US core capital goods orders strengthen in September, but momentum ebbing

The highlights:

- Core capital goods orders increase 0.5% in September

- Shipments of core capital goods drop 0.3%

- Non-defense capital goods orders fall 4.5%; shipments down 3.6%

- Durable goods orders decrease 0.8%

WASHINGTON, Oct 25 (Reuters) - New orders for key U.S.-manufactured capital goods increased more than expected in September, but business spending on equipment likely slowed in the third quarter. Non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, jumped 0.5% last month after an unrevised 0.3% gain in August, the Commerce Department's Census Bureau said on Friday. Economists polled by Reuters had forecast these so-called core capital goods orders would edge up 0.1%. Core capital goods shipments fell 0.3% after dipping 0.1% in the prior month.

Higher borrowing costs have been a constraint on business investment, though a loosening of financial conditions as the Federal Reserve prepared to cut interest rates boosted spending on equipment in the second quarter. Non-defense capital goods orders dropped 4.5% after declining 4.4% in August. Shipments of these goods dropped 3.6% after falling 2.0% in the prior month. These shipments go into the calculation of the business spending on equipment component in the gross domestic product report. Business investment in equipment rose at a brisk 9.8% annualized rate in the second quarter, contributing to the economy's 3.0% growth pace.

"The surge in aircraft shipments earlier in the quarter probably prevented overall business equipment from declining in the third quarter, but the weak September data set the stage for a softer fourth quarter," said Olivia Cross, a North America economist at Capital Economics.

Growth estimates for the July-September quarter are currently as high as a 3.4% rate. The government will publish its advance estimate of third-quarter GDP next week. Orders for durable goods, items ranging from toasters to aircraft meant to last three years or more, decreased 0.8% after falling by the same margin in August. They were pulled down by a 3.1% drop in orders for transportation equipment, which followed a 3.4% decline in August. Motor vehicles and parts orders rebounded 1.1%. Commercial aircraft orders and parts tumbled 22.7% after declining 19.7% in the prior month. Boeing BA.N reported on its website that it had received 65 aircraft orders, up from 22 in August. Last month's rise in unadjusted aircraft orders was probably less than what had been anticipated by the model used by the government to strip out seasonal fluctuations from the data. That resulted in the negative adjusted orders number. The outlook for aircraft orders remains bleak as Boeing is reeling from a host of problems, including a six-week strike by factory workers on the West Coast, which has halted production of its best-selling 737 MAX as well as 767 and 777 wide-body planes. The striking workers on Wednesday rejected a contract offer. Boeing also reported a surge in quarterly losses.

Excluding transportation, orders rose 0.4%, building on the 0.6% gain in August. There were increases in orders of primary metals and fabricated metal products. But orders for machinery fell 0.2%. Orders for computers and electronic products slipped 0.3%, while bookings for electrical equipment, appliances and components were unchanged.

(Reporting by Lucia Mutikani; Editing by Andrea Ricci and Paul Simao)

(Lucia.Mutikani@thomsonreuters.com)

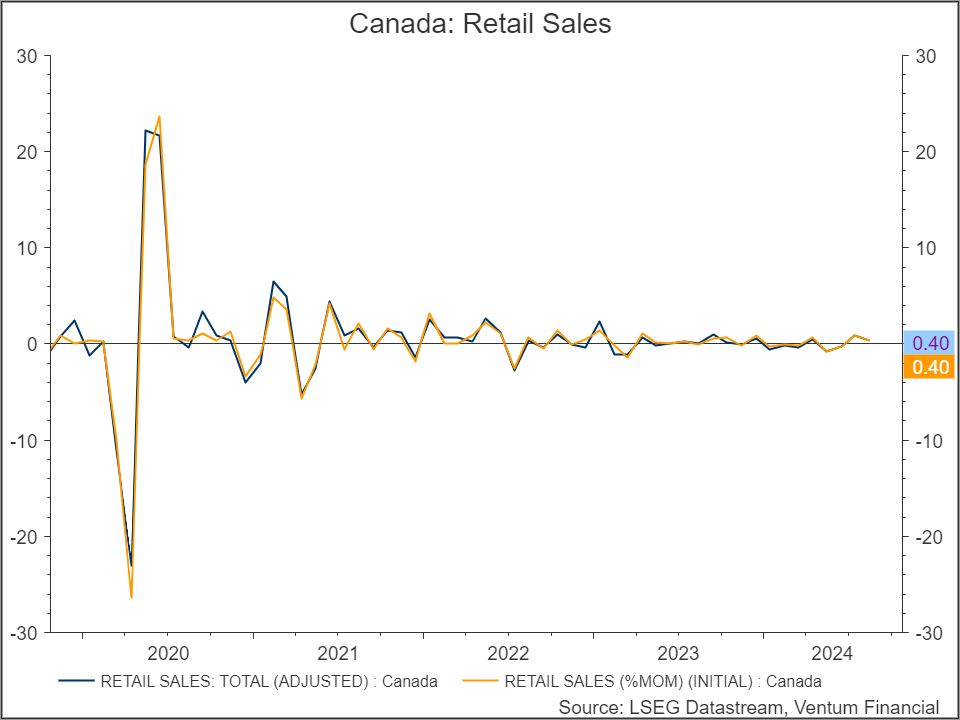

Canada August retail sales up 0.4% on autos, drops across majority of sectors

OTTAWA, Oct 25 (Reuters) - Canada's retail sales in August increased marginally and missed expectations as consumer spending showed strains across majority of sectors, data showed on Friday. Retail sales, which comprise motor vehicles, clothing, furniture, food and beverages among others, grew by 0.4% in August on a monthly basis, slower than growth of 0.9% seen in the previous month. Analysts had forecast growth of 0.5% for August and had estimated sales excluding automotive and parts to be at 0.3%. Excluding sales of motor vehicles and at automotive parts dealers, sales dropped by 0.7% from a revised 0.3% growth in July, Statistics Canada said.

"Today's report suggests that consumer spending remains patchy, and that further reductions in interest rates will likely be needed to bring a sustained acceleration," Andrew Grantham, senior economist at CIBC wrote in a note.

September's retail numbers, which survey only half of the respondents for a preliminary estimate and are prone to revision, showed that sales likely grew by 0.4%, a flash estimate by Statscan said. The retail sales and the projection give an indication of how consumer spending has been in the month and partly informs the direction of Gross Domestic Product, a critical figure closely watched by the Bank of Canada and economists.

The BoC reduced its key policy rate by a jumbo 50 basis points this week as inflation has come below the mid-point of the bank's 1% t 3% target range, but concerns around growth have taken centre stage. GDP data for August is due next week and economists expect growth in Canada for the rest of the year to be likely slower than the central bank's projections. August retail sales totaled C$66.63 billion ($48.14 billion) and saw an increase in four out of nine subsectors. In volume terms, total retail sales grew 0.7%.

The Canadian dollar CAD= was trading 0.9% firmer to 1.3842 against the U.S. dollar, or 72.24 U.S. cents. The two-year government bond yield CA2YT=RR dropped by 2.9 basis points to 3.175%. Sales were led by a 3.5% increase in vehicles and vehicle parts, which account for more than a fourth of total sales. Food and beverages, which contribute roughly a fifth to the overall retail sales, saw the biggest drop of 1.5%. Furniture, home furnishings, electronics and appliances sales dropped by 1.4%, Statscan said.

($1 = 1.3840 Canadian dollars)

[Reporting by Promit Mukherjee; Additional reporting by Dale Smith; Editing by Nick Zieminski)

(( promit.mukherjee@thomsonreuters.com ;))

© 2018-2024 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies.

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited.

Share this post