Weekly Economics Report - Mar 7, 2025

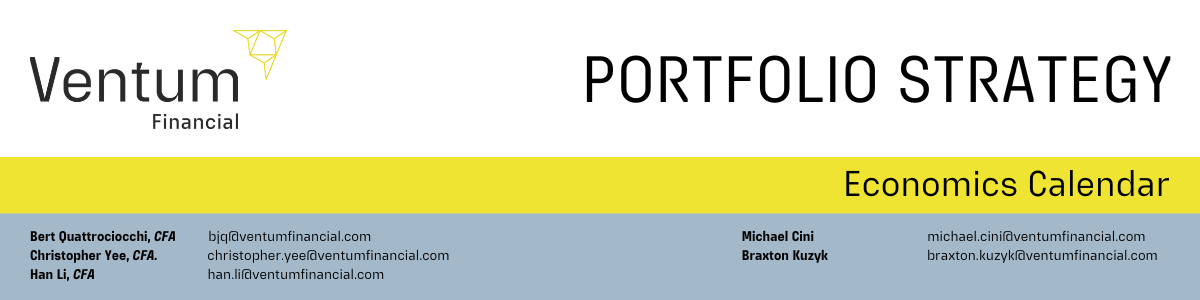

Canadian factory PMI tumbles as tariff uncertainty hits sentiment

TORONTO, March 3 (Reuters) - Canadian manufacturing activity contracted for the first time in six months in February as an uncertain trade outlook led to firms turning the most pessimistic since the start of the COVID-19 pandemic.

The S&P Global Canada Manufacturing Purchasing Managers' Index (PMI) fell to 47.8 from 51.6 in January, its first move below the 50.0 no-change mark since August. A reading below 50 indicates contraction in the sector. "The considerable uncertainty related to tariffs being applied on all goods passing across the Canada-United States border weighed heavily on the manufacturing economy during February," Paul Smith, economics director at S&P Global Market Intelligence, said in a statement.

"Output fell noticeably, driven lower by a steeper decline in new orders as product markets, both at home and abroad, were paralysed by concerns over the applicability and size of tariffs in the coming months. "The output index fell to 47.5 from 52.3 in January and the new orders index was at 45.4, its lowest level since July. U.S. President Donald Trump has proposed 25% tariffs on Mexican and Canadian goods that are due to go into effect on March 4. Canada sends about 75% of its exports to the United States. "Understandably, manufacturers grew increasingly downbeat about the future ... This meant firms also adopted an increasingly cautious approach to purchasing and employment," Smith said.

The measure of future output fell to 48.5 from 57.1 in January, marking the second-lowest level in survey data going back to July 2012. April 2020 was the only month when sentiment was weaker. A stronger U.S. dollar and suppliers adjusting prices in anticipation of tariffs contributed to increased input prices, S&P Global said. The input price index was at 58.9, its highest level since April 2023. The Bank of Canada has worried that tariffs could raise inflation even as they reduce prospects for economic growth.

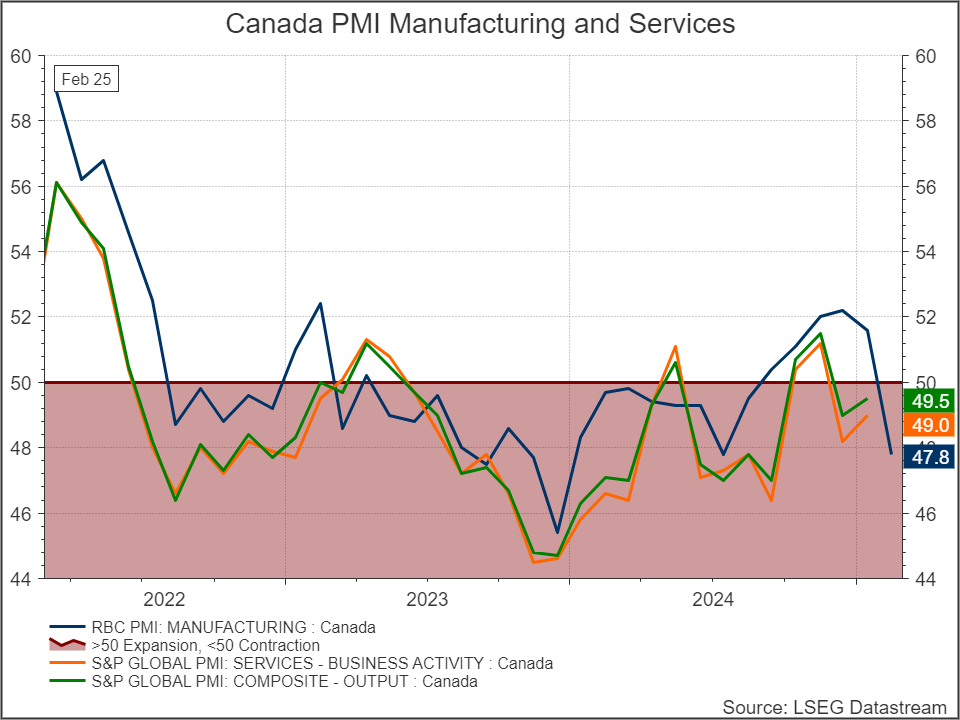

US manufacturing stable in February, but storm brewing from tariffs

WASHINGTON, March 3 (Reuters) - U.S. manufacturing was steady in February, but a measure of prices at the factory gate jumped to near a three-year high and it was taking longer for materials to be delivered, suggesting that tariffs on imports could soon hamper production.

The Institute for Supply Management (ISM) said on Monday that its manufacturing PMI slipped to 50.3 last month from 50.9 in January, which marked the first expansion since October 2022. A PMI reading above 50 indicates growth in the manufacturing sector, which accounts for 10.3% of the economy. Economists polled by Reuters had forecast the PMI easing to 50.6. The dip in the PMI mirrored declines in other sentiment measures as President Donald Trump's administration ratchets up tariffs on imported goods.

Domestic manufacturers rely heavily on imported raw materials. Trump in his first month in office has issued a raft of tariff orders. A 25% tariff on Mexican and Canadian goods comes into effect on Tuesday after being delayed for a month, along with an extra 10% duty on Chinese imports, on top of 10% already imposed. Analysts have warned of a financial fallout for U.S. automakers and other companies manufacturing vehicles in Mexico and Canada to sell in the United States.

Other duties aimed at imported steel, aluminum and motor vehicles will either soon go into effect or are in fast-track development. Manufacturing only just started recovering after a prolonged downturn triggered by the Federal Reserve's aggressive monetary policy tightening in 2022 and 2023 to tame inflation. Concerns that tariffs will raise prices contributed to the U.S. central bank pausing interest rate cuts in January. The ISM survey's forward-looking new orders sub-index slumped to 48.6 last month from 55.1 in January. Production at factories nearly braked after rebounding in the prior month. Its measure of prices paid by manufacturers for inputs surged to 62.4, the highest reading since June 2022. It topped a forecast for 55.8 and was up from 54.9 in January. At face value this suggests goods prices could continue rising after increasing by the most in 11 months in January. Goods prices had largely been muted since last May.

Suppliers' delivery performance slowed considerably. The survey's supplier deliveries index increased to 54.5 from 50.9 in January. A reading above 50 indicates slower deliveries.

A lengthening in suppliers' delivery times is normally associated with a strong economy, which would be a positive contribution to the PMI. But in this case slower supplier deliveries could be indicating bottlenecks in supply chains. Imports grew further, implying that factories were front-loading materials ahead of tariffs. Factory employment contracted after expanding in January for the first time in eight months. The manufacturing jobs index dropped to 47.6 after rebounding to 50.3 in January.

China February manufacturing hits 3-month high, but US tariff war clouds outlook

BEIJING, March 1 (Reuters) - China's manufacturing activity expanded at the fastest pace in three months in February as new orders and higher purchase volumes led to a solid rise in production, an official factory survey showed on Saturday. The reading should reassure officials that fresh stimulus measures launched late last year are helping shore up a patchy recovery in the world's second-largest economy, ahead of China holding its annual parliamentary meeting starting on March 5. Whether the upturn can be sustained remains to be seen amid a trade war that was kicked off by U.S. President Donald Trump's first salvo of punitive tariffs.

The official purchasing managers' index (PMI) rose to 50.2 in February from 49.1 a month prior, the highest since November and beating analysts' forecasts in a Reuters poll of 49.9. The non-manufacturing PMI, which includes services and construction, rose to 50.4 from 50.2 in January.

Chinese policymakers are expected to announce economic targets and fresh policy support next week at the high-profile gathering in Beijing, which investors will also watch for signs of further support for the struggling property sector and indebted local developers.

China's $18 trillion economy hit the government's growth target of "around 5%" in 2024, though in an uneven manner, with exports and industrial output far outpacing retail sales while unemploymentremained stubbornly high.

Beijing is expected to maintain the same growth target this year, but analysts are uncertain over how quickly policymakers can revive sluggish demand, especially given the intensifying trade tensions with the U.S. "Since the PMI data is measured on a month-on-month basis, it may be affected by seasonal factors related to the Spring Festival in January and February," said Zhang Zhiwei, chief economist at Pinpoint Asset Management.

"The manufacturing data is relatively stable," he added, with the caveat that a more accurate assessment would only be possible after the release of further data. China will release trade data for January-February on March 7. New export orders, factory gate prices, employment all remained in negative territory last month, the National Bureau of Statistics data showed, but contracted more slowly. Employment still hit a 22-month high.

TACKLING EXTERNAL SHOCKS

To sustain growth and counter rising external pressures, policymakers have pledged higher fiscal spending, increased debt issuance and further monetary easing.

Top Chinese Communist Party officials met on Friday and vowed to take steps to prevent and resolve any external shocks to China's economy, state media reported.

The Politburo meeting came a day after Trump said he would slap an extra 10% duty on Chinese goods on March 4, on top of the 10% tariff that he levied on February 4 over the fentanyl opioid crisis, to push Beijing to do more to stop the trafficking of the deadly drug.

That would result in a cumulative 20% tariff, which is still lower than the 60% he threatened on the campaign trail.

China's commerce ministry said on Friday it hoped to return to negotiations with the United States as soon as possible, warning that failure to do so could trigger retaliation.

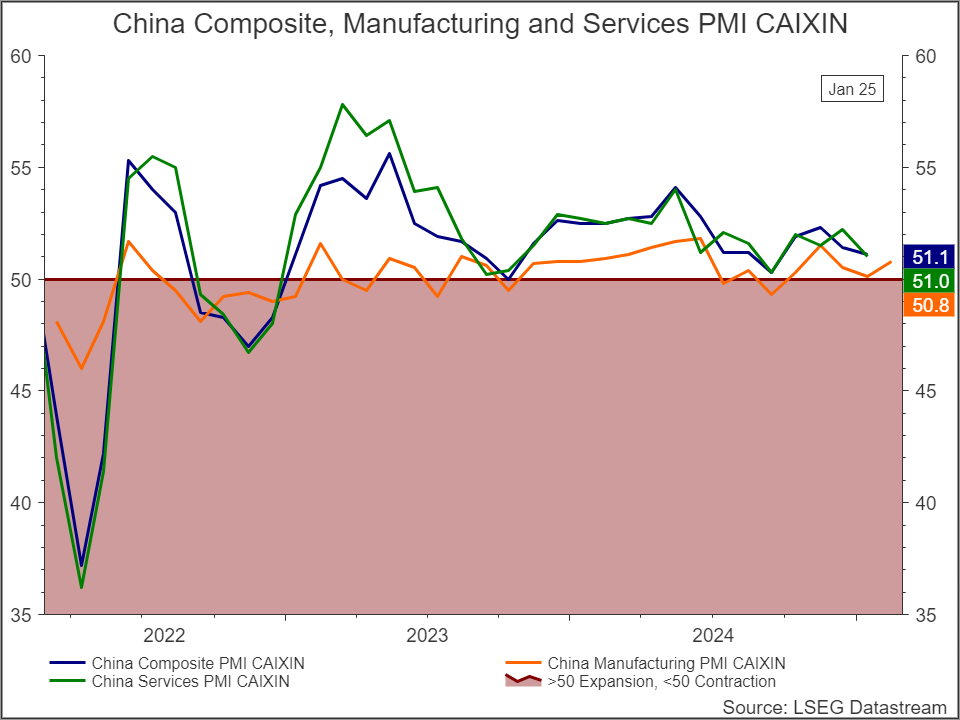

Analysts polled by Reuters estimated the private sector Caixin PMI rose 50.3, from 50.1 in January. The data will be released on March 3.

China targets US agriculture over Trump tariff threat, Global Times says

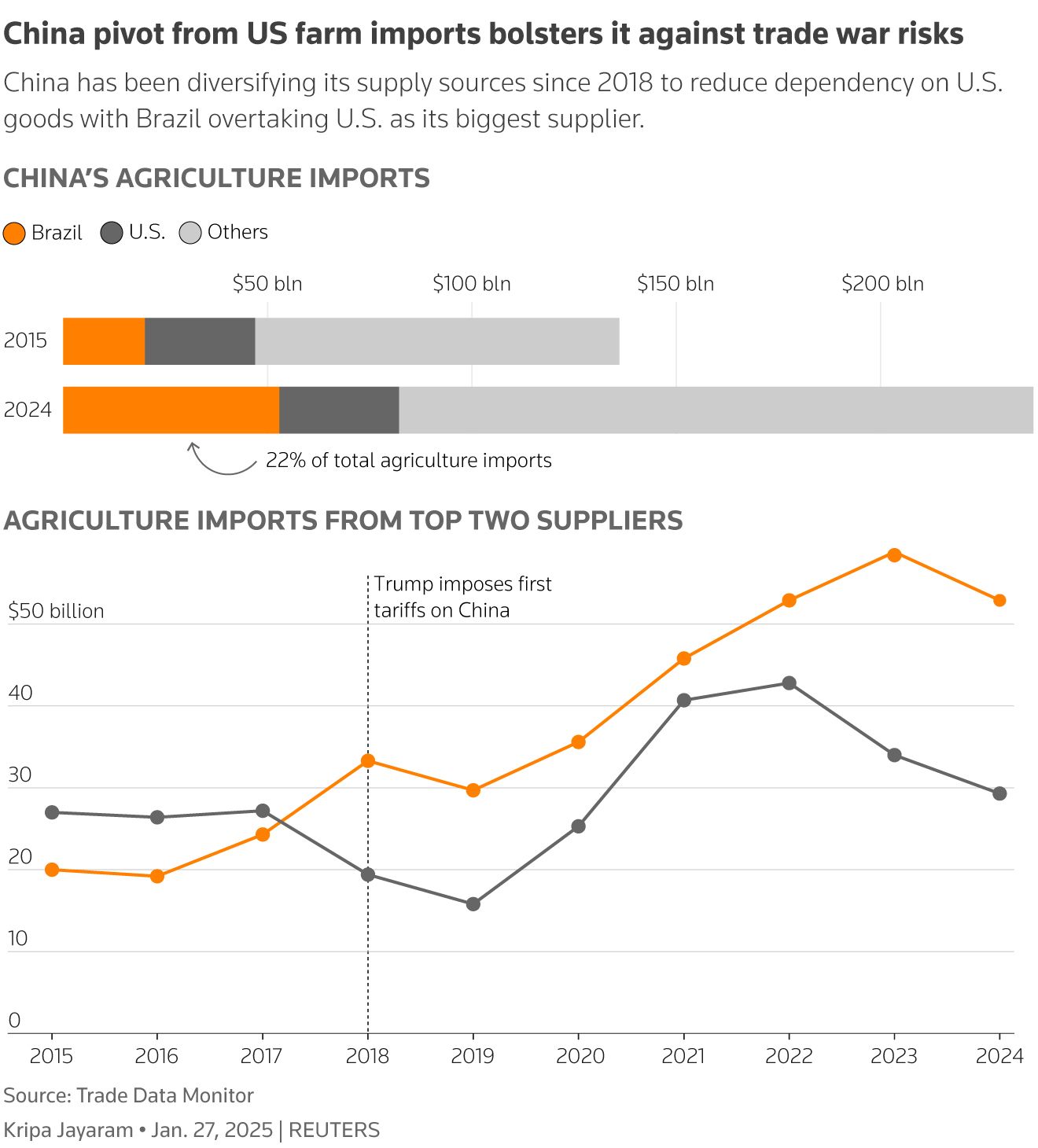

BEIJING, March 3 (Reuters) - China has American agricultural exports in its cross hairs as it prepares countermeasures against fresh U.S. import tariffs, China's state-backed Global Times reported, raising the stakes in an escalating trade war between the world's top two economies.

U.S. President Donald Trump last week threatened China with the extra 10% duty set to take effect on Tuesday, resulting in a cumulative 20% tariff, and accused Beijing of not doing enough to halt the flow of fentanyl into America, which China said was tantamount to "blackmail." "China is studying and formulating relevant countermeasures in response to the U.S. threat of imposing an additional 10% tariff on Chinese products under the pretext of fentanyl," Global Times reported on Monday, citing an anonymous source. "The countermeasures will likely include both tariffs and a series of non-tariff measures, and U.S. agricultural and food products will most likely be listed," the report added.

China's commerce ministry and the U.S. embassy in Beijing did not immediately respond to requests for comment. China is the biggest market for U.S. agricultural products, and the sector has long been vulnerable to being used as a punching bag in times of trade tensions. "Despite a decline in imports since 2018, any tariffs on key U.S. agricultural products like soybeans, meat and grains could have a significant impact on U.S.-China trade as well as U.S. exporters and farmers," said Genevieve Donnellon-May, a researcher at the Oxford Global Society. "The U.S. agricultural sector has had time to prepare for a second Trump administration and trade war 2.0, with lessons learned from the first Trump administration," she added. "So, in theory, it should be in a better place to find alternative markets. However, the reality may prove far more complex."

China's most active soymeal DSMcv1 and rapeseed meal CRSMcv1 futures, already underpinned by a supply shortage, each surged 2.5% after the Global Times report. The soymeal contract on the Dalian Commodities Exchange hit its highest since Sept 30, 2024.

The world's top agricultural importer and second-largest economy brought in $29.25 billion worth of U.S agriculture products in 2024, a 14% drop from a year earlier, extending a 20% decline seen in 2023.

Global Times, which is owned by the newspaper of the governing Communist Party, People's Daily, was first to report the steps China planned to take in response to the European Union slapping tariffs on Chinese electric vehicles last year.

Trump's announcement left Beijing with less than a week to come up with countermeasures or strike a deal. The proposed extra levies also coincide with the start to China's annual meeting of parliament, a political set piece event at which Beijing is expected to roll out its 2025 economic priorities.

TRUMP TARIFFS TO 'BACKFIRE'

Analysts say Beijing still hopes to negotiate a truce with the Trump administration, but with no signs of any trade talks yet the prospect of a rapprochement between the two economic giants is fading. "A China-U.S. trade war is not inevitable, but Trump's decision to impose tariffs now is a bad decision," said Wang Dong, executive director of the Institute for Global Cooperation and Understanding at Peking University. "Trump and his advisors may think that imposing tariffs at this time is to put pressure on China, sending a signal, but this will backfire and China will inevitably respond strongly." Tit-for-tat tariffs between the two countries during Trump's first term set off a full-blown trade war, upending financial markets and hurting global growth.

This time around, Trump's first salvo of fentanyl-related import duties on Feb. 4 was met by a quick retaliatory move by Beijing. China announced a series of wide ranging countermeasures targeting U.S. businesses including GoogleGOOGL.O and the owner of fashion brand Calvin Klein, and fresh import duties on U.S. coal, oil and some autos. China's commerce ministry said on Friday that it hoped to return to negotiations with the U.S. as soon as possible, warning that failure to do so could trigger retaliation.

State media said top Chinese Communist Party officials met the same day and vowed to take steps to prevent any external shocks to China's economy.

The Politburo meeting comes a week after the White House released an America First investment memorandum which placed China on a list of "foreign adversaries."

German chancellor-in-waiting promises swift moves on defence, investors sniff bonanza

BERLIN, March 3 (Reuters) - The prospect of a military spending boom by Germany unprecedented since the Cold War sent Europe's defence stocks soaring after Reuters reported the likely next government was mulling a fiscal sea change for Europe's biggest economy.

Germany's likely next chancellor, Friedrich Merz, did not confirm that his conservatives and the Social Democrats were mulling setting up special funds worth nearly a trillion euros to finance urgent defence and infrastructure spending. But he said spending decisions had to be taken "with great urgency" after U.S. President Donald Trump and his deputy harangued Ukraine's President Volodymyr Zelenskiy in the Oval Office on Friday, crystalising European fears that Washington had cooled on backstopping Europe's defence. "We must now show that we are in a position to act independently in Europe," he said. "The question of defence has priority."

News of the proposed funds sent shares in defence contractors including Thyssenkrupp TKAG.DE, Hensoldt HAGG.DE, Renk R3NK.DE, Rheinmetall RHMG.DE, BAE Systems BAES.L and Leonardo LDOF.MI jump by double-digit percentages on Monday morning. Neither party has confirmed that a special fund for defence worth 400 billion euros ($417 billion) and for infrastructure worth as much as 500 billion euros were under discussion, a sum which combined would amount to 20% of German GDP.

"There is an enormous need for investment and we won't create consent for it if we just invest in defence," said SPD General Secretary Matthias Miersch on Monday. "The two need to be considered together." Merz made no comment on the numbers which, if confirmed, would amount to an extra 2% of economic output in spending over the next 10 years, kicking in from next year. "This would be about as much as the country has invested in East Germany since reunification," Deutsche Bank wrote in a note. "It would be a fiscal regime shift of historic proportions."

Bild newspaper reported that an extraordinary session of parliament might be called for next Monday, which would allow the measure to be passed with the backing of the Greens - who on Monday urged Chancellor Olaf Scholz's outgoing government to approve a further 3 billion euros' funding for Ukraine.

After the new parliament is seated this month, the defence-sceptical Left party's support will be needed to reach the necessary two-thirds majority.

For decades, Germany has been a defence laggard, until 2023 spending less than NATO's target of 2% of economic output on defence, with Russia's invasion of Ukraine and Scholz's defence "Zeitenwende" or sea change only bringing modest changes.

The use of a special fund - effectively a credit line - reflects the difficulties in circumventing a constitutional spending cap that limits the amount of new debt German governments can take on each year. The soaring shares reflect investor confidence that the makers of military vehicles, ammunition and other battlefield kit will be big winners from the bonanza.

Scholz's previous attempts to boost military spending also relied on a special fund, formally separate from Germany's 2 trillion euros in public spending.

They are legally tricky: a court ruling against his use of another fund paved the way for the collapse of his government and the election he lost last month, while the state auditor has called for their use to be reined in.

The economic impact of the defence fund would be modest in the short term, Deutsche Bank wrote, since much of it would be spent on imports.

The infrastructure fund, badly needed after years of frugality have left much of Germany's public realm, from bridges to railways, in a ragged state, would have a bigger impact.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

Share this post