More Bad News S'Il Vous Plaît

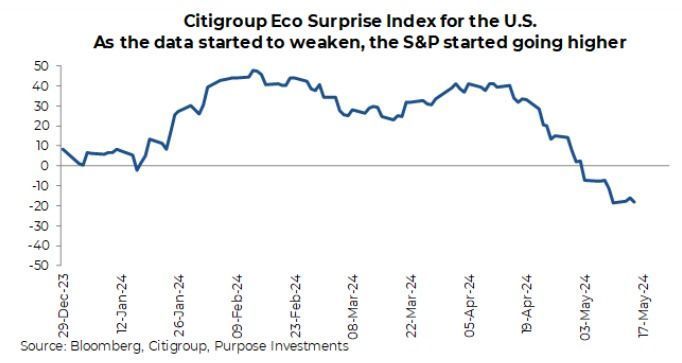

Of course, all eyes were on the U.S. inflation print for April, which was marginally softer than expected (soft CPI is truly good news), helping bond yields fall and pushing the S&P 500 to a new all-time high. But really, 0.3% vs. expectations of 0.4% is not huge, especially given that the core reading was in line at 0.3%. This still has the annualized 3-month change running a hot 4.5%. To be fair, there was some good news beneath the surface on the CPI print. But on that day, helping, and less talked about, was a really weak Empire manufacturing survey and weak retail sales.

The U.S. economy is about 25% of the global economy, and the U.S. consumer is about 70% of the U.S. economy. So, with some rough math, the U.S. consumer is about 18% of the global economy, which is kind of important. We are well versed in never betting against the U.S. consumer, but what is not being talked about much is some clear signs of erosion. No denying past rate hikes are starting to take a toll. As is inflation, that has been making everything cost much more than before. For the past few quarters, the consumer has been complaining about the higher prices of everything from vacations to goods but still paying the tab. This is mainly because of some positives. Good gains in labour over the past few years, wage gains too, and don’t forget all those accumulated savings that built up during the pandemic period when mobility was restricted.

Unfortunately, those positives appear to be fading while the consumer headwinds remain. Wage growth has slowed, as have job gains. But this erosion may be more apparent in behaviours. Walmart just posted stronger numbers, helped by higher-end consumer shopping at the big box. When the wealthy start showing up at Walmart, this could be evidence that higher prices are causing consumers to start downshifting their spending habits.

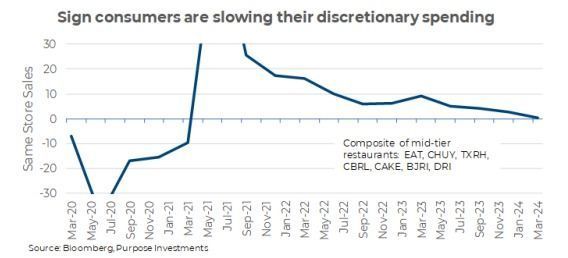

It is not just trips to Walmart; instead of higher-end retailers, look at the restaurants. Dining-out options vary greatly from those Michelin-star restaurants all the way to picking up a happy meal at McDonald’s. It is hard to get data on Michelin-star restaurants. Still, it continues to be challenging to get reservations, so high-end consumers still appear confident. First, popping into Walmart, then off to Le Bernardin. However, there is a quality of restaurants just above QSR (Quick Service Restaurants) that may be showing signs of softening spending choices. We created a basket of seven publicly traded sit-down restaurants that are a notch above McDonalds, Chipotle or Wild Wings. The list was created by asking one of our team members where his family eats when travelling in the U.S.

We cut off the peak and trough caused by abrupt changes brought on by the pandemic, but you can clearly see that same-store sales at these restaurants have been slowing and starting to turn negative. Even more impactful is that same-store sales are a nominal measurement, which means if volumes remained steady, then this would be higher, given that the ‘food away from home’ component of CPI is up 4.1% over the past year. Adjusted for inflation, the consumer appears to be slowing their spending habits in this very discretionary category.

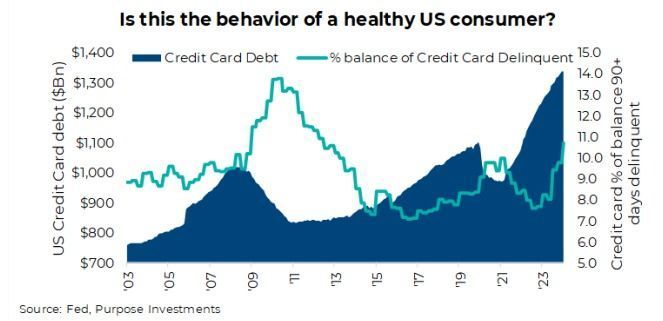

Then, there is how people are paying for things. During the pandemic, consumers were spending less and still earning well. This helped them pay down debt, including credit cards. But look at the trajectory or slope of credit card debt accumulation during the past few years, even as rates rose. Maybe we could argue that society has gone more cashless, leading us to use cards more. Fair point. So then look at the delinquency rates, ticking over 10%. Of that big pile of credit card debt, over 10% is beyond 90 days delinquent. A level not seen since early in the financial crisis of ‘08/’09.

Final Thoughts

Fortunately, all this is good news today. Because this is how it is supposed to work. A central bank raises rates to slow inflation, causing slowing economic activity. Now, this mechanism, which operates on slow variable lags, has been further delayed due to aggressive fiscal spending. But it does appear to be starting to show up, at least in some of the more discretionary categories or behaviours. I'm not betting against the consumer yet, but they are certainly on a fragile-looking footing.

— Craig Basinger is the Chief Market Strategist at Purpose Investments

Source: Charts are sourced to Bloomberg L.P. and Purpose Investments Inc.

The contents of this publication were researched, written and produced by Purpose Investments Inc. and are used by Echelon Wealth Partners Inc. for information purposes only.

This report is authored by Craig Basinger, Chief Market Strategist, Purpose Investments Inc.

Disclaimers

Echelon Wealth Partners Inc.

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Echelon Wealth Partners Inc. or its affiliates. Assumptions, opinions and estimates constitute the author's judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them.

Purpose Investments Inc.

Purpose Investments Inc. is a registered securities entity. Commissions, trailing commissions, management fees and expenses all may be associated with investment funds. Please read the prospectus before investing. If the securities are purchased or sold on a stock exchange, you may pay more or receive less than the current net asset value. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

Forward Looking Statements

Forward-looking statements are based on current expectations, estimates, forecasts and projections based on beliefs and assumptions made by author. These statements involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. Neither Purpose Investments nor Echelon Partners warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. These estimates and expectations involve risks and uncertainties and are not guarantees of future performance or results and no assurance can be given that these estimates and expectations will prove to have been correct, and actual outcomes and results may differ materially from what is expressed, implied or projected in such forward-looking statements. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise the forward-looking statements, whether as a result of new information, future events or otherwise. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional

advice.

The particulars contained herein were obtained from sources which we believe are reliable, but are not guaranteed by us and may be incomplete. This is not an official publication or research report of either Echelon Partners or Purpose Investments, and this is not to be used as a solicitation in any jurisdiction.

This document is not for public distribution, is for informational purposes only, and is not being delivered to you in the context of an offering of any securities, nor is it a recommendation or solicitation to buy, hold or sell any security.

Share this post