Weekly Economics Report - April 4, 2025

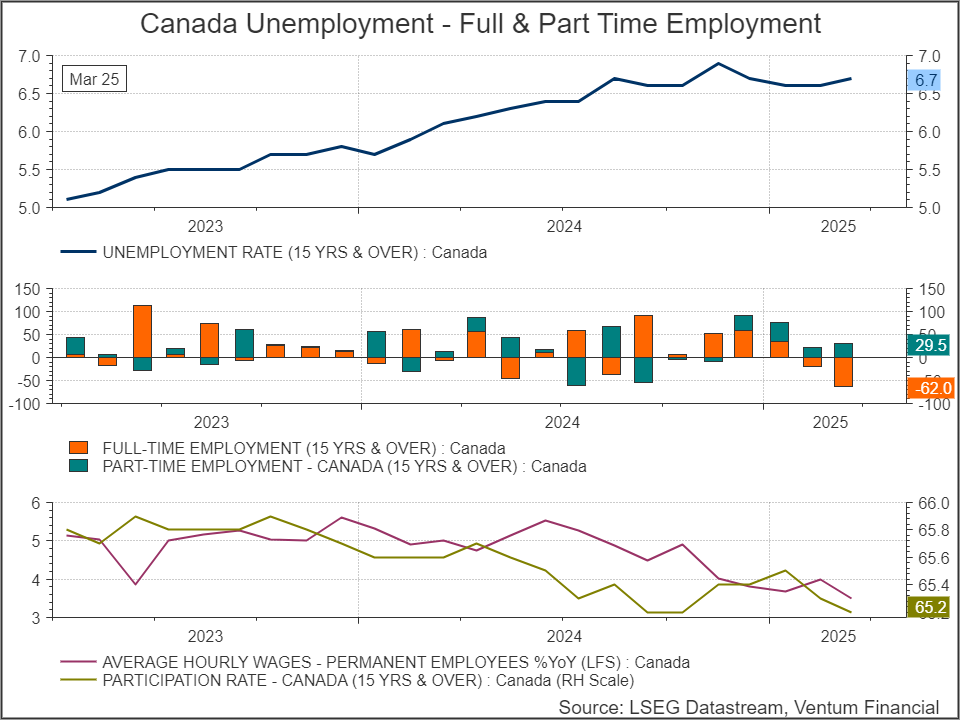

Canada sees drop in total jobs in March for first time in over three years, unemployment rate up

OTTAWA, April 4 (Reuters) - Canada's total employment fell and the unemployment rate ticked up in March, data showed on Friday, as the uncertainty around tariffs and their subsequent implementation took a toll on hiring and spurred some layoffs.

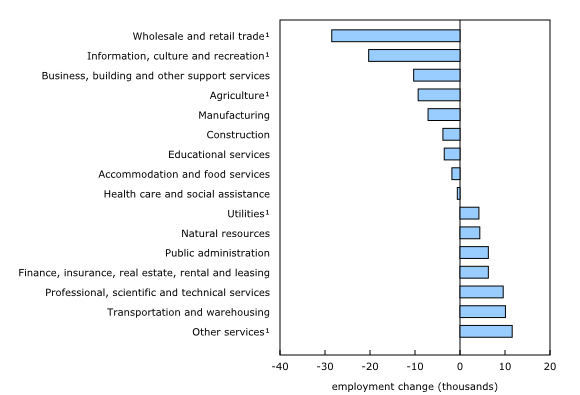

The country's employment number dropped by a net 32,600 people, the first decrease in more than three years, driven by a steep decline in full-time work, Statistics Canada said.

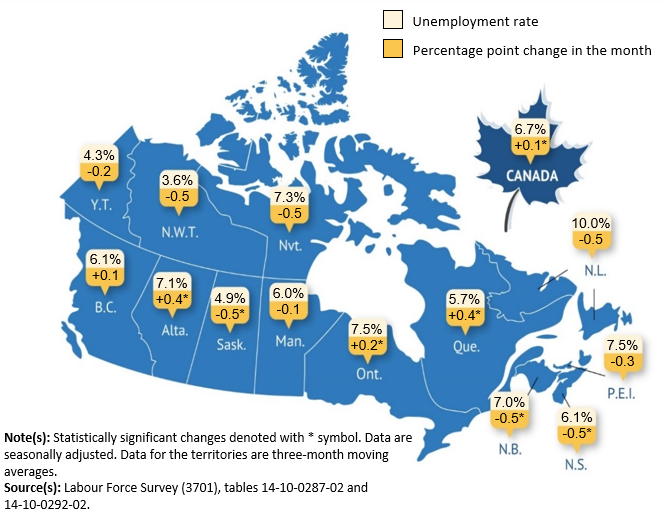

The decline in March followed largely flat growth in jobs in February and robust expansion of 211,000 new jobs from November to January. The unemployment rate rose to 6.7% from 6.6% a month earlier.

Analysts polled by Reuters had forecast a net job addition of 10,000 people and had estimated the unemployment rate to rise to 6.7%.

Most economists had expected the job market to start showing signs of weakening as companies held back on investments and hiring due to the uncertain tariff situation.

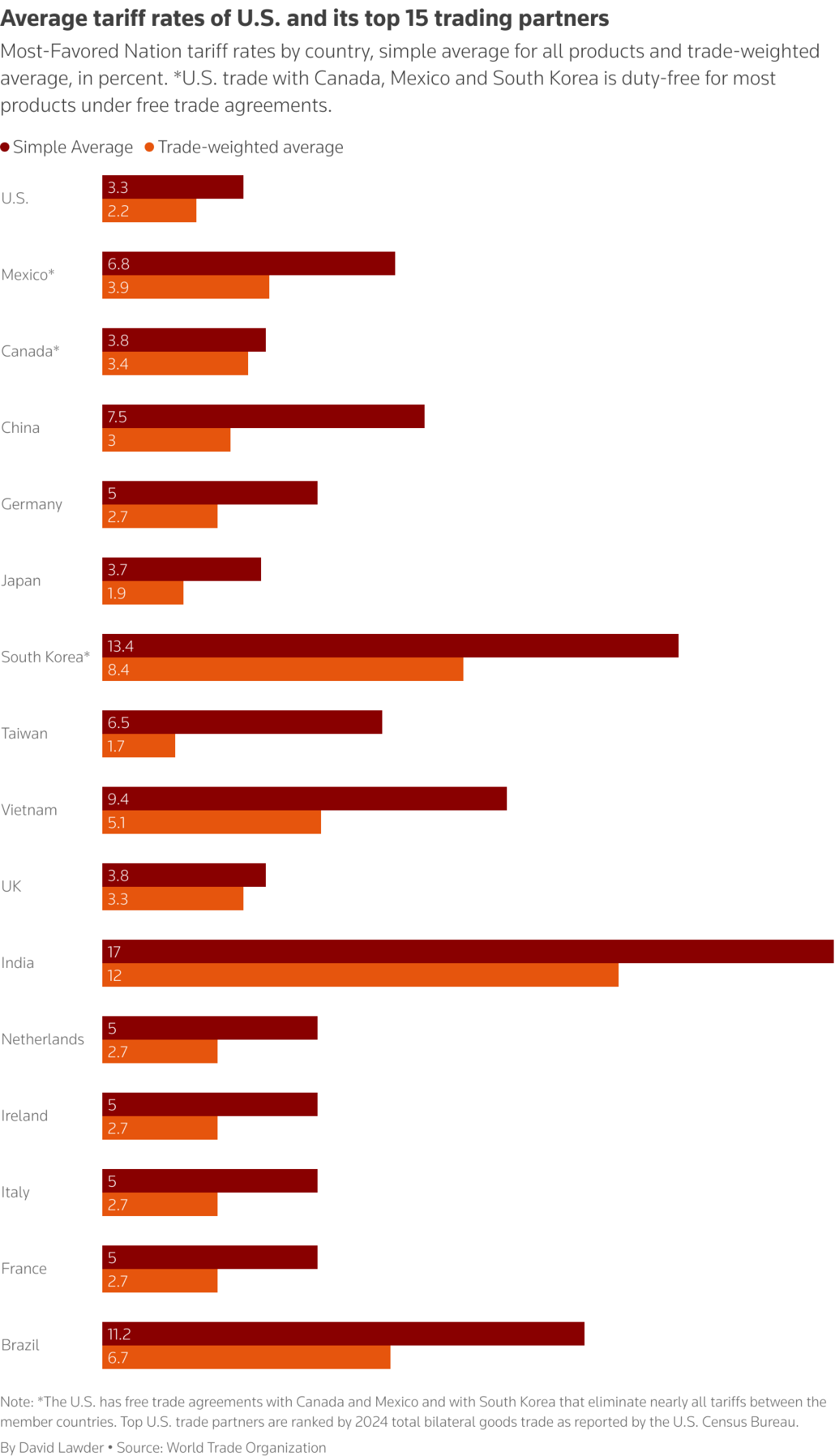

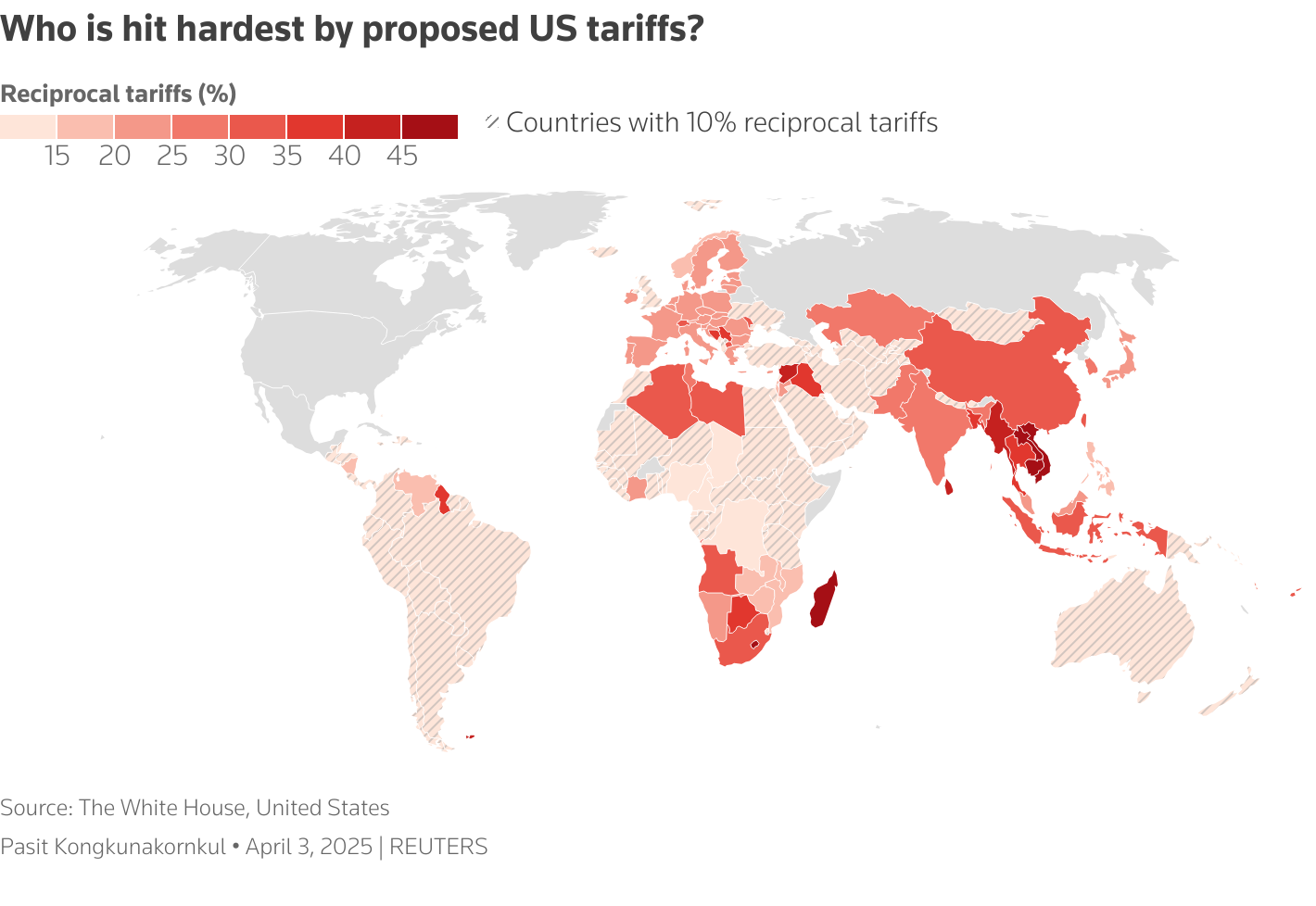

U.S. President Donald Trump imposed a 25% tariff on Canadian steel and aluminum from March and slapped import duties on cars and parts based on non-U.S. content and non-compliance to a free trade deal. He also announced sweeping reciprocal tariffs across all trading partners. These reciprocal tariffs and retaliation by many countries are expected to hit the global economy hard, pushing many countries into recession, analysts have said.

CHINA RETALIATES

The Canadian dollar CAD= was trading down 0.72% to 1.4194 to the U.S. dollar, or 70.45 U.S. cents, after Chinaimposed retaliatory tariffs on the United States.

Currency markets are betting that there is a 62% chance of yet another rate cut by the Bank of Canada on April 16, a sharp turn from just a 25% chance seen a day earlier. 0#CADIRPR.

The rise in the unemployment rate, or the number of people unemployed as a percentage of the labor force, was the first increase since November, Statscan said. In total, there were 1.5 million unemployed people in March, up 36,000 in the month and up 167,000 on a year-over-year basis, it said.

The Bank of Canada said last month that Canadians were more worried about their job security and financial health as a result of the trade tensions, and they intend to spend more cautiously.

Statscan said that among the total unemployed, about 44% had lost their job due to a layoff within the previous 12 months. Of these, 18.4% last worked in construction, while 12.4% last worked in wholesale or retail trade. However it clarified that the March layoff rate - the proportion of the employed population in a given month who were unemployed the following month due to a layoff - was 0.7%, similar to the pre-pandemic period. The average hourly wage growth of permanent employees, a metric closely watched by the BoC too gauge inflationary trends, was at 3.5% in March from 4% in February.

US job growth beats expectations in March

WASHINGTON, April 4 (Reuters) - The U.S. economy added far more jobs than expected in March, but President Donald Trump's sweeping import tariffs could test the labor market's resilience in the months ahead amid sagging business confidence and a stock market selloff.

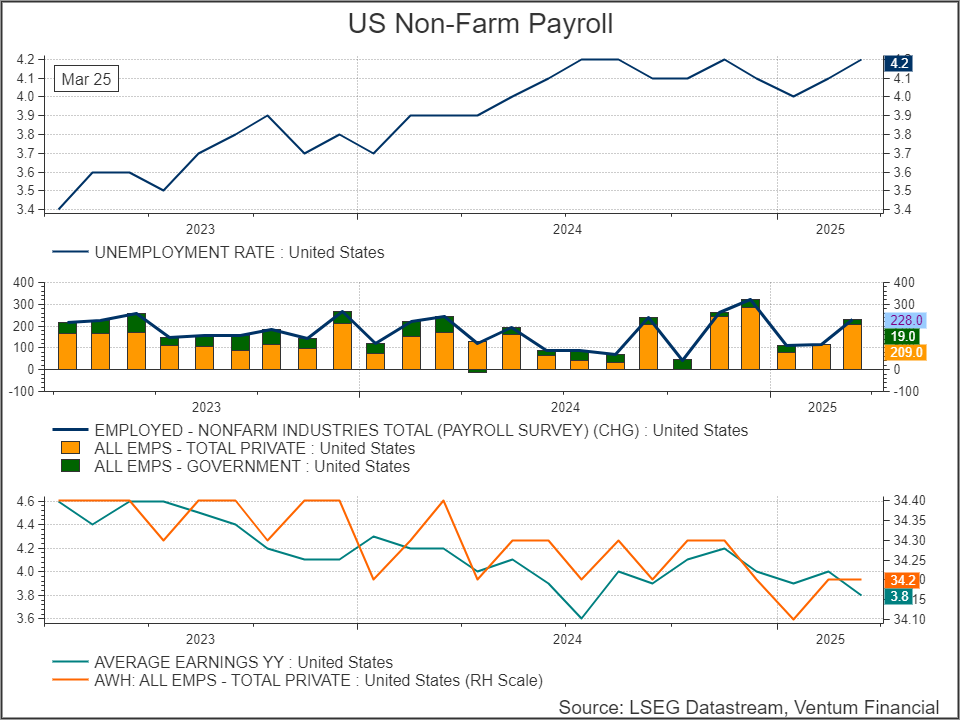

Nonfarm payrolls increased by 228,000 jobs last month after a downwardly revised 117,000 rise in February, the Labor Department said in its closely watched employment report on Friday. Economists polled by Reuters had forecast payrolls advancing by 135,000 jobs after a previously reported 151,000 rise in February. Estimates ranged from 50,000 to 185,000.

The unemployment rate rose to 4.2% from 4.1% in February. The labor market is being underpinned by low layoffs, generating solid wage gains that are helping to sustain the economic expansion.

But businesses have been hesitant to hire because of an uncertain trade policy. That caution could give way to job cuts after Trump unveiled on Wednesday a 10% minimum tariff on most goods imported into the U.S., unleashing threats of retaliation and rattling global financial markets.

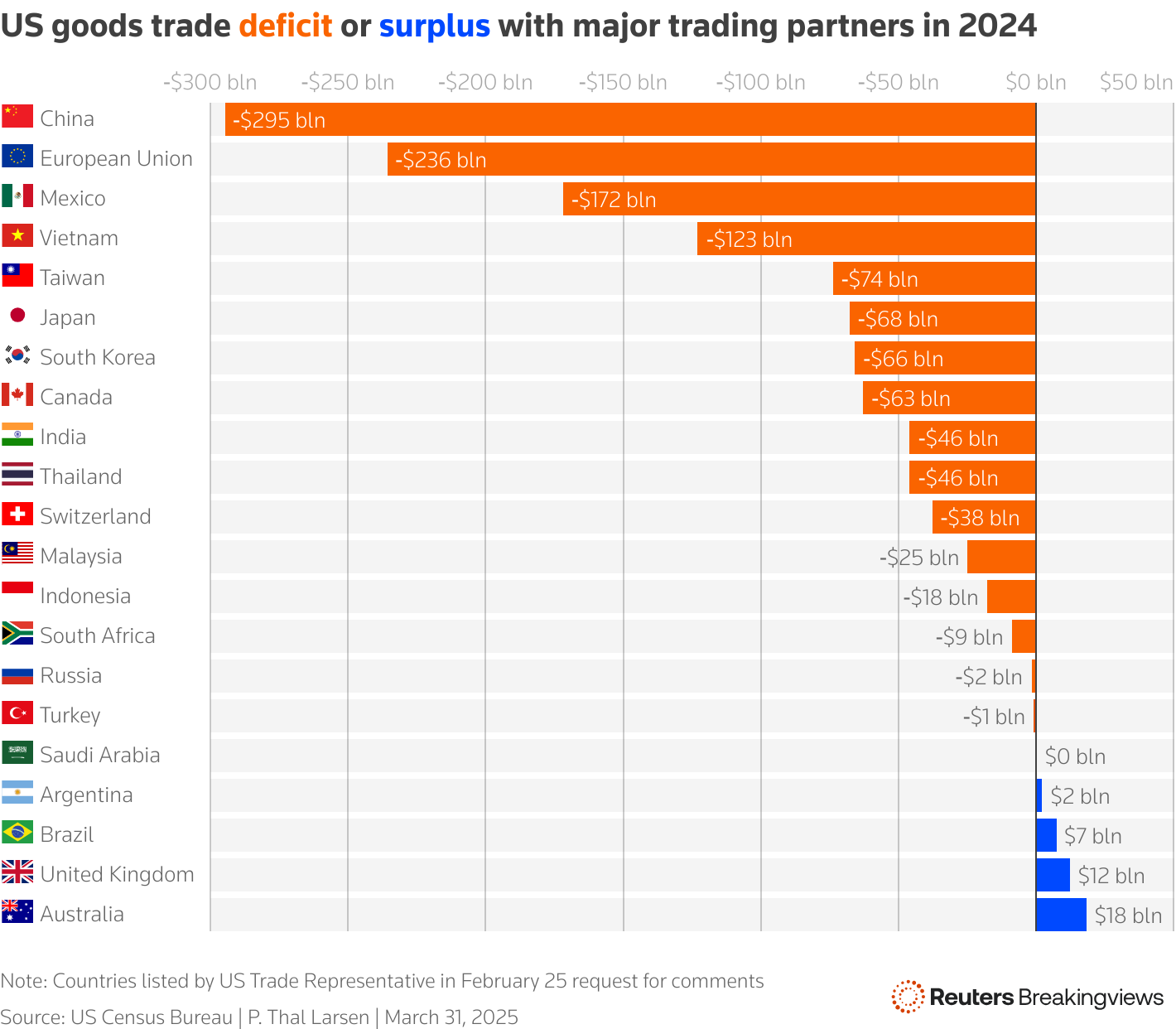

Economists estimated that Trump's sweeping import duties had boosted the nation's effective tariff rate to the highest level in more than a century. They warned of snarled supply chains and high prices, culminating in layoffs as spending by both households and consumers retrenches. Trump's tariffs blitz since returning to the White House has already unnerved businesses, who had cheered his electoral victory in November. The report could offer some short-term relief to financial markets roiled by the import duties.

Data and sentiment surveys have suggested the economy stalled in the first quarter because of trade policy uncertainty and winter storms. Gross domestic product growth estimates for the first quarter are below a 0.5% annualized rate, with high odds of a contraction. Economists are not ruling out a recession in the next 12 months.

They expect the effects of the reciprocal tariffs could be evident as soon as with April's employment report. Retail payrolls are most likely to decline as consumers hunker down amid price increases. Financial market expect the Federal Reserve to resume cutting interest rates no later than June after pausing its policy easing cycle in January. U.S. central bank officials last month projected two interest rate cuts this year. The Fed's policy rate is currently in the 4.25%-4.50% range.

China hits back hard in global trade war with tariffs on US goods

BEIJING/WASHINGTON/BRUSSELS, April 4 (Reuters) - China announced additional tariffs of 34% on U.S. goods on Friday, the most serious escalation in a trade war with President Donald Trump that has fed fears of a recession and triggered a global stock market rout.

In the standoff between the world's top two economies, Beijing also announced controls on exports of some rare earths and filed a complaint at the World Trade Organisation.

It added 11 entities to the "unreliable entity" list, which allows Beijing to take punitive actions against foreign entities, including firms linked to arms sales to democratically governed Taiwan, which China claims as part of its territory.

Nations from Canada to China have readied retaliation in a mounting trade war after Trump raised U.S. tariff barriers to their highest level in more than a century this week, leading to a plunge in world financial markets.

Investment bank JP Morgan said it now sees a 60% chance of the global economy entering recession by year end, up from 40% previously.

U.S. stock futures fell sharply on Friday, signaling more losses on Wall Street, after China retaliated with fresh tariffs a day after the Trump administration's sweeping levies knocked off $2.4 trillion from U.S. equities.

"China comes out swinging with an aggressive response to Trump's tariffs," said Stephane Ekolo, Market & Equity Strategist, Tradition, London.

"This is significant and is unlikely to be over, hence the negative market reactions. Investors are afraid of a 'tit for tat' trade war situation."

Shares of Big Tech stocks fell in premarket trading, with companies such as Apple AAPL.O and Nvidia NVDA.Ohaving big exposure to China and Taiwan for manufacturing their products.

In Japan, one of United States' top trading partners, Prime Minister Shigeru Ishiba said the tariffs had created a "national crisis" as a plunge in banking shares on Friday set Tokyo's stock market on course for its worst week in years.

U.S. Secretary of State Marco Rubio on Friday disputed any economic crash, telling reporters that markets were reacting to the change and would adjust.

"Their economies are not crashing. Their markets are reacting to a dramatic change in the global order in terms of trade," he said at a press conference in Brussels. "The markets will adjust."

DIVISIONS AND MIXED SIGNALS

With European shares also heading for the biggest weekly loss in three years, the European Union's trade commissioner Maros Sefcovic will speak to U.S. counterparts. "We will not shoot from the hip – we want to give negotiations every chance to succeed to find a fair deal, to the benefit of both sides," he said on social media.

The EU is divided on how best to respond to Trump's tariffs, including on use of its 'Anti-Coercion Instrument', which allows the bloc to retaliate against third countries that put economic pressure on EU members to change their policies.

Countries that are cautious about retaliating and thereby raising the stakes in the standoff with the U.S. include Ireland, Italy, Poland and the Scandinavian nations.

French President Emmanuel Macron led the charge on Thursday by calling on companies to freeze investment in the U.S.

However, French Finance Minister Eric Lombard later cautioned against like-for-like countermeasures on the U.S. tariffs, warning this would also rebound on European consumers.

"We are working on a package of responses that can go well beyond tariffs, in order, once again, to bring the U.S. to the negotiating table and reach a fair agreement," Lombard said in an interview with broadcaster BFM TV. There were conflicting messages from the White House about whether the tariffs were meant to be permanent or were a tactic to win concessions, with Trump saying they "give us great power to negotiate."

The U.S. tariffs could jack up the price for U.S. shoppers of everything from cannabis to running shoes to Apple's iPhone. A high-end iPhone could cost nearly $2,300 if Apple passes the costs on to consumers, based on projections from Rosenblatt Securities.

Businesses have raced to adjust. Automaker Stellantis STLMA.MI said it would temporarily lay off U.S. workers and close plants in Canada and Mexico, while General Motors GM.N said it would increase U.S. production.

China is retaliating for Trump's 54% tariffs on imports from the world's No. 2 economy. The European Union faces a 20% duty.

"Others have maybe learned their lessons (from Trump's last term)," said Eddie Kennedy, head of Bespoke Discretionary Fund Management, Marlborough, London. "They are fighting back and saying we can play the same game as you and we are more in a position of strength to negotiate."

Other trading partners, including Japan, South Korea, Mexico and India, said they would hold off on any retaliation for now as they seek concessions. Britain's foreign minister said it was working to strike an economic deal with the United States.

Trump says the "reciprocal" tariffs are a response to barriers put on U.S. goods, while administration officials said the tariffs would create manufacturing jobs at home and open up export markets abroad, although they cautioned it would take time to see results.

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Ventum Financial Corp. www.ventumfinancial.com

Vancouver Office

2500 - 733 Seymour Street

Vancouver, BC V6B 0S6

Ph: 604-664-2900 | Fax: 604-664-2666

For a complete list of branch offices and contact information, please visit our website.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

For further disclosure information, reader is referred to the disclosure section of our website.

Share this post