Weekly Economics Report - Feb. 10, 2025

China's consumer inflation at 5-month high, producer deflation persists

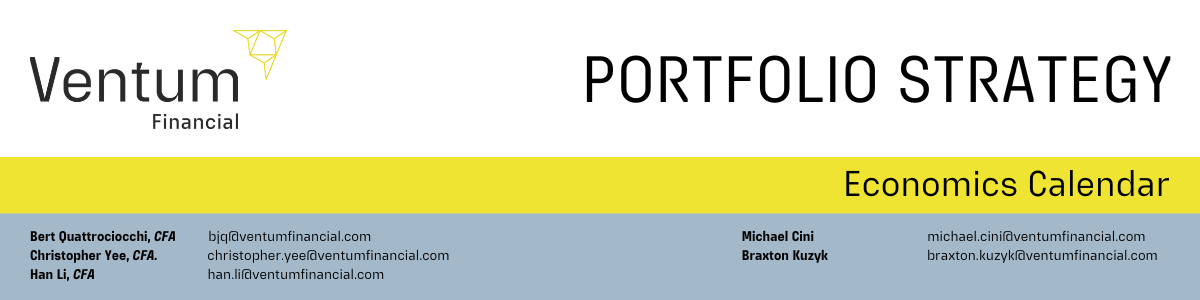

BEIJING, Feb 9 (Reuters) - China's consumer inflation accelerated to its fastest in five months in January while producer price deflation persisted, reflecting mixed consumer spending and weak factory activity.

Deflationary pressures are likely to persist in China this year, analysts say, unless policymakers can rekindle sluggish domestic demand, with tariffs by U.S. President Donald Trump on Chinese goods adding pressure on Beijing to spur growth in the world's second-largest economy.

The consumer price index rose 0.5% last month from a year earlier, quickening from December's 0.1% gain, data from the National Bureau of Statistics showed on Sunday, above the 0.4% rise estimate in a Reuters poll of economists.

Core inflation, excluding volatile prices for food and fuel, sped up to 0.6% in January from 0.4% the previous month. Although consumer prices are expected to rise gradually, producer prices are unlikely to return to positive territory in the short term as overcapacity in industrial goods persists, said Xu Tianchen, senior economist at the Economist Intelligence Unit. "If measured by the GDP deflator, it will still take a few quarters to get out of deflation, " Xu said.

The numbers were skewed by seasonal factors, as the Lunar New Year, China's biggest annual holiday, began in January this year versus February last year. Typically, prices rise as consumers stockpile goods, particularly food for big family gatherings. Prices of airplane tickets rose 8.9% from a year earlier, tourism inflation was 7.0% and movie and performance ticket prices rose 11.0%. Consumer spending reports over the holidays were mixed, reflecting worries over wage and job security.

While Chinese flocked to movie theatres and spent more on shopping, catering and domestic travel, per capita spending during the holidays grew by only 1.2% from a year earlier, versus a 9.4% rise in 2024, analysts at ANZ estimated.

CPI edged up 0.7% in January from the previous month, below the forecast 0.8% rise and compared with an unchanged outcome in December. For 2024, CPI rose 0.2%, in line with the previous year's pace and well below the official target of around 3% for last year, suggesting inflation missed annual targets for the 13th straight year.

China's provinces have announced 2025 economic growth targets with the average of target prices below 3%, showing that policymakers are anticipating changes and pressures on the price level, said Bruce Pang, adjunct associate professor at CUHK Business School. China's manufacturing unexpectedly contracted in January, while services activity weakened, keeping alive calls for more stimulus. Beijing is widely expected to retain its economic growth forecast of around 5% this year, but fresh U.S. tariffs will put stress on exports, one of the few bright spots in the economy last year.

The producer price index declined 2.3% on year in January, matching December's drop and deeper than the forecast 2.1% fall. Factory-gate prices have remained deflationary for 28 straight months. The government is not expected to change monetary or fiscal policy before the annual parliament session in March, said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. "For policymakers, external uncertainty seems to rank higher than domestic economic challenges at this stage," Zhang added.

Euro zone investor morale improves in February

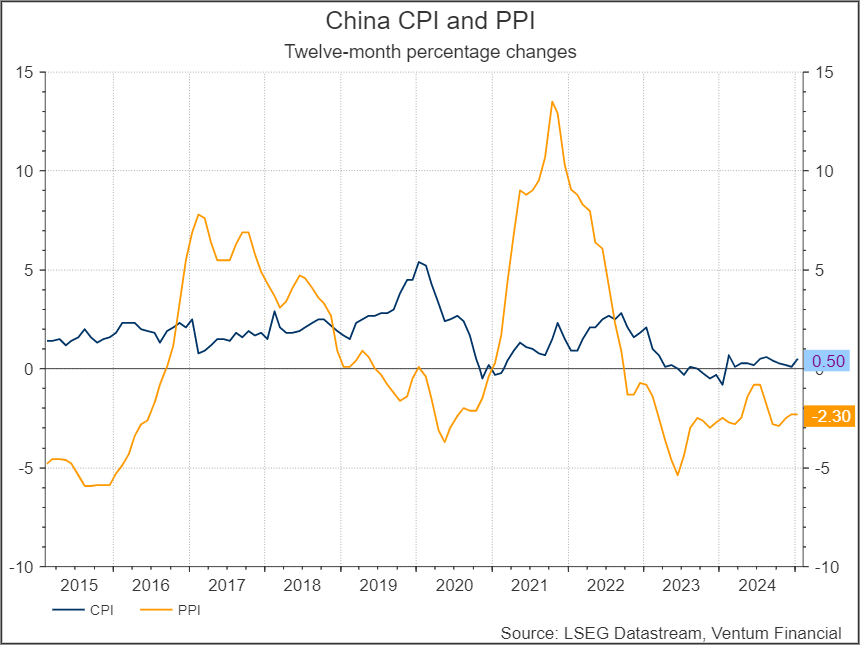

BERLIN, Feb 10 (Reuters) - Investor morale in the euro zone brightened in February to its highest since July, a survey showed on Monday, with Germany also benefiting from the rise in confidence.

The Sentix index for the euro zone rose to -12.7 in February from -17.7 in January, above the -16.3 forecast by analysts polled by Reuters. The survey of 1,111 investors from February 6-8 showed the assessment of the current situation also improved to -25.5 in February from -29.5 in January.

Economic expectations for the next six months rose more dynamically, to 1.0 in February from -5.0 in January, exceeding the magic zero line for the first time since July.

"Germany's recessionary economy is hanging like a lead weight on the euro zone," the survey said. "It is precisely from here that there is now hope for improvement." The survey found that in Germany - Europe's largest economy and one facing federal elections this month - expectations improved, reflecting hope that a newly elected government could change the economic course.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

Share this post