Weekly Commodities Report - Jan. 31, 2025

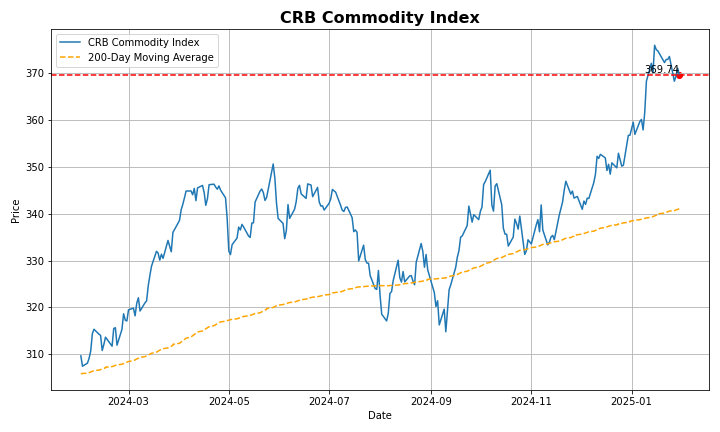

CRB Commodity Index increased 12.93 points or 3.62% since the beginning of 2025, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, CRB Commodity Index reached an all time high of 470.17 in July of 2008.

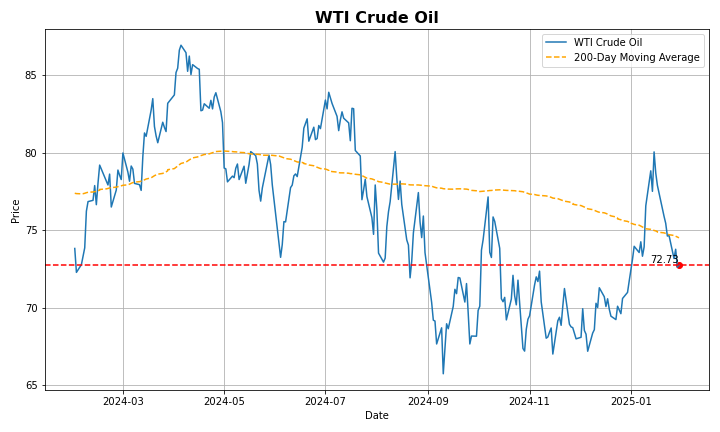

WTI crude oil futures rose toward $73 per barrel on Friday, extending gains from the previous session, as traders awaited further clarity on President Trump's looming tariff deadline. Trump reaffirmed plans to impose 25% tariffs on Canada and Mexico starting Saturday but indicated he was still considering whether to exempt oil from the levies. Canada and Mexico are the two largest crude exporters to the US. Meanwhile, investors are also looking ahead to the OPEC+ meeting scheduled for February 3, as Trump pressures the group, particularly Saudi Arabia, to lower oil prices. Traders expect OPEC+ to maintain its current supply policy, with additional supply increases only starting in April. For the month, oil is on track for a second consecutive monthly gain, driven by early reports of US sanctions on Russia and cold weather in the US.

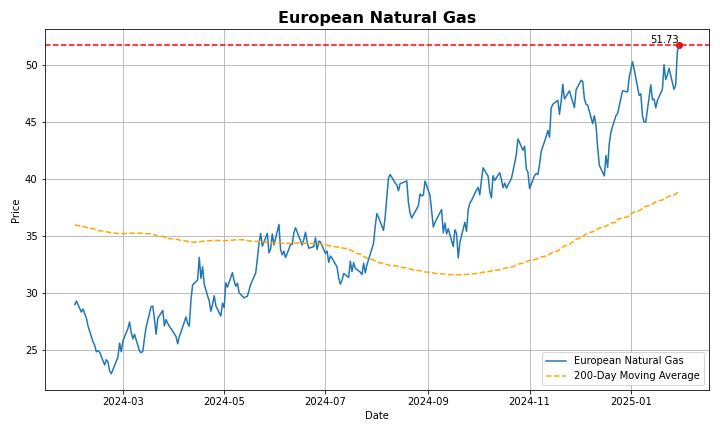

European natural gas futures climbed toward €52 per megawatt-hour, closing in on the highest level since October 2023, as colder weather boosted demand and Norwegian gas outages limited the supply. Outages at Norway’s Gullfaks, Troll, and Aasgard fields are restricting supply to Europe, with Norwegian gas nominations dropping to 313 million cubic meters on Wednesday, a 5 mcm decrease from the previous day. Adding to woes, gas storage in Europe stands at 55.46% full, down from 71.79% at the same time last year, and depletion is expected to accelerate in the coming days. Still, while forecasts predict lower wind speeds, the temperatures is set to return to normal, with light to moderate frost at night.

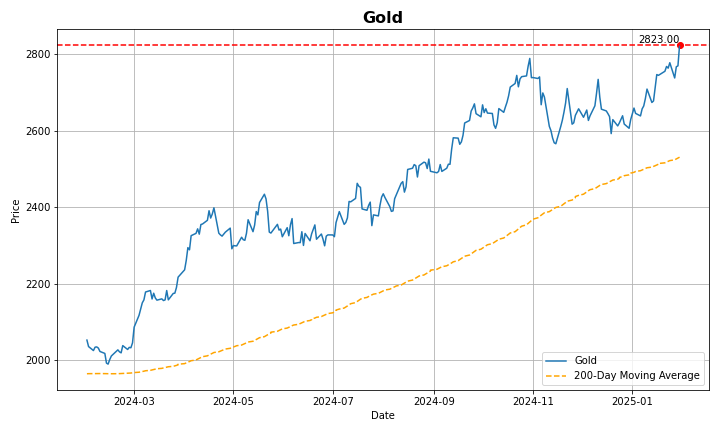

Gold rose past $2,805 per ounce, a new record high, supported by a wave of looser monetary policy from major central banks. The Federal Reserve held its rates unchanged and refrained from hinting at future moves, sustaining market expectations of two rate cuts this year. In turn, the Bank of Canada cut its main interest rate and announced the end of quantitative tightening, in addition to a base scenario for the purchase of government debt in the near future. Also on the policy front, both the ECB and Swedish Riksbank delivered rate cuts, while central banks from major gold consumers in the PBoC and RBI also signaled looser monetary policy and higher liquidity in the near future. Meanwhile, investors awaited clarity on tariff exchanges between North American nations after reports suggested that US tariffs on Canada and Mexico will be delayed to March instead of this weekend, limiting concerns of trade barriers as Washington DC displays more indecision on the matter.

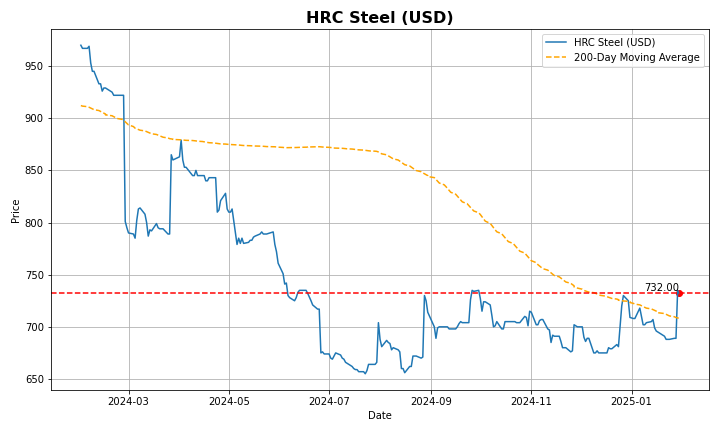

Steel rebar futures were over CNY 3,300 per tonne before Chinese commodity markets closed for the Lunar New Year, as the impact of poor economic data on the demand outlook was offset by optimism of open trade. The latest official PMI data pointed to a sharp contraction in construction activity in the first month of the year, with the official construction PMI slumping to a record low of 49.3 from 53.2 in the previous month, especially impacting the outlook for rebar. Besides its major use in construction, demand for ferrous metals was also supported by the unexpected deterioration in manufacturing activity. Still, the new US Presidential Administration relaxed its rhetoric of tariffs on China, limiting concerns of global protectionist policies. Such developments lift global demand for Chinese steel, among the main clients for mills as China exported 9.7 million tons of steel in December, a 26% surge from the previous year to cap off a record-setting year for steel exports.

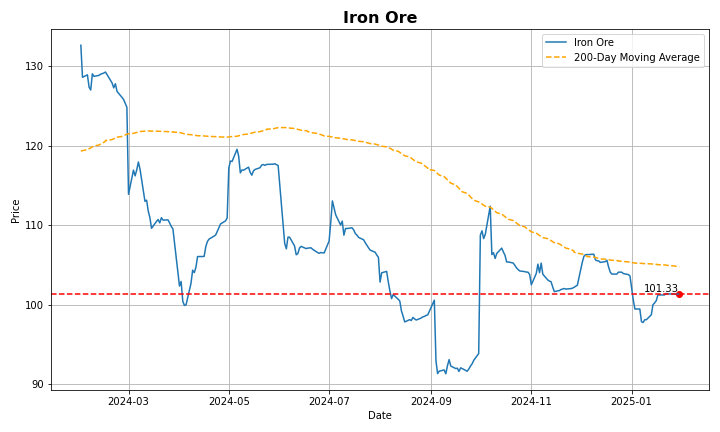

Iron ore prices for cargoes with 62% iron content held steady above $101 per ton in late January, maintaining a sideways trend for about two weeks as investors continued to assess the potential impact of upcoming tariffs. US President Donald Trump reiterated his threat to impose a 25% tariff on Mexico and Canada starting on Saturday, while a 10% tariff on China remains under consideration. The President also recently announced plans to impose tariffs on imported chips, pharmaceuticals, steel, aluminum, and copper in an effort to boost domestic production. In top consumer China, recent data showed that manufacturing activity unexpectedly contracted in January. Meanwhile, trading volumes are expected to remain lighter as Chinese markets are closed for the week-long Lunar New Year holiday.

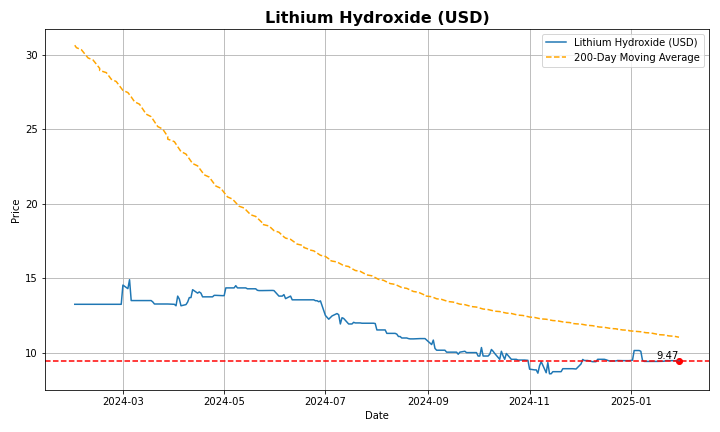

Lithium carbonate prices were at near the CNY 78,000 per tonne, holding the rebound from the two-month low of CNY 75,000 from the start of the year, amid hints that the ongoing supply glut may ease in 2025. Fiscal benefits tied to EV purchases by Chinese households aligned with data that pointed to a 30.5% surge in output of new energy vehicles in December. The results aided hopes that battery prices will rise in the near future as manufacturers stabilize their inventory levels. In the meantime, the closure of selected mines due to the slump in lithium prices has not offset increased production for other major producers. Still, other key Chinese miners refrain from closing operations to retain market share and business relationships with governments and battery producers. In turn, US President Trump revoked the previous administrations order that ensured half of all new vehicles sold in 2030 were fully electric, driving major EV producers with exposure to US market to drop.

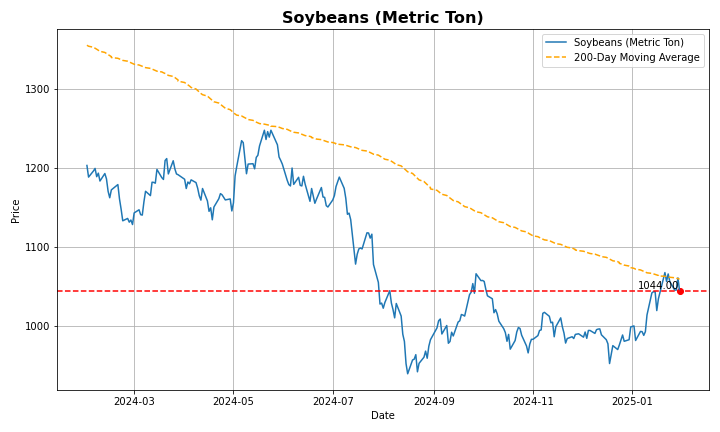

Soybean futures traded around $10.40 per bushel, its lowest in over a week, as anticipated favorable weather conditions in top producer Brazil tempered concerns about supplies. Despite a slow harvest, analysts remain optimistic about a bumper crop in Brazil, with any crop loss due to Argentina’s hot, dry weather expected to be offset by Brazil's production. According to Commodity Weather Group, southern Brazil and Paraguay could see relief next week, with dry conditions in northern Brazil aiding the early harvest, though wet weather is set to return briefly. In Argentina, rain in key regions like Cordoba, Santa Fe, and Entre Rios should improve moisture levels in the north, but dry conditions are set to persist in the south and central areas. At the same time, concerns over demand grew after news on Wednesday that China had halted soybean shipments from five Brazilian firms due to cargoes failing to meet plant health requirements.

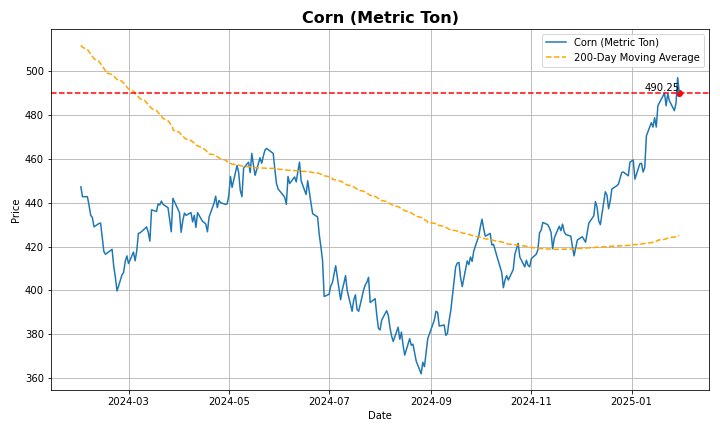

Corn futures increased 26.67 USd/BU or 5.82% since the beginning of 2025, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, Corn reached an all time high of 843.75 in August of 2012.

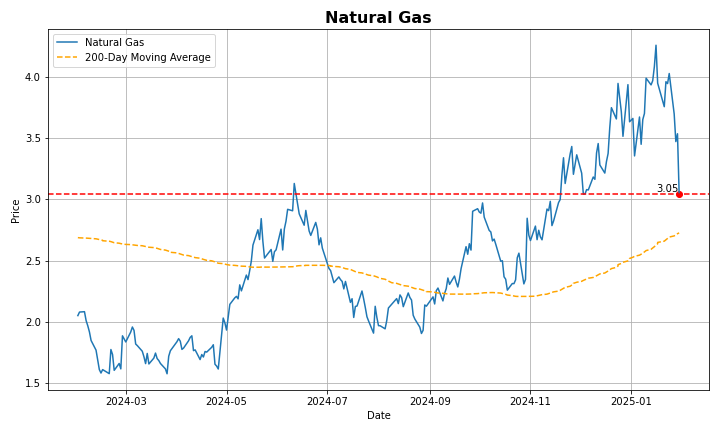

US natural gas futures dropped below $3.6/MMBtu, near a three-week low, due to warmer-than-expected weather forecasts for early February. Weekend updates predicted milder conditions across much of the US from February 1-5, reducing anticipated heating demand. While colder weather in the Midwest and Northeast will bring moderate demand this week, most regions are expected to stay warmer than usual over the next two weeks. Analysts still expect a 317 bcf gas withdrawal for the week ending January 24, which could eliminate the gas inventory surplus for the first time since early 2022. Meanwhile, LNG exports are increasing, helped by the restart of Freeport LNG’s Texas facility.

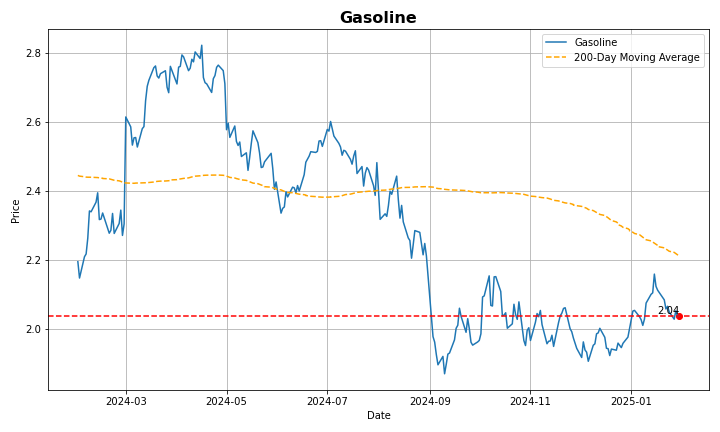

US gasoline futures rose to $2.05 per gallon after hitting a three-week low, as traders awaited clarity on President Trump's upcoming tariff deadline. Trump reaffirmed his plan to impose 25% tariffs on Canada and Mexico starting Saturday but suggested he might exempt oil from the levies. Meanwhile, investors are watching the OPEC+ meeting on February 3, as Trump continues to pressure the group, particularly Saudi Arabia, to lower oil prices. Traders expect OPEC+ to maintain its current supply policy, with any additional increases likely beginning in April.

Silver prices remained above $31.40 per ounce on Friday, hovering near seven-week highs as US President Donald Trump reiterated his threat to impose a 25% tariff on Mexico and Canada starting Saturday, boosting safe-haven demand for precious metals. The Silver Institute also projected a fifth consecutive year of significant market deficit for the metal in 2025. This outlook is largely driven by strong industrial demand and retail investment, which are expected to outweigh weaker consumption in jewelry and silverware. Key industrial uses include solar panels, electric vehicles, and consumer electronics. While global silver supply is expected to rise this year, with increased output from China, Canada, and Chile, the ongoing deficit is anticipated to continue.

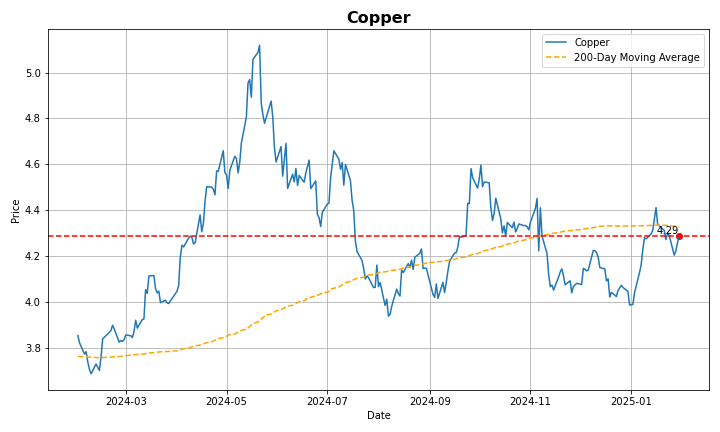

Copper futures hovered around $4.28 per pound on Friday, on track to finish the week little changed after experiencing significant volatility throughout the period, driven by concerns over US President Donald Trump’s tariff threats. In recent developments, Trump reaffirmed plans to impose 25% tariffs on Mexico and Canada on Saturday, while a 10% tariff on China is still under consideration. The President also recently unveiled plans to impose tariffs on imported chips, pharmaceuticals, steel, aluminum, and copper to support domestic production. Meanwhile, in China, the world’s top copper consumer, recent data revealed an unexpected contraction in manufacturing activity for January. With Chinese markets closed for the week-long Lunar New Year holiday, trading volumes are expected to remain lighter than usual.

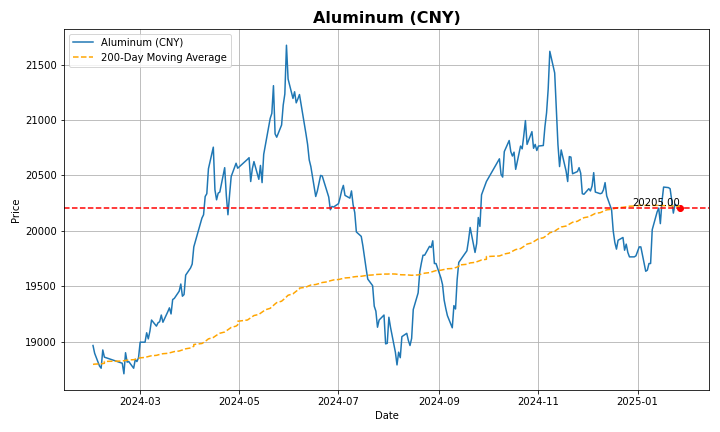

Aluminum futures held below the $2,600 per tonne threshold, tacking the pullback in base metals as pessimistic demand expectations outweighed risks of lower global supply. The official manufacturing PMI in China pointed to a sharp contraction in activity during January, erasing the earlier hope that stronger credit aggregates would translate to traction in economic activity and industrial metal demand. Additionally, US President Trump threatened to put tariffs on aluminum and other key base and ferrous metals, easing the outlook on US demand. On the supply front, China produced a record high 44 million tons of aluminum in 2024, meaning that output will be forced to slow as Beijing capped output at the 45 million tons in 2017 to prevent excess supply and aid carbon emission targets. In turn, the EU was set to sanction the import of primary aluminum from Russia in its upcoming package, consolidating the phase out of metal from the country.

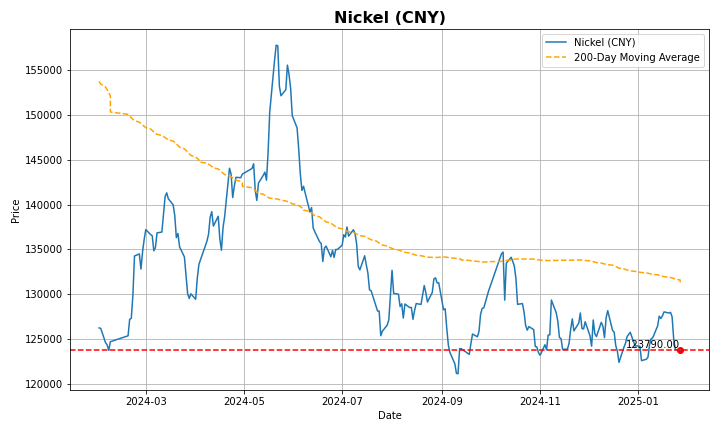

Nickel futures were below $15,400, the lowest since touching to the four-year low of $15,000 touched on January 2nd as threats of output curbs were not enough to impact bets of an oversupplied market in upcoming years. Reports indicated that top producer Indonesia is considering policy to reduce nickel mining quotas to 150 million tons this year from 270 million tons in 2024, enough to reduce global supply by 35%. Still, the muted magnitude of the rebound indicate that markets expect the nickel market to remain in oversupply. This is due the surge of Chinese smelting projects in Indonesia after the latter prohibited the export of nickel ores in 2020. Indonesia was the host of 44 nickel smelting operations as of September, compared with four 10 years prior. Adding to the bearish pressure, new technology used by Chinese battery producers started to use technologies that refrain from using nickel, further denting the outlook for the metal.

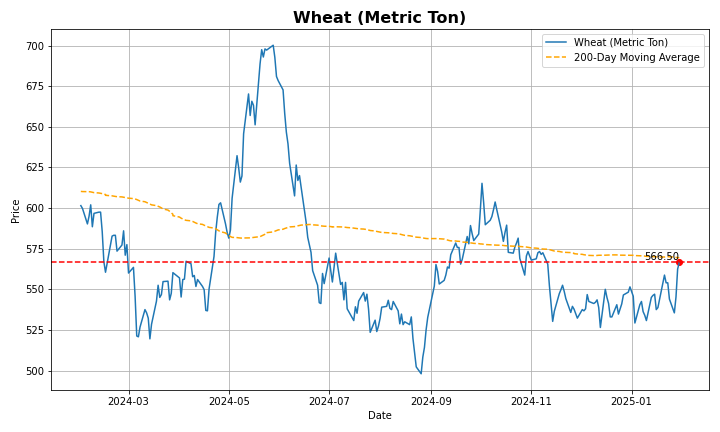

Wheat futures have fluctuated between $5.30 and $5.50 per bushel in January, as traders closely observed demand and supply trends. Despite relatively weak demand, concerns over supply remained, including the risk of severe cold damaging some U.S. winter wheat and ongoing challenges in Russia. However, Australia's wheat production for the 2024-25 marketing year is estimated at 32 million tonnes, 21% above the 10-year average, despite insufficient rainfall in the southern regions, according to a report from the Foreign Agricultural Service (FAS) of the U.S. Department of Agriculture. Meanwhile, the International Grains Council recently projected global wheat production to reach a record 805 million tonnes in 2025/26, a 1% increase from the previous year, with 2024/25 production estimated at 796 million tonnes and consumption forecast to match production at 805 million tonnes.

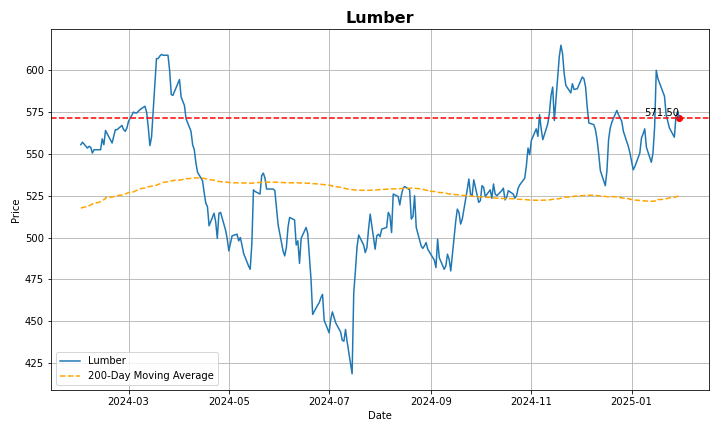

Lumber prices climbed toward $580 per thousand board feet, approaching eight-week highs of $600 on January 16th, driven primarily by the impending 25% US tariff on Canadian exports, set to take effect on February 1st. Canada, the largest supplier of U.S. lumber, accounts for about a quarter of the nation's needs, and this tariff will significantly impact U.S. housing construction, where lumber is a key input. The ongoing trade dispute has already reduced Canada's share of the U.S. market from 33% in 2016 to 24% in 2024, further tightening supply. Meanwhile, U.S. mills are operating at near full capacity, and efforts to ramp up domestic production are constrained by environmental restrictions on public forests and opposition to expanded logging. Compounding these issues, severe weather has disrupted Southern Pine production, exacerbating the supply strain. In anticipation of price increases, U.S. buyers are maintaining lean inventories, adding to market volatility.

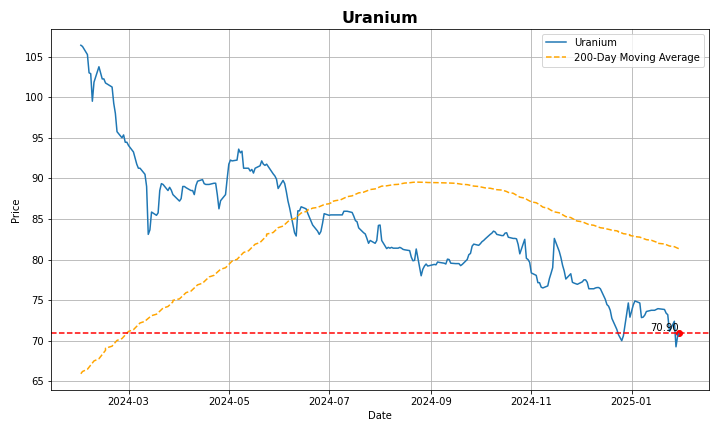

Uranium futures fell below $69 per pound for the first time in 16 months in January as markets recalibrated demand expectations against a backdrop of ample supply. Restrictions on imports of enriched nuclear fuel from Russia, which is responsible for around half of global enrichment capacity according to some estimates, shrunk the pool of yellowcake consumers in the market for mined uranium. The relatively ample availability of yellowcake is expected to remain as import wavers for nuclear fuel in the US are due to expire by 2027. In the meantime, markets reconsidered their speculative positions on nuclear power demand for US datacenters following the emergence of more efficient large language models. China’s open-source DeepSeek AI claimed to consume 95% less power than established US counterparts, erasing the race to develop alternative power sources. Such deals included nuclear power plants coming online to service data centers for Microsoft, Alphabet, and Amazon Web Services.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

Share this post