Weekly Economics Report - Mar 15, 2025

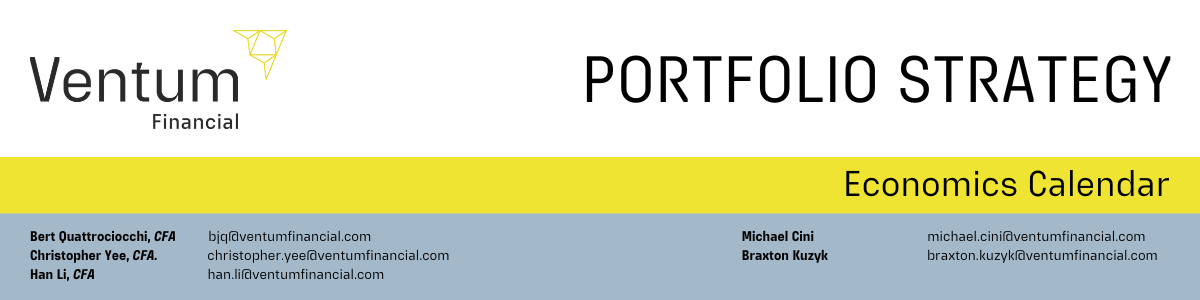

China's deflationary pressures deepen in February

BEIJING, March 9 (Reuters) - China's consumer price index in February missed expectations and fell at the sharpest pace in 13 months, while producer price deflation persisted, as seasonal demand faded and households remained cautious about spending amid job and income worries.

Beijing last week vowed greater efforts to boost consumption in the face of an escalating trade war with the U.S., but analysts expect deflationary pressures in the world's second-largest economy to drag on.

The government set the 2025 economic growth target at around 5%, unchanged from last year, while lowering the annual inflation target to around 2% from around 3% last year.

The consumer price index (CPI) fell 0.7% last month from a year earlier, reversing January's 0.5% increase, data from the National Bureau of Statistics (NBS) showed on Sunday.

It was the first contraction in the index since January 2024, and worse than a 0.5% slide estimated by economists in a Reuters poll."China's economy still faces deflationary pressure. While sentiment was improved by the developments in the technology space, domestic demand remains weak," said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management.

As exports face risks from the trade war, fiscal policy needs to become more proactive, he said, noting that China's property sector also continues to struggle. "Monetary policy also needs to be loosened further with interest rate and reserve requirement ratio cuts, as indicated by the government work report."

Core CPI, excluding volatile food and fuel prices, fell 0.1% in February, the first fall since January 2021.

Food prices fell 3.3% last month, versus a 0.4% rise in January. Lunar New Year celebrations, the country's biggest annual holiday, fell in late January compared with February last year, leading to higher food prices and tourist-related services prices in January.

NBS statistician Dong Lijuan said in a note on Sunday that the high base of last February's CPI brought about the fall of the index last month: "If excluding the impact of the different months of the Lunar New Year, CPI rose by 0.1% year-on-year in February."

On a month-on-month basis, CPI fell 0.2%, against a 0.7% rise in January and below a predicted 0.1% drop.

To revive sluggish household demand, China has doubled its allocation to an expanded consumer subsidy program for electric vehicles, home appliances and other goods to 300 billion yuan ($41.42 billion) this year.

But more profound measures to address its incomplete welfare system are still some way off, leaving consumers and businesses wary of spending amid a sputtering economic rebound. The main problems lie in "weak consumption capacity and willingness," Commerce Minister Wang Wentao said on Thursday on the sidelines of the annual parliamentary meeting.

In this year's government work report unveiled on Tuesday, consumption was mentioned 31 times, up from 21 last year, surpassing references to technology. The producer price index fell 2.2% on-year in February, easing from a 2.3% slide in January and the smallest contraction in six months, but missing the forecast 2.1% decline.

China's producer prices have been falling since September 2022.

Global tariff threats and industrial overcapacity at home are pushing Chinese exporters into price wars all over the world, forcing many of them to cut prices of their products and wages.

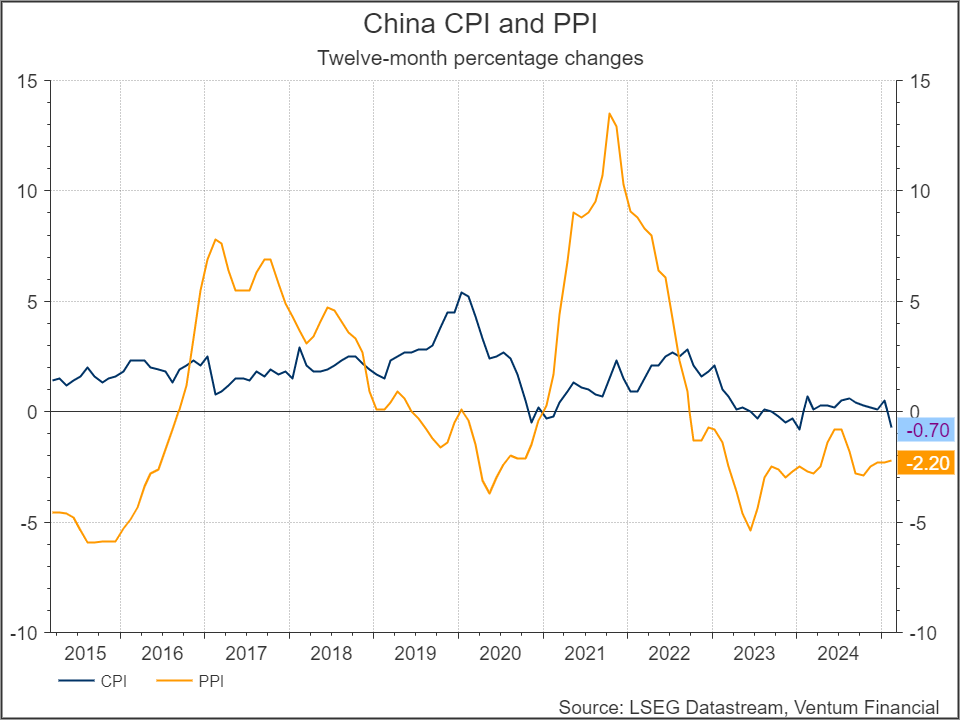

China's property sector is showing positive changes, minister says

BEIJING, March 9 (Reuters) - China's property sector is showing positive changes and market confidence is improving, its housing minister said on Sunday, as policymakers try to set a more optimistic tone for the economy this year in the face of mounting U.S. trade pressure.

The comments come after several tough years for the once high-flying real estate sector, with property investment slumping the most on record last year and property sales and new construction falling at a double-digit pace, weighing heavily on economic growth.

At a press conference on the sidelines of an annual parliament meeting in Beijing, housing minister Ni Hong said that "since January and February, the real estate market maintained a positive trend of stopping declines and returning to stabilisation."

China will not release early 2025 figures for housing sales and starts until March 17, but analysts at Nomura said in a recent note that sales and prices early this year were holding up better than expected in China's biggest cities.

Still, analysts polled by Reuters last month expect home prices to drop further this year and do not expect a market recovery until 2026.

Some analysts estimate average home prices have slumped by 20-30% since a peak in August 2021. That sparked severe cash crunches and led to incomplete projects, developer debt defaults and even public protests by homebuyers, hammering market sentiment.

Signs of stabilisation or even a mild rebound in the property market could help cushion China's economy from the impact of mounting U.S. trade tariffs on Chinese goods.

With 70% of household wealth held in real estate, which at its peak accounted for about a quarter of the economy, consumers have kept their wallets shut tight amid growing economic uncertainty.

Official data showed on Sunday that deflationary pressures deepened last month, as households remained cautious about spending amid job and income worries.

China will step up lending for so-called "whitelist" projects to help qualified developers with more financial support, and expand the scale of urban village renovation after a million units were renovated last year, Ni said.

The government's 2025 work report released last week by Premier Li Qiang said that sustained efforts are needed to stabilize the real estate market and prevent further declines. Li also pledged to push forward the construction of safe, green and intelligent "good houses".

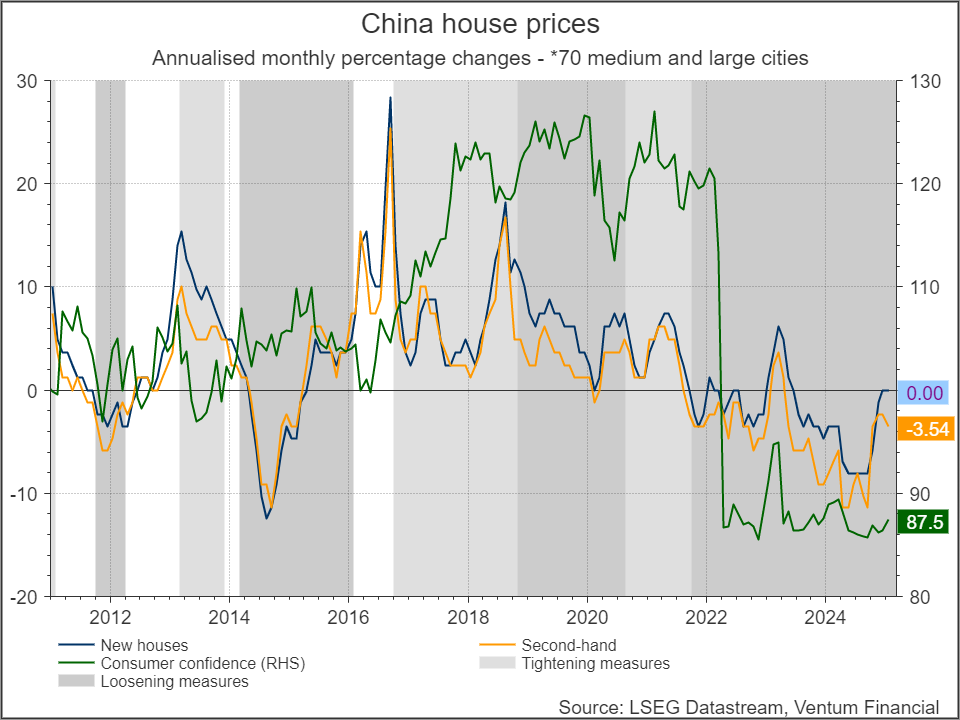

Euro zone investor morale brightens substantially in March

FRANKFURT, March 10 (Reuters) - Investor morale in the euro zone brightened substantially in March, with economic expectations hitting their highest reading since July 2021, a survey showed on Monday, as Germany's plans for new debt contributed to the positive sentiment.

The overall Sentix index for the currency union shot up to -2.9 in March from -12.7 in February, beating expectations from analysts polled by Reuters for a rise to -8.4.

The indicator focused on economic expectations for the next six months rose for a third time in a row to 18.0 in March from 1.0 the month before, according to the survey.

The survey of 1,097 investors from March 6-8 also showed the assessment of the current situation improved to -21.8 in March from -25.5 in February.

The survey cited new debt-financed investments planned for armament in Europe and in Germany, where a newly forming government wants to bump up defence and infrastructure, as behind the bump.

"For Germany, investors are downright euphoric," Sentix said in a statement about Europe's largest economy.

Expectations for Germany alone jumped by 26.3 points, to 20.5, and the overall index rose by 17.2 points to -12.5, it added.

The picture was different in other parts of the world, Sentix noted. In the United States, there was a massive slump in current situation and expectations values.

Trump won't predict whether recession could result from his tariff moves

WASHINGTON, March 9 (Reuters) - President Donald Trump declined to predict whether the U.S. could face a recession amid stock market concerns about his tariff actions on Mexico, Canada and China over fentanyl.

The Republican president, whose trade policies have rekindled fears of worsening U.S. inflation, was asked if he expected a recession this year in a Fox News interview broadcast on Sunday. "There is a period of transition, because what we're doing is very big. We're bringing wealth back to America," Trump told the "Sunday Morning Futures" program. "It takes a little time, but I think it should be great for us."

Tariffs have been one key concern for investors, as many believe they can harm economic growth and be inflationary. While Trump acknowledged as early as February 2 that his sweeping tariffs could cause some "short-term" pain for Americans, his own advisers have repeatedly downplayed any negative impact.

"Absolutely not," Commerce Secretary Howard Lutnick said on Sunday. "There's going to be no recession in America." Lutnick did acknowledge that the Trump tariffs would lead to higher prices for U.S. consumers on some foreign-made goods, but said American products will get cheaper. "He's not going to step off the gas," Lutnick said on NBC's "Meet the Press."

Trump imposed new 25% tariffs on imports from Mexico and Canada last Tuesday, along with fresh duties on Chinese goods, after he declared the top three U.S. trading partners had failed to do enough to stem the flow of deadly fentanyl and its precursor chemicals into the United States.

Two days later, he exempted many imports from Mexico and some from Canada from those tariffs for a month, the latest twist in a fluctuating trade policy that has whipsawed markets and fanned worries about U.S. inflation and growth.

It was the second time in two months that Trump has walked back fentanyl-related tariffs on the U.S. neighbors. "If fentanyl ends, I think these will come off. But if fentanyl does not end, or he's uncertain about it, he will stay this way until he is comfortable," Lutnick said. White House officials say Canada and Mexico are conduits for shipments of fentanyl - which is 50 times more potent than heroin - and its precursor chemicals into the U.S. in small packages that are often not inspected.

Public data shows 0.2% of all fentanyl seized in the U.S. comes from the Canadian border, while the vast majority arrives via Mexico. In a concession to Trump, Canada appointed a new fentanyl czar last month.

The exemptions for the two largest U.S. trading partners expire on April 2, when Trump has threatened to impose a global regime of reciprocal tariffs on all U.S. trading partners.

Kevin Hassett, director of the White House's National Economic Council, said on ABC's "This Week" that he hoped the drug-related tariffs can be resolved by the end of the month so the focus can be on imposing the reciprocal measures.

TRADE CONFUSION

Seesaw tariff announcements have unnerved Wall Street as investors say flip-flopping moves by the Trump administration to roll back levies on trading partners are causing confusion rather than bringing relief. The Trump trade policies have raised fears of trade wars that could slam economic growth and raise prices for Americans still smarting from years of high inflation.

China said it would "resolutely counter" pressure from the United States on the fentanyl issue after Trump imposed tariffs of 20% on all imports from China. Democratic senators from two border states criticized Trump's tariff policy as inconsistent and irresponsible.

"These broad, indiscriminate and on-again, off-again tariffs don't help anyone. They don't help farmers. They don't help auto workers. They're a mistake," U.S. Senator Adam Schiff of California said on ABC. "Pounding Canada as if they're the exact same thing as China - it just creates this chaotic feeling," U.S. Senator Elissa Slotkin, of Michigan, said on NBC.

Trump said he put a hold on tariffs on some goods last week because, "I wanted to help Mexico and Canada," according to the "Sunday Morning Futures" interview, which was taped on Thursday.

The three countries are partners in a North American trade pact that was renegotiated by Trump during his first White House term. Yet Trump also told the Fox News program that those 25% tariffs "may go up" and he said on Friday that his administration could soon impose reciprocal tariffs on Canadian lumber and other products.

Separately, U.S. tariffs of 25% on imports of steel and aluminum will take effect as scheduled on Wednesday, Lutnick said during the interview. Canada and Mexico are both top exporters of the metals to U.S. markets, with Canada in particular accounting for most aluminum imports.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

Share this post