Weekly Commodities Report - December 6, 2024

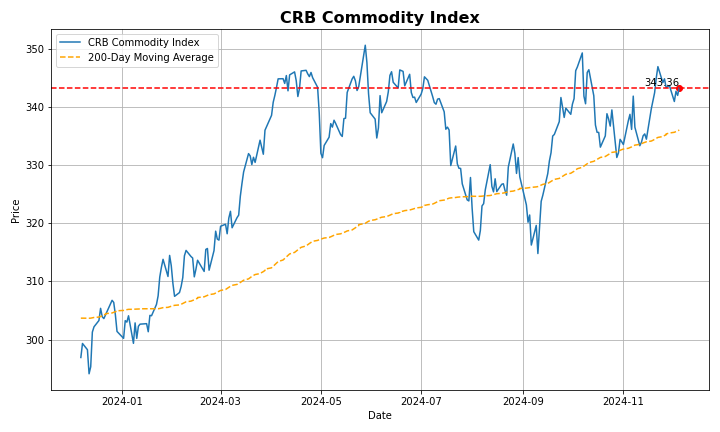

CRB Commodity Index increased 41.96 points or 13.92% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, CRB Commodity Index reached an all time high of 470.17 in July of 2008.

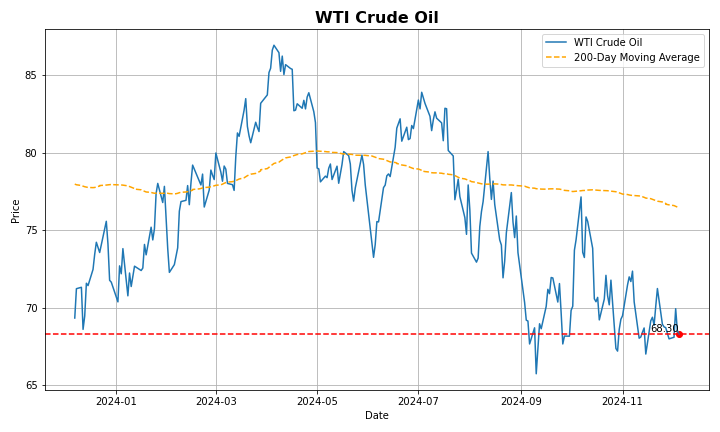

WTI crude oil futures extended its recent decline to below $68 per barrel on Friday, as OPEC+'s decision to delay restoring halted production failed to lift market sentiment amid expectations of oversupply next year. On Thursday, the producer group postponed the supply hike by another three months, opting to begin with a gradual increase in April and phase out production cuts over 18 months, at a slower pace than originally planned. This decision aligns with market expectations, as the group aims to balance declining global demand with rising output from non-OPEC+ countries. Meanwhile, the UAE also announced it would delay the planned 300,000 bpd increase in its crude production target from January to April. Over the week, oil is on track for modest gains following a sharp decline the previous week.

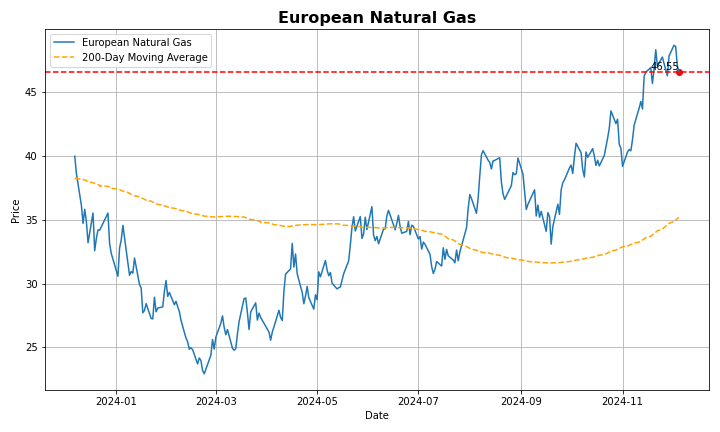

European natural gas futures dropped to €46.3 per megawatt-hour, their lowest in over two weeks, after Russia eased payment rules for gas purchases, reducing fears of supply disruptions. President Vladimir Putin’s decision allows foreign buyers to use third-party banks to convert payments into rubles and transfer them to Gazprombank, avoiding complications from US sanctions. Although Europe has diversified its gas sources, faster-than-normal storage withdrawals this winter have heightened vulnerability to potential disruptions. Current inventories are about 84% full, below last year’s levels. Increased liquefied natural gas imports and mild, windy weather forecasts are helping ease supply concerns. Prices are on track for their first weekly decline since November, down over 3%.

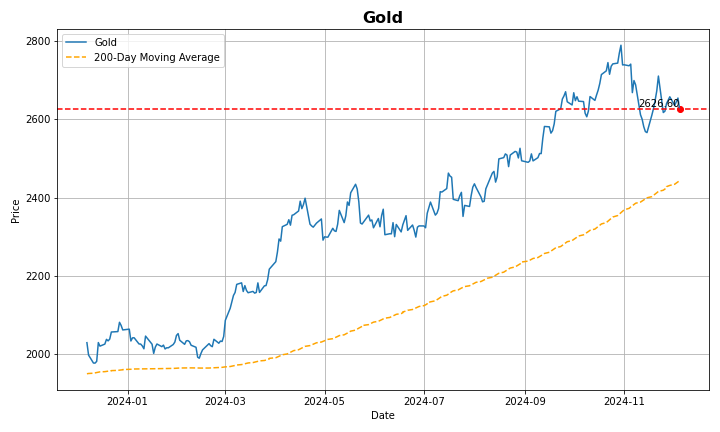

Gold retraced earlier gains to trade near $2,625 on Friday, as investors monitored recent data. Although the US economy added 237,000 jobs in November, surpassing the upwardly revised 236,000 in October and market expectations of 200,000, the jobless rate inched higher to 4.2%. Consequently, traders believe that this might not be sufficient to deter the Fed from cutting interest rates this month. Currently, markets are pricing in an 87% chance of a 25 basis point rate reduction this month, up from 71% yesterday and 66.5% a week ago. On the other hand, the World Gold Council reported a decline in physical demand from China, a leading gold consumer. Additionally, global physically backed gold exchange-traded funds (ETFs) experienced outflows in November following six consecutive months of inflows.

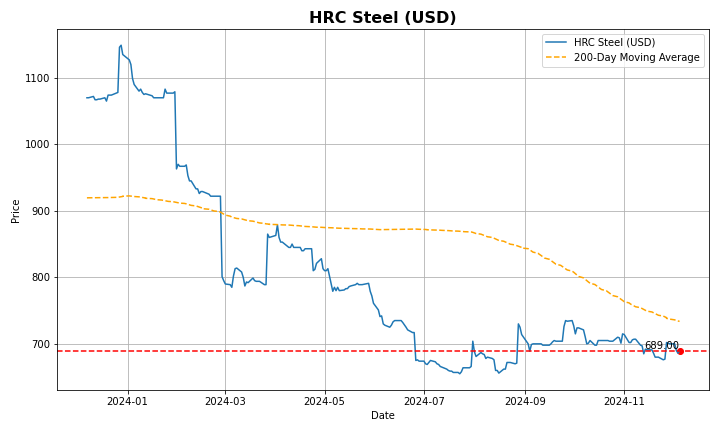

Steel futures rose to CNY 3,350 per tonne, the highest in one-and-a-half months, and tracking the sharp gains for equities of major property developers amid expectations of more economic support for house buyers ahead of China’s Central Economic Work Conference. Markets expect key Chinese policymakers to expand their arsenal of economic support measures in response to tariff threats from US President-elect Trump. Among the support measures are reports that policymakers will set the 2025 fiscal deficit at higher-than-expected levels, increasing liquidity for debt-ridden property developers, among the main consumers of steel rebar in the world. Tariffs and the momentum of protectionist policies would hamper foreign demand for Chinese steel as mills have increasingly depended on foreign consumers to meet sales targets. Chinese steel production rose to 81.9 million tons in October, driving exports in the period to surge to 11.2 million tons, the second-highest on record.

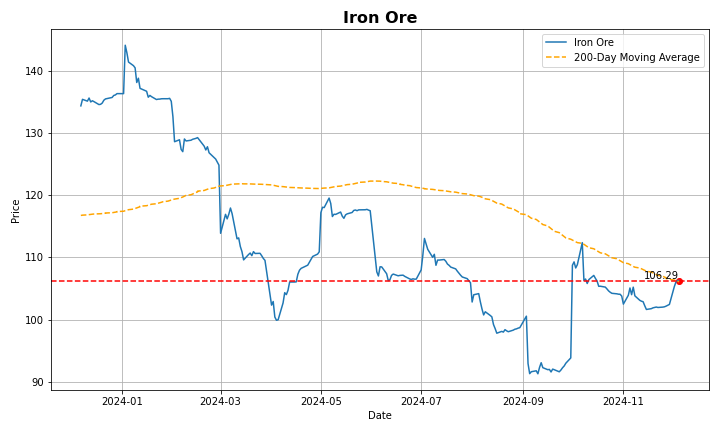

Iron ore prices for cargoes with 62% iron content climbed above $106 per ton in early December, supported by hopes that Beijing will introduce more stimulus measures during key political meetings this month. The Politburo’s decision to skip a readout of its regular November meeting has fueled speculation that stimulus support could be on its way as the world’s second-largest economy braces for the return of Donald Trump. The US president-elect has made two tariff threats in the past week, including a warning to impose a 100% tariff on the BRICS nation if they create a currency to rival the US dollar. Strong steel exports and destocking in China have also boosted steel margins, supporting higher production. Additionally, the latest data revealed that Chinese manufacturing activity expanded for the second consecutive month in November, further strengthening the demand outlook for iron ore.

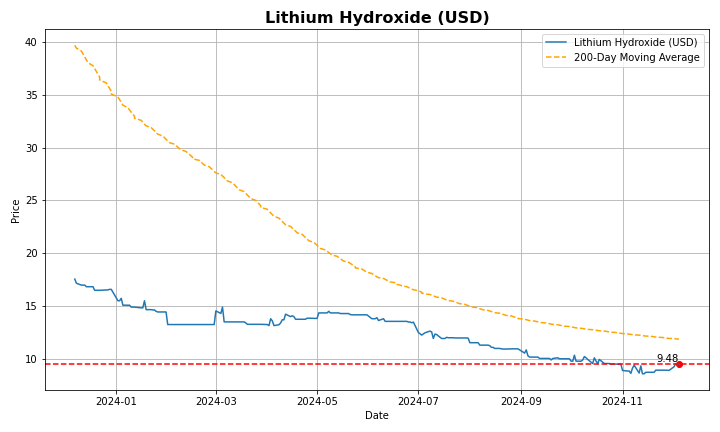

Lithium decreased 19,600 CNY/T or 20.31% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, Lithium reached an all time high of 5750000.00 in December of 2022.

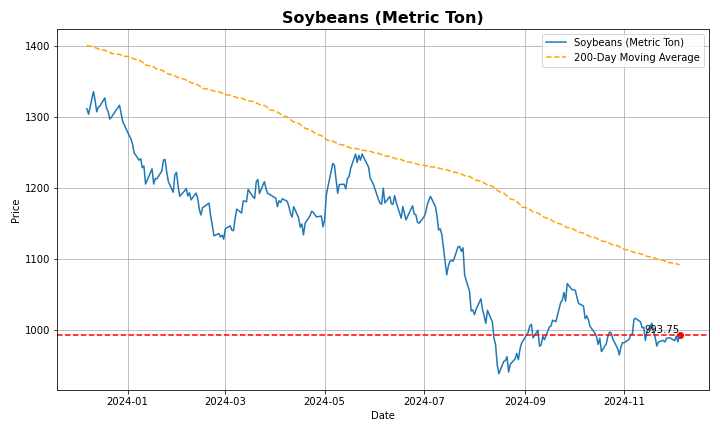

Soybean prices stabilized just below $10 per bushel, underpinned by strong production outlooks in Brazil and improved weather in Argentina. Brazilian soybean output for the 2024/25 season is forecast to hit record levels, with Celeres estimating 170.8 million metric tons, nearly 1 million tons higher than previous projections, and StoneX forecasting 166.2 million tons. Meanwhile, much-needed rainfall in Argentina’s key farming regions has boosted soil conditions as planting progresses. Despite increased U.S. export sales, soybeans remain locked in a narrow range due to ample global supplies and lingering concerns over potential trade tensions with China, the world's top soybean importer, under the incoming Trump administration.

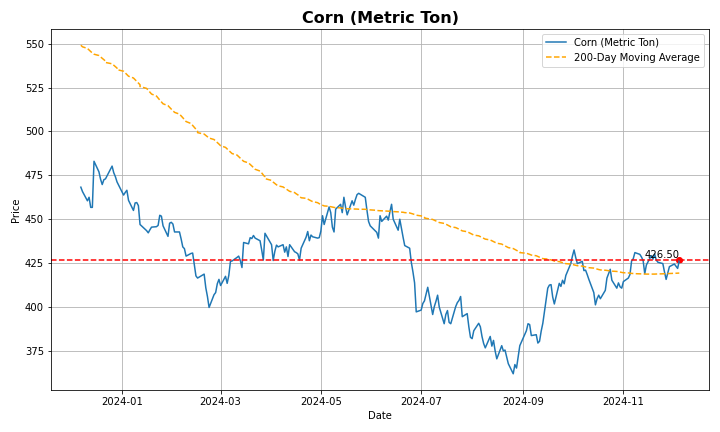

Corn futures dipped toward $4.20 per bushel in late November amid ample supplies and demand concerns.

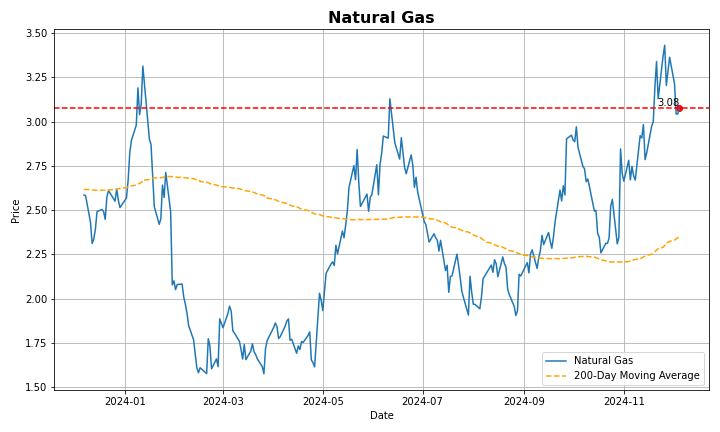

US natural gas futures dipped toward $3/MMBtu after a smaller-than-expected storage drawdown reported by the EIA. Utilities withdrew 30 billion cubic feet of natural gas in the week ending November 29, below market expectations of a 43 billion cubic feet draw, leaving inventories at 3,937 billion cubic feet. Natural gas prices are down over 8% this week, as forecasts suggest a shift from colder-than-normal weather through December 7 to warmer-than-normal conditions afterward, likely reducing heating demand. On the supply side, December production in the Lower 48 states rose to 102.3 bcfd from 101.5 bcfd in November but remained below the record 105.3 bcfd from last December. Analysts anticipate production increases in 2025, driven by stronger LNG export demand and recovering prices. Supporting this, feedgas volumes to major LNG export plants averaged 14.2 bcfd in early December, up from November’s 13.6 bcfd, approaching record levels.

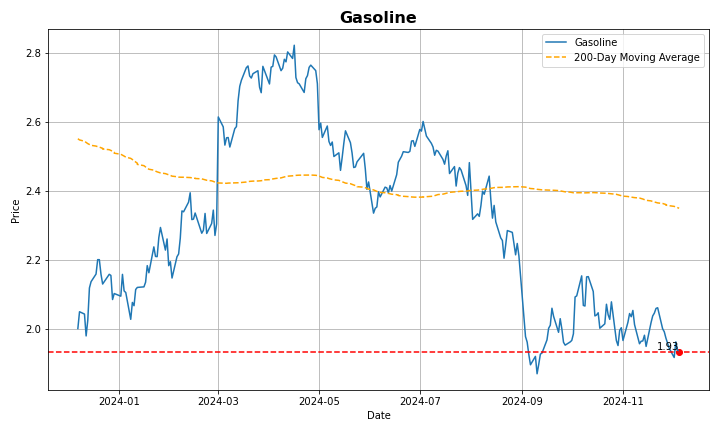

US gasoline futures edged closer to $1.90 per gallon, nearing a two-and-a-half-month low, as oil markets remained under pressure despite OPEC+’s decision to delay production increases. OPEC+ announced it would keep current output levels through Q1 2025 and gradually lift production starting in April, extending cuts over 18 months at a slower pace than planned, reflecting concerns about a potential supply glut next year. Traders are also monitoring China's upcoming economic plans for potential stimulus measures. In the US, crude stockpiles posted their largest decline in five months, but gasoline and distillate inventories rose more than expected, adding to bearish market sentiment.

Silver prices prices held steady above $31 per ounce on Friday, nearing one-month highs as traders piled on bets that the US Federal Reserve will cut interest rates again this month. The probability of a 25 basis point rate cut in December surged to around 72%, up from 66% last week. These expectations grew even after Fed Chair Jerome Powell signaled that the central bank is in no rush to lower rates, citing strong growth, a robust labor market, and persistent inflationary pressures. Additionally, speculation is rising that China could announce more stimulus measures during key political meetings this month, which could further boost demand in the world’s largest consumer of metals. Silver, along with other precious metals, also benefited from increased safe-haven demand amid political turmoil in France and South Korea, as well as ongoing conflicts in Eastern Europe and the Middle East.

Copper futures climbed above $4.17 per pound on Friday, approaching four-week highs, driven by expectations that Chinese authorities may announce additional policy support measures during key political meetings this month. The Politburo's decision to forgo a readout of its regular November meeting has fueled speculation that stimulus could be forthcoming, as China, the world’s second-largest economy, faces growing uncertainties, including the return of US President-elect Donald Trump. Trump recently issued two tariff threats, including a warning to impose a 100% tariff on BRICS nations if they create a currency to rival the US dollar. Meanwhile, recent data indicated that Chinese manufacturing activity expanded for the second consecutive month in November, further strengthening the demand outlook for copper.

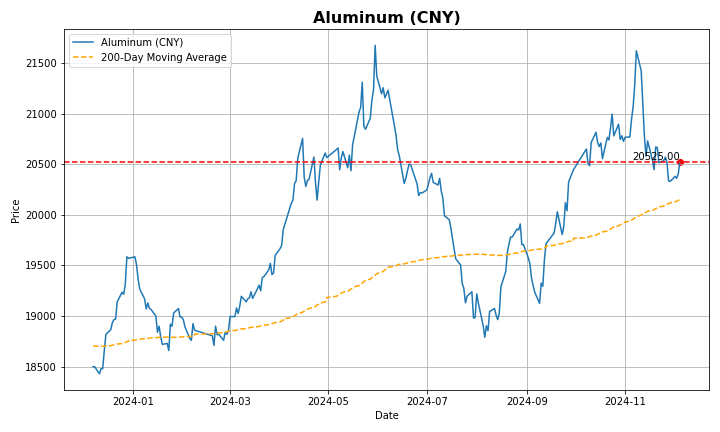

Aluminum futures increased 219 USD/Tonne or 9.19% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, Aluminum reached an all time high of 4103 in March of 2022.

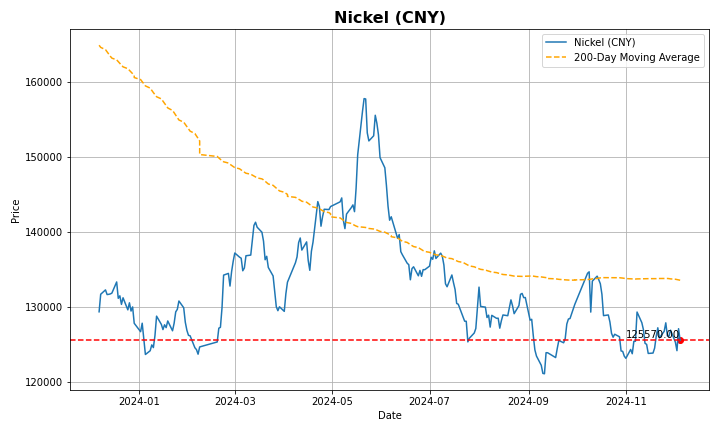

Nickel futures rebounded to around $16,200 per tonne from a 4-year low, fueled by concerns over Indonesia, the world’s largest nickel producer, tightening its mining policies. Reports indicate that approved mining quotas could decline by up to 27% by 2026, and the government plans to reduce license fees for low-grade nickel ore (less than 1.5% nickel content) used in battery production. This policy could restrict nickel availability for industries like stainless steel manufacturing. Additionally, nickel ore imports to Indonesia surged 50-fold year-on-year to over 9.3 million tons between January and October 2024, reflecting efforts to preserve domestic reserves. Officials have repeatedly warned of dwindling nickel stocks, emphasizing the need to prioritize domestic industries and stabilize prices, according to the mining minister.

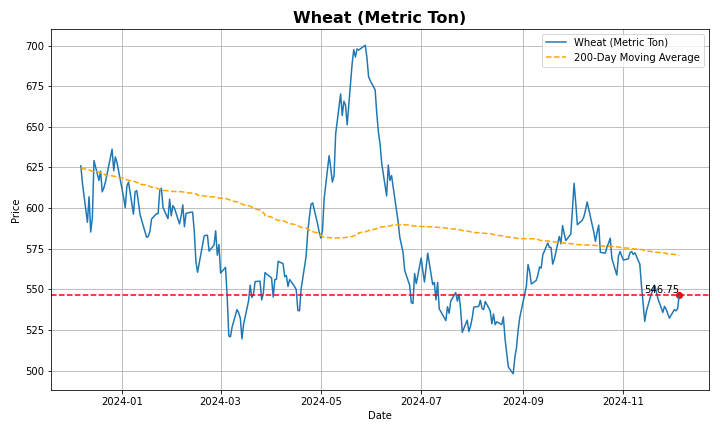

Wheat futures rose to nearly $5.5 per bushel, reaching a two-week high amid concerns over deteriorating Russian winter wheat conditions and Ukraine’s wheat shipping disruption. Analysts predict that 37% of Russia's winter crops are in poor condition compared to just 4% a year ago, marking the worst assessment on record. Moreover, many of these crops may need replacement with spring plantings, creating uncertainty around next year’s harvest. Further supporting prices, Ukraine’s wheat shipping capacity faces potential threats, with its 2024-25 wheat exports projected to decline by 14% year-on-year. However, Argentina’s wheat production may exceed earlier forecasts, as farmers report better-than-expected yields during the ongoing harvest, tempering price gains.

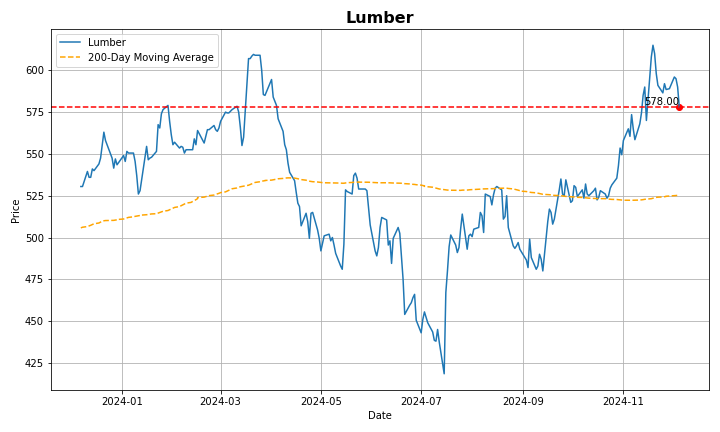

Lumber prices fell below $600 per thousand board feet after reaching an eight-month high of $615 in mid-November, reflecting a softened demand outlook for construction materials.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

Share this post