Weekly Economics Report - Feb. 3, 2025

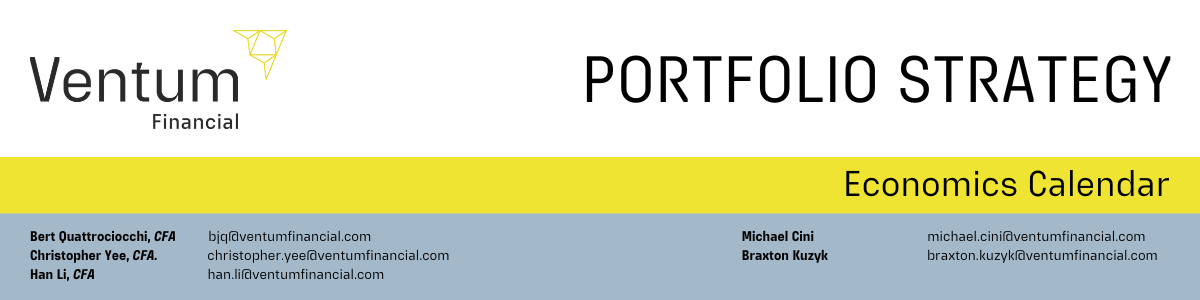

Canadian factory PMI dips in January as trade war risk dents confidence

TORONTO, Feb 3 (Reuters) - Canadian manufacturing activity increased at a slower pace in January as looming U.S. trade tariffs reduced confidence in the outlook, even as moves by clients to get ahead of the taxes led to the first increase in export orders in 17 months.

The S&P Global Canada Manufacturing Purchasing Managers' Index (PMI) fell to 51.6 in January from 52.2 in December. Still, it was the fifth straight month above the 50.0 no-change mark. A reading above 50 indicates expansion in the sector.

U.S. President Donald Trump on Saturday ordered sweeping tariffs of 25% on goods from Mexico and Canada, demanding they stanch the flow of fentanyl and illegal immigrants. Canadian Prime Minister Justin Trudeau said Canada would respond with 25% tariffs against $155 billion of U.S. goods, including beer, wine, lumber and appliances.

“January’s survey highlighted the complex impact that possible U.S. tariffs are presently having on the Canadian manufacturing economy," Paul Smith, economics director at S&P Global Market Intelligence, said in a statement.

Canada sends about 75% of its exports to the United States. The new export orders index rose to 50.3, its first move above the 50 threshold since August 2023.

"Firms noted that clients in some instances were bringing forward their orders to get ahead of these potential tariffs, and output amongst manufacturers was being raised in response," Smith said. “However, the threat of tariffs from the U.S. is leading to a huge amount of uncertainty in product markets, and firms are growing increasingly concerned about a potential trade war with a key trading partner."

The output index fell to 52.3 from 53.0 in December and the measure of future output was at 57.1, its lowest level since July.

A stronger U.S. dollar, which jumped on Monday to a 22-year high against its Canadian counterpart, contributed to increased material costs, S&P Global said.

The input price index rose to 58.3, its highest level since April 2023, while the output price index was at 53.5, up from 52.3 in December. Last week, the Bank of Canada said it was concerned that U.S. tariffs could stoke persistently high inflation as it cut interest rates by 25 basis points to 3%.

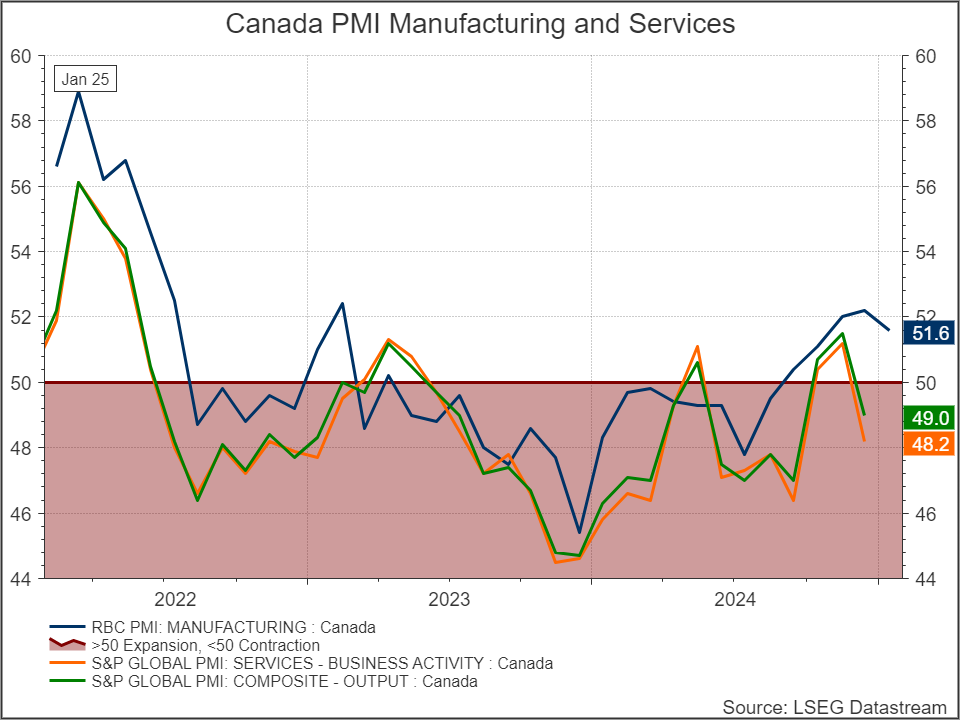

US manufacturing rebounds in January; inputs prices paid measure surges

WASHINGTON, Feb 3 (Reuters) - U.S. manufacturing grew for the first time in more than two years in January amid strong orders, but a measure of prices paid by factories for raw materials rose solidly, and more increases are likely after President Donald Trump imposed tariffs on goods from Canada and Mexico at the weekend.

The Institute for Supply Management (ISM) said on Monday that its manufacturing PMI increased to 50.9 last month, the highest reading since September 2022, from 49.2 in December. It was the first time since October 2022 that the PMI rose above the 50 mark, indicating growth in the manufacturing sector, which accounts for 10.3% of the economy. Economists polled by Reuters had forecast the PMI rising to 49.8.

The tentative recovery, likely partly driven by hopes of tax cuts, could be short-lived as tariffs are expected to raise the costs of raw materials and snarl supply chains. Trump on Saturday slapped 25% tariffs on Canadian and Mexican goods that are due to take effect on Tuesday.

Manufacturing has been undercut by the Federal Reserve hiking interest rates by 5.25 percentage points in 2022 and 2023 to tame inflation. The U.S. central bank started its policy easing cycle in September. It lowered rates by 100 basis points before pausing in January amid uncertainty about the economic impact of the administration's policies, including deportations.

Manufacturing contracted 0.4% from the fourth quarter of 2023 through the fourth quarter of 2024, Fed data showed.

The ISM survey's forward-looking new orders sub-index jumped to 55.1 last month from 52.1 in December. Production at factories also picked up.

Its measure of prices paid by manufacturers raced to an eight-month high of 54.9 from 52.5 in December, where economists had forecast a rise to 53.5.

Imports grew, suggesting manufacturers were front-loading materials ahead of tariffs. Factory employment expanded for the first time since May, with the manufacturing jobs index rebounding to 50.3 from 45.4 in December.

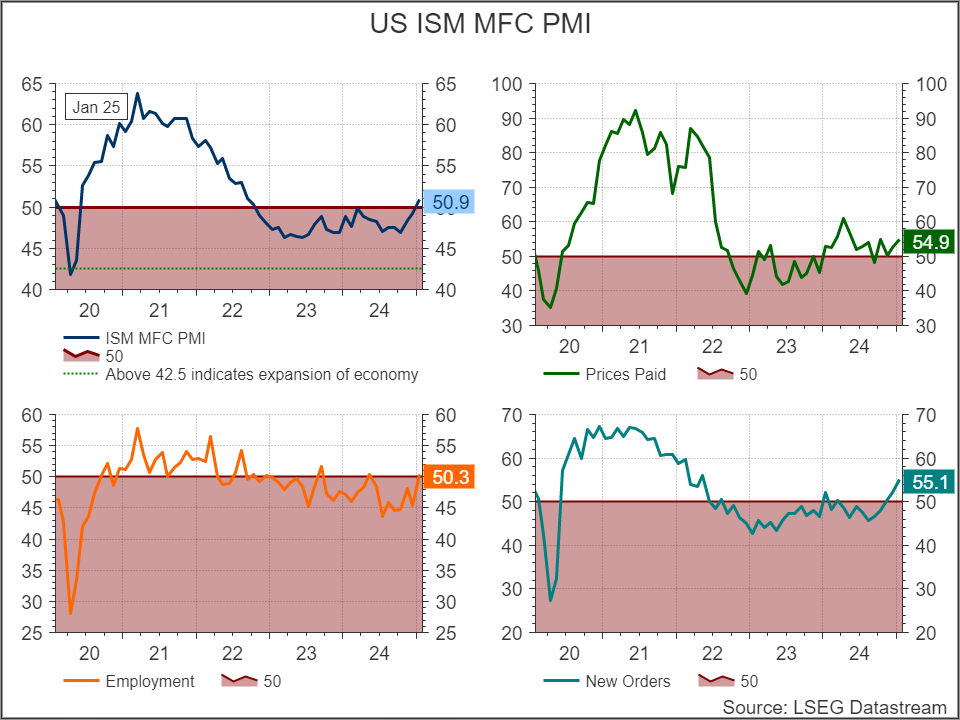

MONTHLY CONSTRUCTION SPENDING, DECEMBER 2024

February 3, 2025 — The U.S. Census Bureau announced the following value put in place construction statistics for December 2024:

Total Construction spending during December 2024 was estimated at a seasonally adjusted annual rate of $2,192.2 billion, 0.5 percent (± 0.8 percent)* above the revised November estimate of $2,180.3 billion. The December figure is 4.3 percent (±1.3 percent) above the December 2023 estimate of $2,101.3 billion. The value of construction in 2024 was $2,154.4 billion, 6.5 percent (±1.0 percent) above the $2,023.7 billion spent in 2023.

Source: US Census Bureau

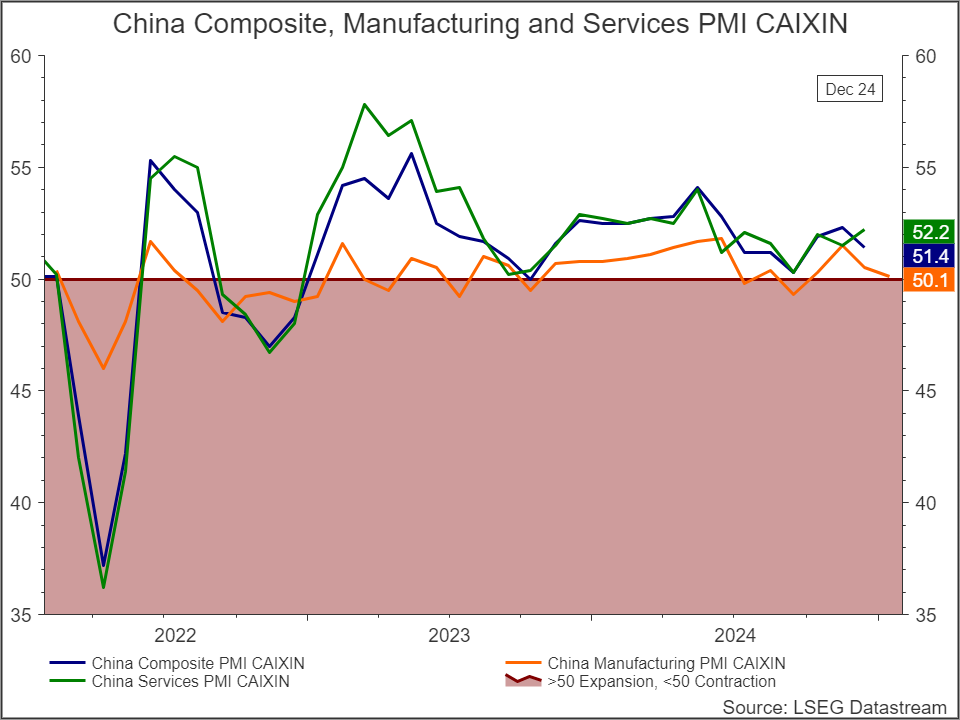

China factory activity growth slows in January, Caixin PMI shows

BEIJING, Feb 3 (Reuters) - China's factory activity grew at a slower pace in January, while staffing levels fell at the quickest pace in nearly five years as trade uncertainties increased, a private-sector business survey showed on Monday.

The Caixin/S&P Global manufacturing PMI slipped to 50.1 in January from 50.5 the previous month, missing analysts' forecasts in a Reuters poll of 50.5 and easing to a four-month low. But it just exceeded the 50-mark that separates growth from contraction.

Still, the reading was better than an official survey last week, which showed manufacturing activity unexpectedly contracted at the start of 2025, keeping alive calls for more stimulus in the world's second-largest economy. The smaller Caixin survey is believed to focus more on export-oriented companies.

According to the Caixin survey, manufacturing production accelerated in January from December, while total new orders increased at the quickest pace since November. Factory owners reported improved demand and anecdotal evidence suggested that some clients had ramped up orders for stockpiling purposes.

In the face of U.S. President Donald Trump's tariff threats, anecdotal evidence suggested exporters rushed to load cargoes at a major Chinese port before the eight-day Lunar New Year holiday and ahead of any new tariffs. Trump on Saturday ordered 10% tariffs on goods from China and larger levies on Canadian and Mexican imports, risking a new trade war that economists say could slow global growth and reignite inflation.

The Caixin survey showed January new orders from abroad declined for a second straight month. And factories' average selling prices declined at fastest pace since July 2023, reflecting pressure to support sales and market share amid rising competition and global uncertainties.

Still manufacturers' sentiment improved on signs of improving domestic demand and expectations of more government support measures for the economy. Employment usually eases as factories tend to shut temporarily over the long Lunar New Year holiday. But January's job shedding rate speeded up to the fastest since February 2020.

According to manufacturers, the fall in employment levels reflected the non-replacement of job leavers and redundancies due to cost concerns.

Nonethless, the reduction in staffing levels and rising new orders led to a fourth monthly accumulation of backlogged work in the manufacturing sector.

“Rising uncertainty in international policies could worsen China’s export environment, posing significant challenges for the economy,” said Wang Zhe, economist at Caixin Insight Group. Economic policies hence ”must be well-prepared and adjusted promptly” to adapt to evolving circumstances, he added.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

Share this post