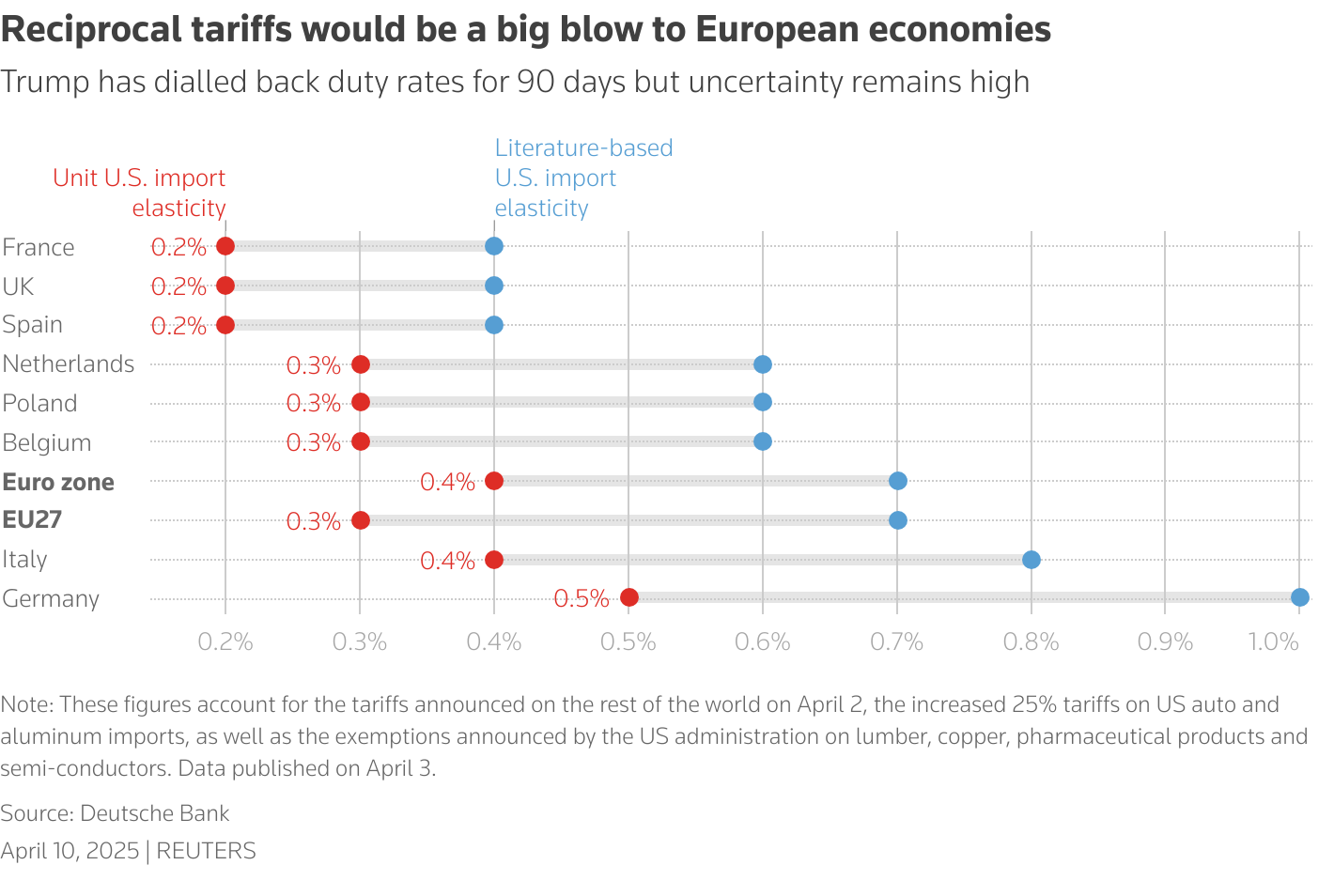

Hard to say, given negotiations ahead. But even with the 90-day reprieve, the EU is still being hit by a broad 10% tariff, not to mention higher rates on steel, aluminium and cars, so they will certainly hurt growth.

Before Trump's U-turn on Wednesday, ECB sources told Reuters a previous estimate of a 0.5-percentage-point hit to growth in the first year was too low and could even exceed 1 percentage point, which would wipe out all expected growth for 2025. The impact on inflation is more ambiguous and will depend on the degree of retaliation against Trump's tariffs and, longer term, on how fragmented global trade becomes.

But for now, oil prices have tanked 15% this month, the euro is up over 9% since the start of March while China, the biggest source of EU imports, is taking the biggest hit from tariffs, all pointing to further disinflation. "There is an across-the-board downward revision to the growth forecast and also because the euro has been so strong, which helps dampen inflation, (the ECB) can in the short-term focus on growth," said Principal Asset Management chief global strategist Seema Shah.

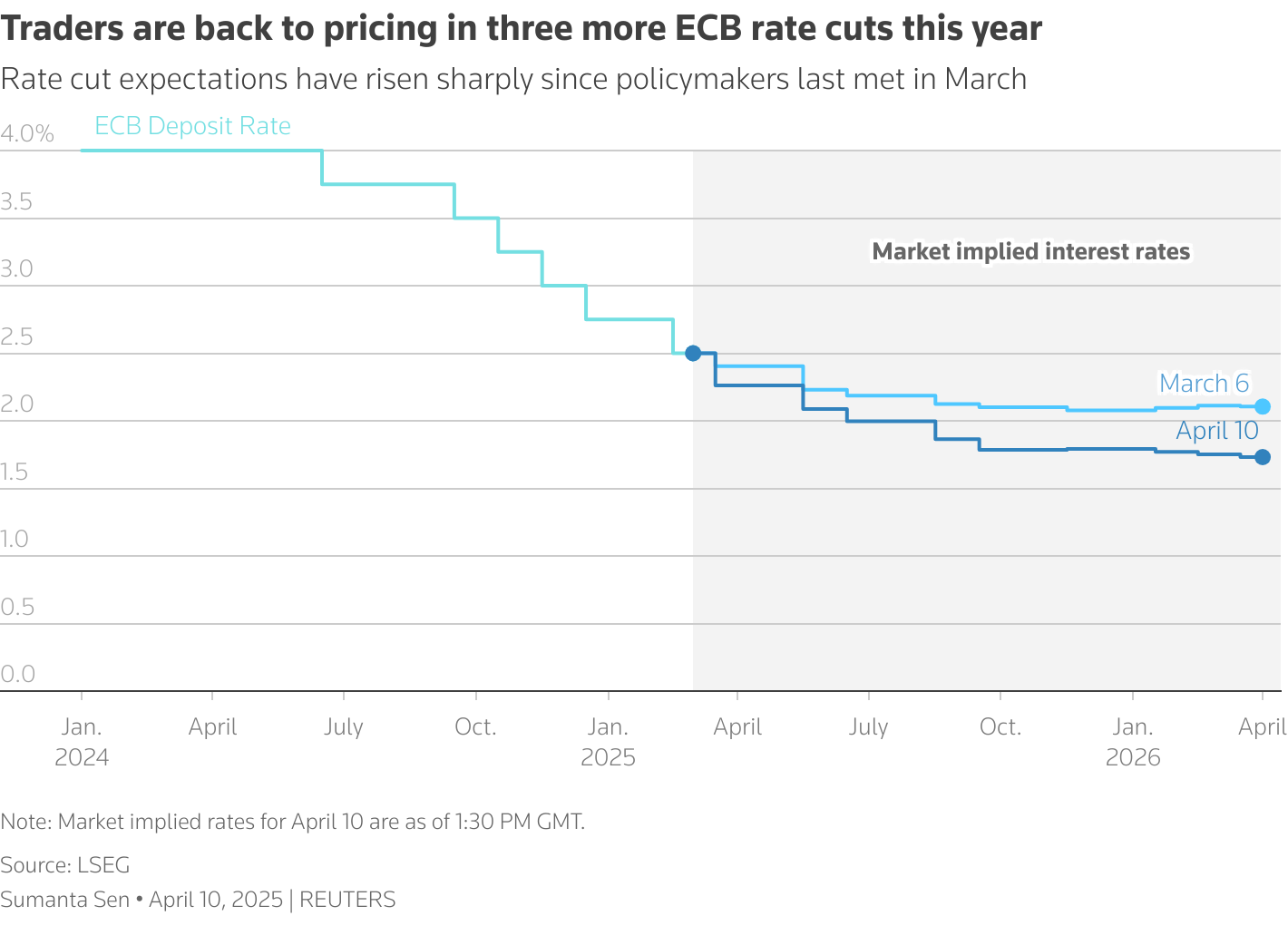

3/ So will the ECB have to speed up rate cuts?

Markets sure think so. Traders now expect the ECB to cut rates twice more this year after Thursday. That's quite a change, given they had seen less than a full chance of another move this year and priced in the chance of a 2026 hike when the bank last convened in March. But economists see a more modest path. The median expectation in a Reuters poll was for just one further cut, putting rates at 2% in the second half of the year. "The fundamental problem, that we are facing very high uncertainty as to what type of economic policy we can expect out of the U.S., that has not gone away," said Morgan Stanley's Eisenschmidt, a former ECB economist.

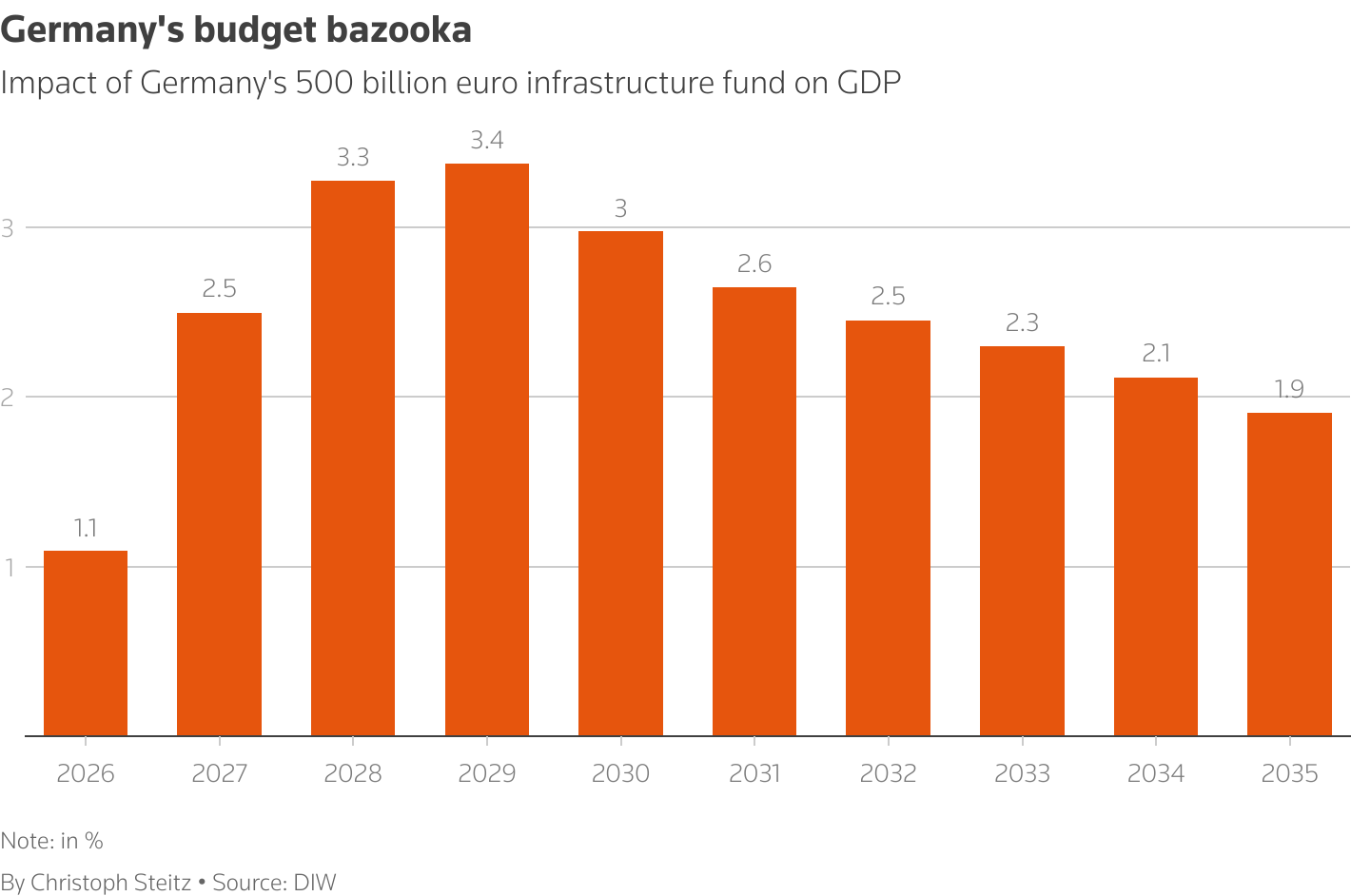

4/ Will German stimulus come to the rescue?

Not yet. Germany's historic debt-rule overhaul to ramp up infrastructure and defence spending is seen as a game changer for the European economy, but it will take time to feed through. "The economic impact of German fiscal spending is a story for 2026, not 2025," said Simon Wells, HSBC's chief European economist.

5/ How concerned is the ECB about financial stability?

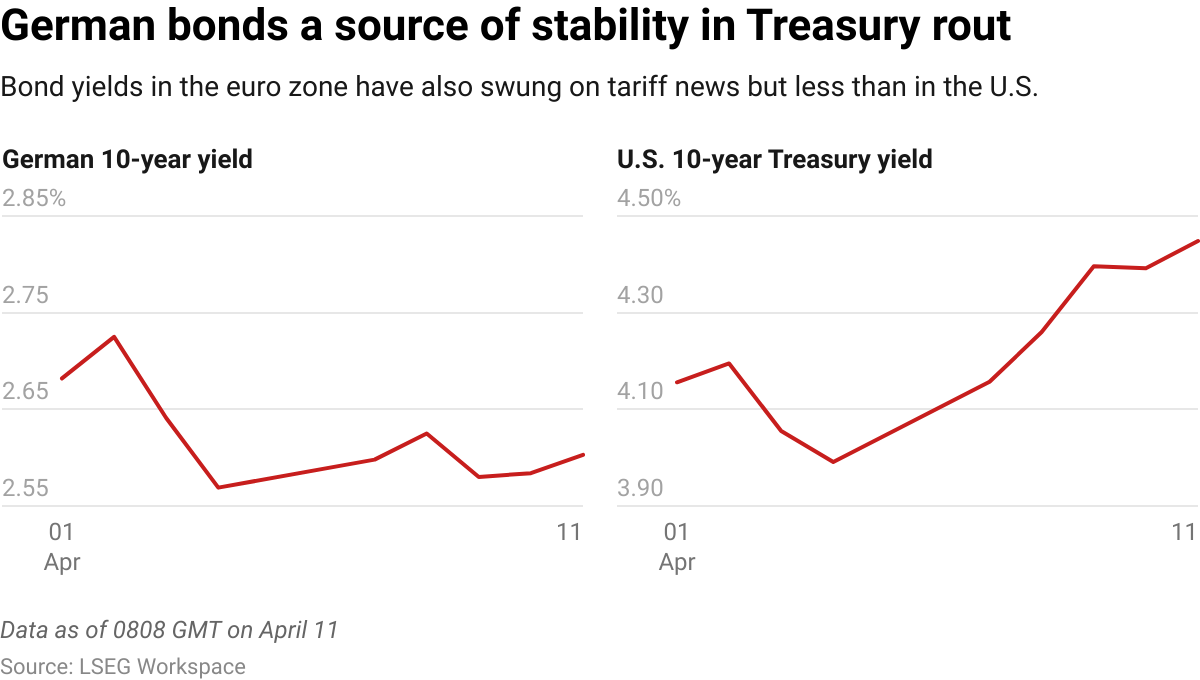

Policymakers don't seem alarmed yet, but have stepped up their monitoring of banks and markets. Euro zone bonds have also swung, but been less volatile than U.S. Treasuries, while the gap in borrowing costs between poorer member states and Germany, Europe's largest economy, has not widened to worrying levels.

But the ECB remains concerned that financial stress could spread from non-financial entities to regular lenders in periods of market stress. Hedge funds unwinding some debt-laden bets is thought to have played a role in recent volatility. "I expect them (the ECB) to say they are ready to act if volatility in the market is unjustified by the fundamentals," said Gregoire Pesques, fixed income chief investment officer at Europe's largest asset manager Amundi.

Indeed, ECB chief Christine Lagarde said on Friday the bank is ready to deploy its instruments to maintain financial stability and has a solid track record in devising new tools when required.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post