Weekly Economics Report - Feb. 21, 2025

Canada's annual inflation in January edges up to 1.9%, core measures also up

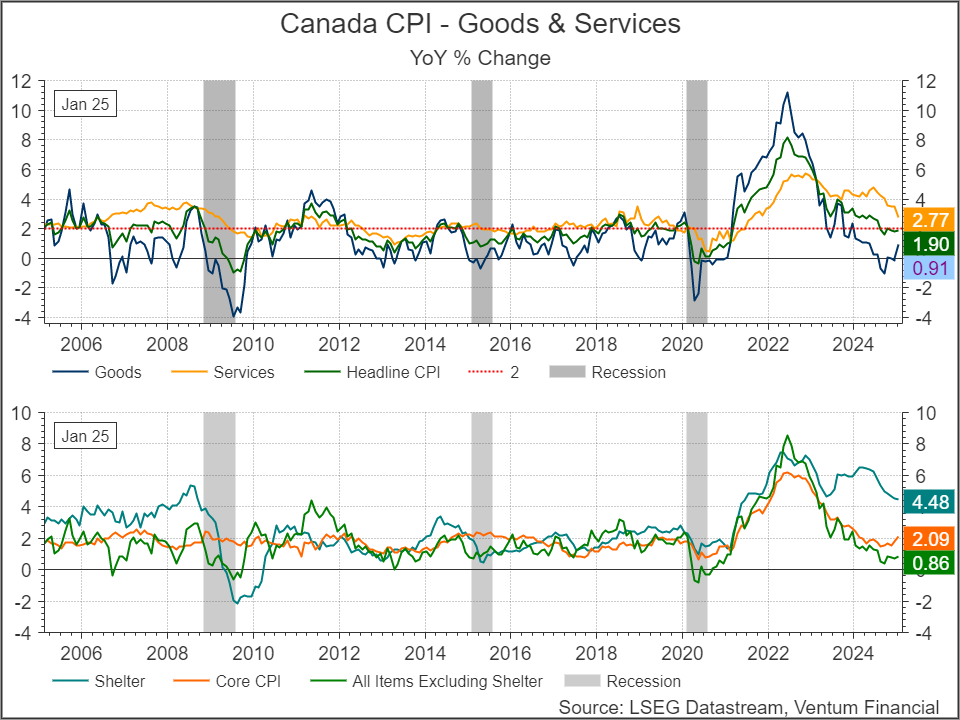

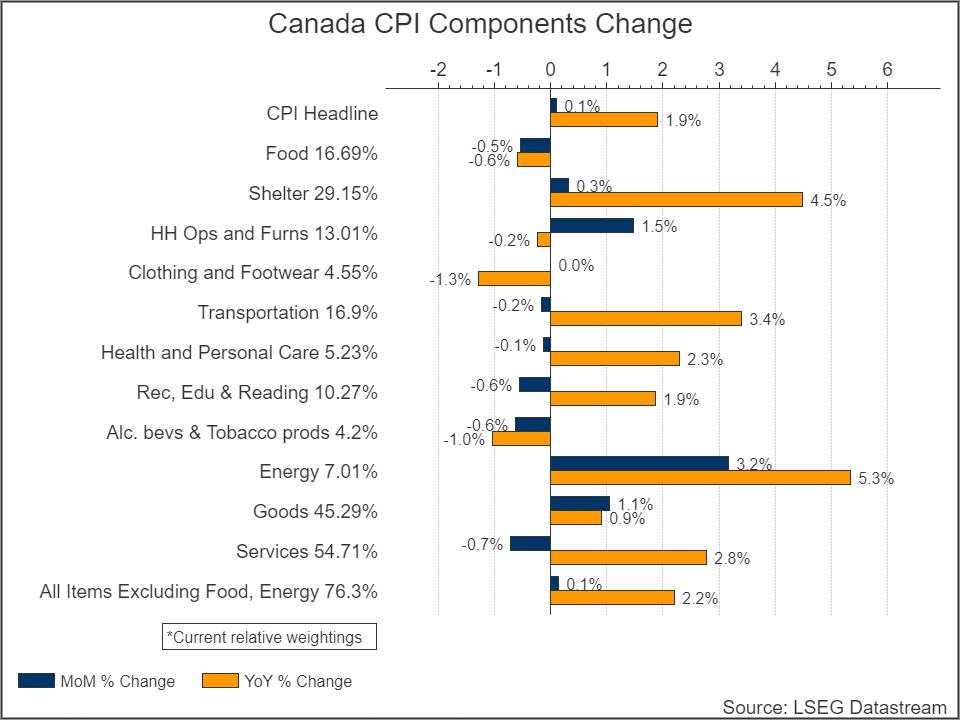

OTTAWA, Feb 18 (Reuters) - Canada's annual inflation rate inched up to 1.9% in January from the previous month as higher gasoline and natural gas costs reduced the impact of a sales tax reprieve on broader consumer prices, official data showed on Tuesday.

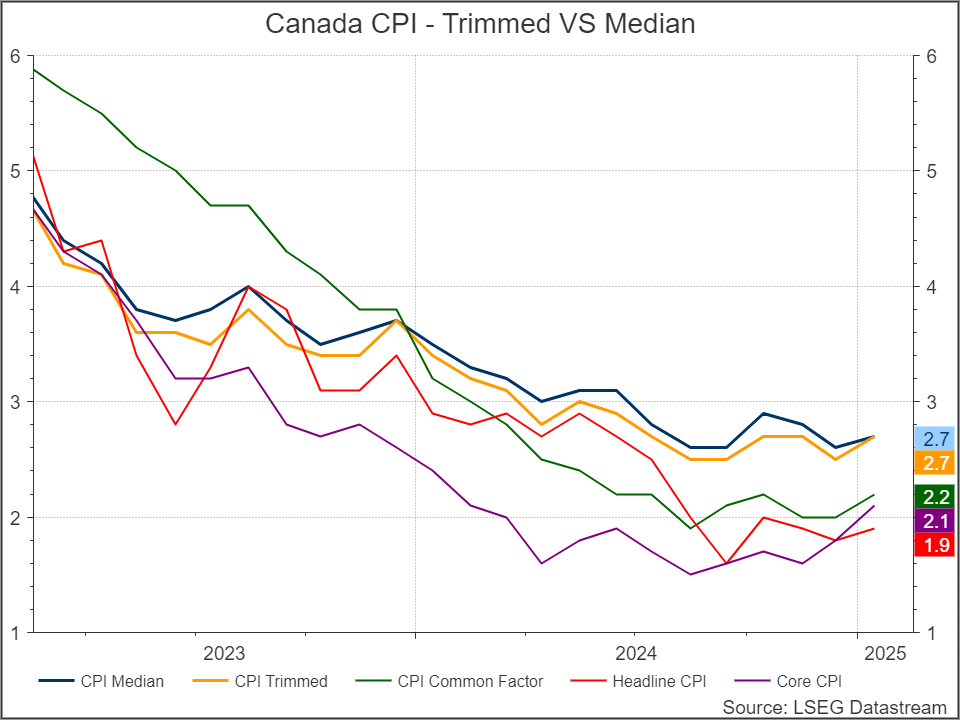

The core measures of the consumer price index, which have not declined as fast as the inflation rate in the past few months, edged up too. January's CPI reading racked up a six-month record of inflation coming in at or below the 2% mark - the mid-point of the Bank of Canada's 1%-3% target range, but underlying price pressures reduced currency swap market bets for an interest rate cut next month.

They now see an almost 63% chance of no rate cut in March, compared with 56% before January's inflation data was released. 0#CADIRPR. If U.S. President Donald Trump decides to impose tariffs on Canadian imports from March, market expectations for a rate cut could change considerably.

Tuesday's annual inflation reading matched the forecast of analysts polled by Reuters. In December, inflation stood at 1.8%. On a monthly basis, prices were up 0.1% in January, Statistics Canada said. The government announced a sales tax holiday on a range of products such as food, beverages, restaurant meals and children's clothing from mid-December to mid-February, helping to ease inflationary pressures, it said.

Prices for the food component of the CPI basket fell 0.6% on a year-over-year basis in January, the first yearly decrease since May 2017, driven by a record 5.1% decline in prices for food purchased from restaurants, the data showed.

Without the tax relief, consumer prices would have risen at a rate of 2.7%, Statscan said. In December, excluding the tax break, prices were up 2.3%.

The Canadian dollar CAD= weakened on Tuesday and was trading down 0.13% at 1.4199 to the U.S. dollar, or 70.43 U.S. cents.

Yields on the two-year government bond CA2YT=RR were up 6.8 basis points to 2.797%. Economists have said the sales tax break had distorted overall inflation numbers, and that core inflation was a more accurate gauge of consumer price trends.

The BoC has two preferred measures of core inflation - CPI-median and CPI-trim. CPI-median - or the centermost component of the CPI basket when arranged in an order of increasing prices - rose to 2.7% from an upwardly revised 2.6% in December. CPI-trim - which excludes the most extreme price changes - was up to 2.7% from 2.5% in the prior month.

The upward pressure on inflation in December was led by an 8.6% jump in prices paid by Canadians at fuel pumps, Statscan said. That was further boosted by a 4.8% rise in natural gas prices and the first year-over-year rise in eight months in passenger vehicle costs. With prices staying at or below the BoC's 2% target, the central bank has been able to implement the most aggressive rate easing among the G7 nations. Last month, it reduced the key policy rate to 3%.

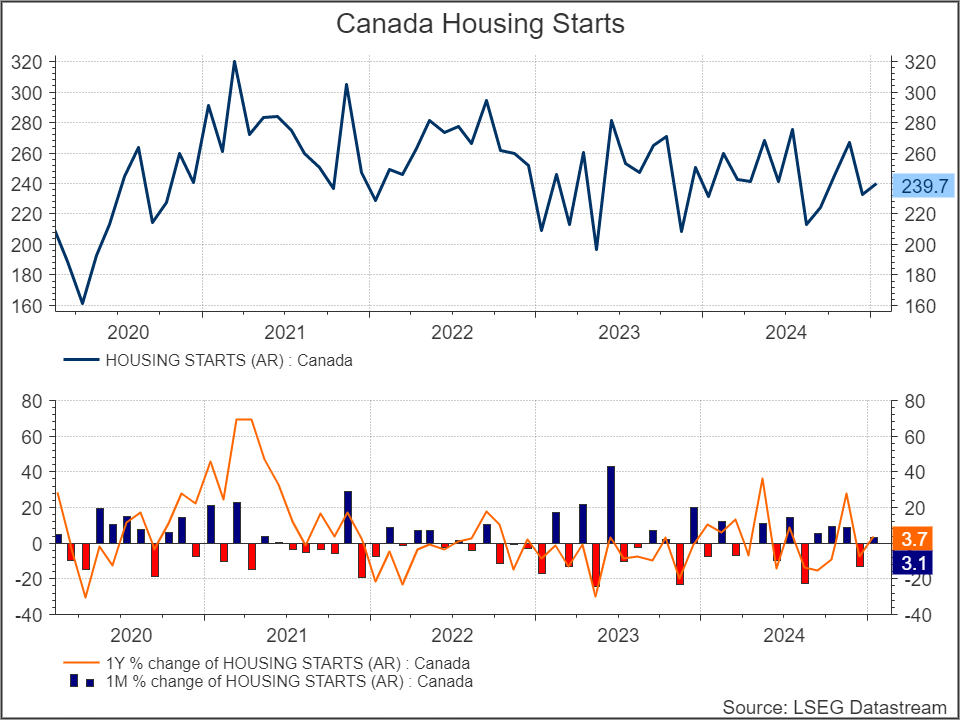

Canadian housing starts rise 3% in January, CMHC says

OTTAWA, Feb 17 - Canadian housing starts rose 3% in January compared with the previous month as groundbreaking increased on multiple unit urban homes, data from the national housing agency showed on Monday. The seasonally adjusted annualized rate of housing starts rose to 239,739 units in January from revised 232,492 units in December, the Canadian Mortgage and Housing Corporation (CMHC) said. Economists had expected starts to rise to 252,500 units.

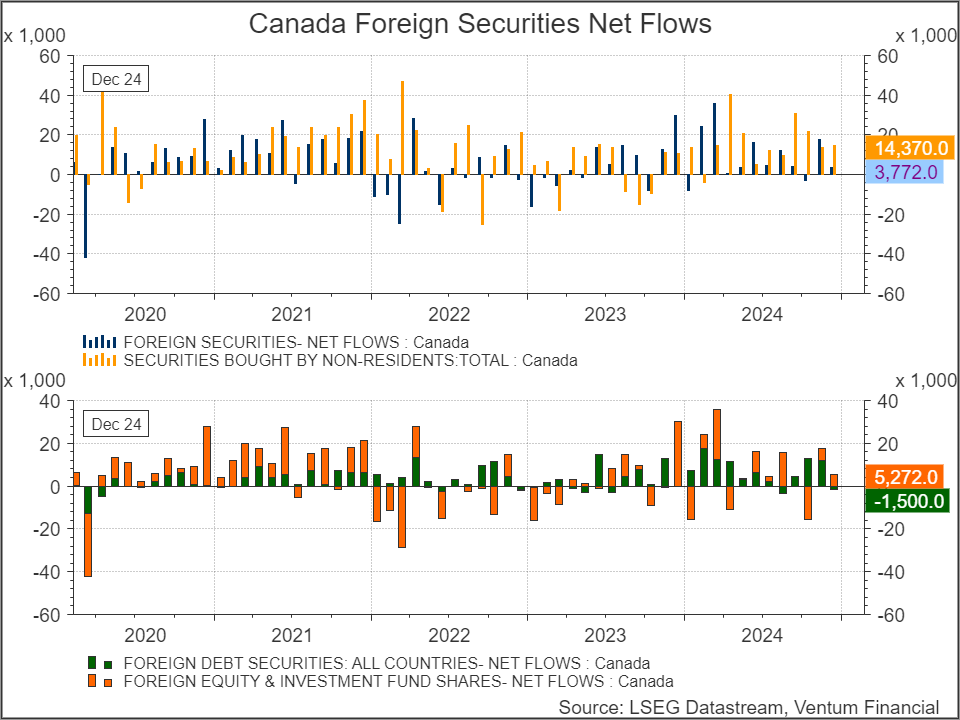

Foreigners buy C$14.37 bln in Canadian securities in December

Feb 17 (Reuters) - Foreign investors bought a net C$14.37 billion ($10.13 billion) in Canadian securities in December, led by federal government bonds, following a downwardly revised C$13.84 billion total purchase in November, Statistics Canada said on Monday. Canadian investors bought a net C$3.77 billion worth of foreign securities, led by purchases of U.S. shares.

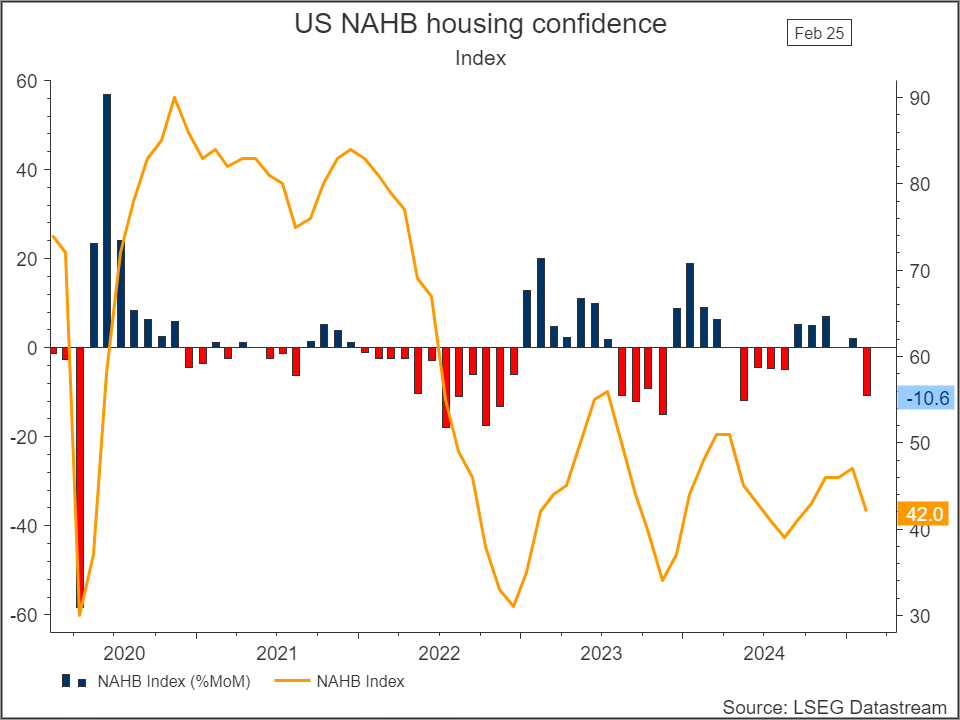

US homebuilder sentiment drops to five-month low in February

WASHINGTON, Feb 18 (Reuters) - U.S. homebuilder sentiment tumbled to a five-month low in February amid worries that tariffs on imports would combine with higher mortgage rates to further drive up housing costs.

The National Association of Home Builders/Wells Fargo Housing Market Index plunged five points to 42 this month, the lowest reading since September. That erased all the gains that were notched in the aftermath of President Donald Trump's election victory in November, when sentiment had risen in anticipation of a less-stringent regulatory environment

Trump in his first weeks in office slapped an additional 10% tariff on imported goods from China. A 25% levy on imports from Mexico and Canada was suspended until March. Trump this month raised tariffs on steel and aluminum imports to 25%.

New home construction is heavily reliant on imported materials, including lumber, as well as other goods like household appliances. The decline in homebuilder sentiment mirrored a decrease in consumer sentiment. Tariffs have also rattled consumers. "While builders hold out hope for pro-development policies, particularly for regulatory reform, policy uncertainty and cost factors created a reset for 2025 expectations in the most recent HMI," said NAHB Chairman Carl Harris.

The survey's measure of current sales conditions fell four points to a five-month low of 46. A gauge of sales expectations in the next six months plunged 13 points to 46, the lowest level since December 2023. Its measure of prospective buyers traffic slipped three points to 29. "With 32% of appliances and 30% of softwood lumber coming from international trade, uncertainty over the scale and scope of tariffs has builders further concerned about costs," said NAHB Chief Economist Robert Dietz. "Addressing the elevated pace of shelter inflation requires bending the housing cost curve to enable adding more attainable housing."

The nation is facing a housing shortage, which has boosted rents and contributed to elevated inflation. The average rate on the popular 30-year fixed-rate mortgage is hovering just under 7%. Residential spending rebounded in 2024, lifted by single-family home construction as builders took advantage of a shortage of previously owned homes for sale.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

Share this post