Weekly Commodities Report - November 1, 2024

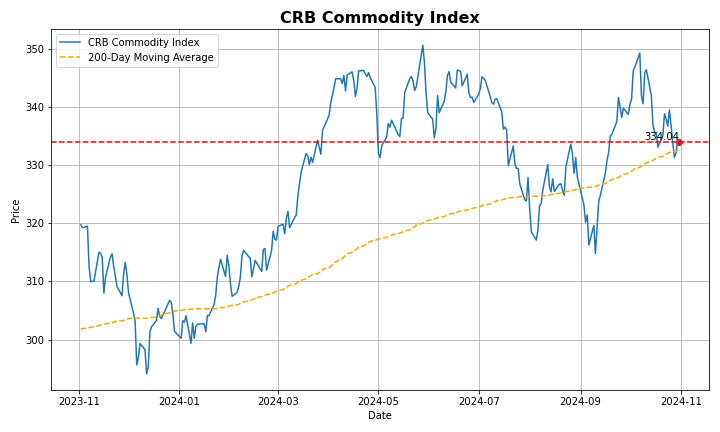

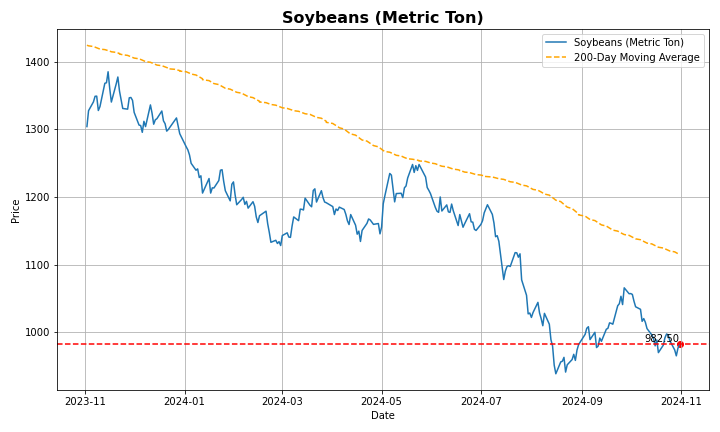

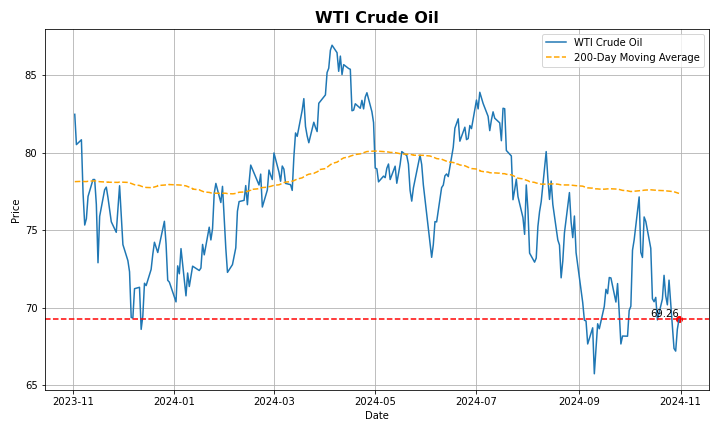

The CRB Commodity Index fell to a six-week low of 331 points, mainly driven by declines in energy prices. WTI crude dipped to $68 per barrel after a 6% drop, the sharpest in two years as Israel’s strikes on Iran spared key oil sites. Similarly, U.S. natural gas prices dropped to $2.8/MMBtu as supply concerns eased. Moreover, soybeans slipped below $10 per bushel amid a record U.S. harvest, and wheat hit a seven-week low of $5.6 as rain improved U.S. crop conditions. Meanwhile, Copper remained near $4.3 per pound, with markets awaiting potential fiscal announcements from China’s National People’s Congress. In contrast, precious metals rallied, with gold reaching $2,750 per ounce and silver just above $34, driven by Middle East tensions and upcoming U.S. economic data ahead of the Fed's policy decision.

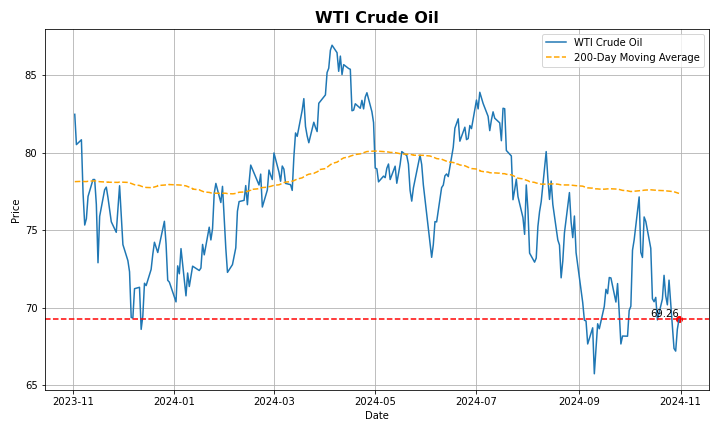

WTI crude oil futures rose toward $71 per barrel on Friday, advancing for the third consecutive session, as market attention shifted back to the Middle East conflict. This change was prompted by a report suggesting that Iran may be preparing to launch an attack on Israel from Iraqi territory in the coming days, with media sources indicating that the anticipated attack could involve drones and ballistic missiles. Investors remained on edge, especially following Israel's military chief's warning that a "very hard" strike on Iran would follow any further missile attacks. Oil prices were also bolstered by expectations that OPEC+ might postpone the planned increase in oil production scheduled for December by a month or longer. Additionally, China, the world’s top crude importer, saw manufacturing return to growth in October, according to both private and official surveys, indicating that stimulus measures are starting to take effect. Still, oil is set to record a weekly decline.

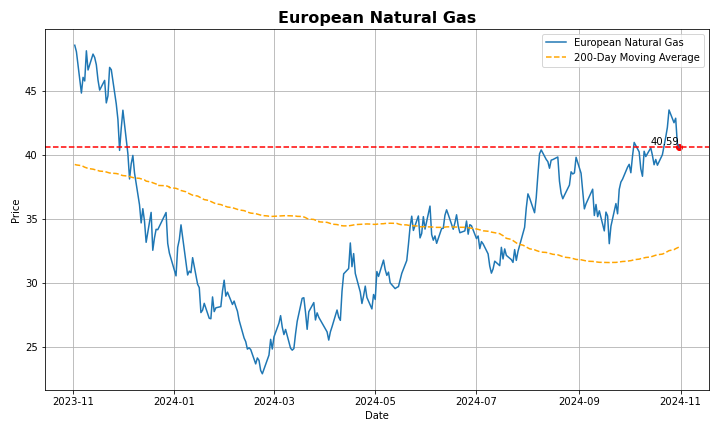

European natural gas futures were below €39.4 per megawatt-hour, holding the sharp decline from the 11-month high of €43.6 on October 25th amid fresh expectations of ample supply. Reports emerged stating that utilities and buyers are approaching a deal with Azerbaijan to keep Russian gas flowing into Europe after the current agreement with Ukrainian pipelines ends at the end of the year, securing supplies in the near term and reducing concerns of more dependency on LNG imports. In the meantime, unusually mild weather as the European winter approaches kept demand for gas-intensive heating at seasonally lower levels. This allowed the continent’s storage capacity to remain near 95% full ahead of the winter. Still, lingering geopolitical concerns in the Middle East kept the pullback in check.

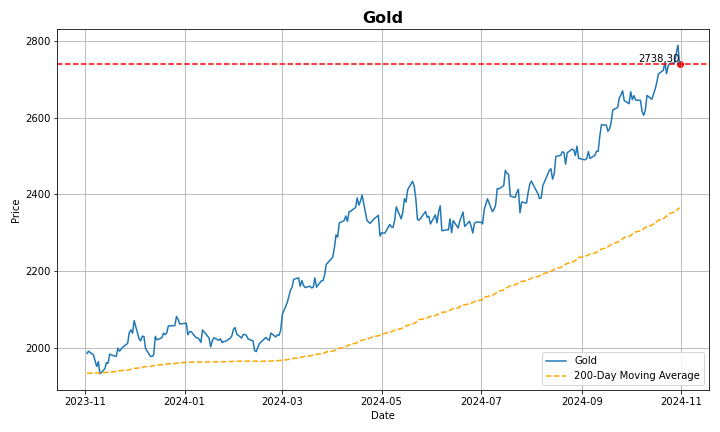

Gold was at the $2,750 per ounce mark on Friday, holding the near 1.5% decline from the record high in the prior session as markets continued to assess demand for safety ahead of the upcoming US elections while continuing to gauge the Fed’s policy outlook. Payroll data showed that job growth in the US nearly stalled in October instead of expectations of over 100 thousand payrolls being added, although distortions from strikes and catastrophic hurricanes over the month blurred the data point’s reflection on underlying economic trends. In the meantime, political uncertainty in the US supported gold, as the prospects for another Trump presidency raised expectations of expansionary fiscal policy and higher tariffs, leading investors to hold gold as a hedge against long-term inflation risks. Additionally, lingering tensions in the Middle East continued to lift gold’s appeal.

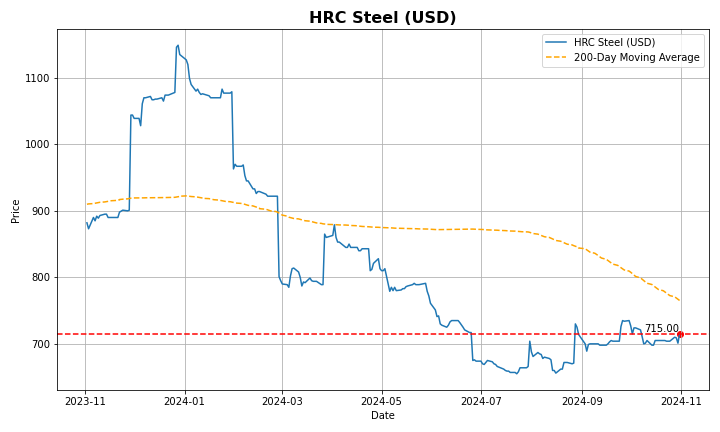

Steel decreased 638 Yuan/MT or 16.24% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, Steel reached an all time high of 6198 in May of 2021.

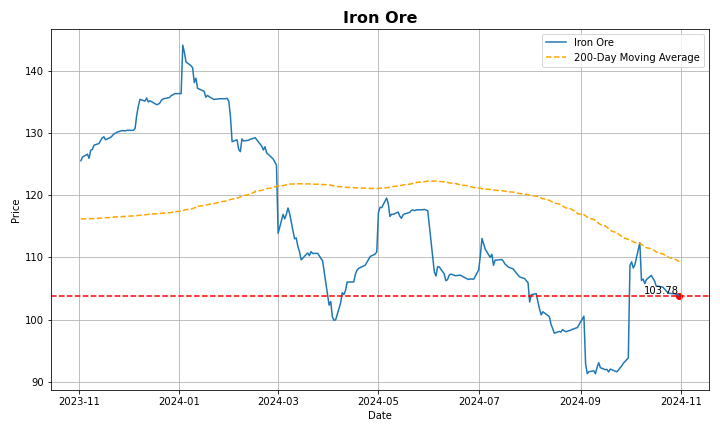

Prices for iron ore cargoes with a 62% iron content steadied near $104 at the start of November as investors continued to assess the demand outlook in China, the top consumer. A private survey indicated that factory activity in China turned expansionary in October, following a series of stimulus measures from Beijing aimed at reviving growth. This report corroborated official data released the previous day, which marked the first manufacturing expansion in six months. Investors are now looking forward to potential additional stimulus measures expected to be discussed at the National People’s Congress meeting scheduled for next week, with markets anticipating announcements related to debt and other fiscal policies. Meanwhile, imported iron ore stocks at major Chinese ports have risen for the fourth consecutive week, reflecting a decline in discharge volume.

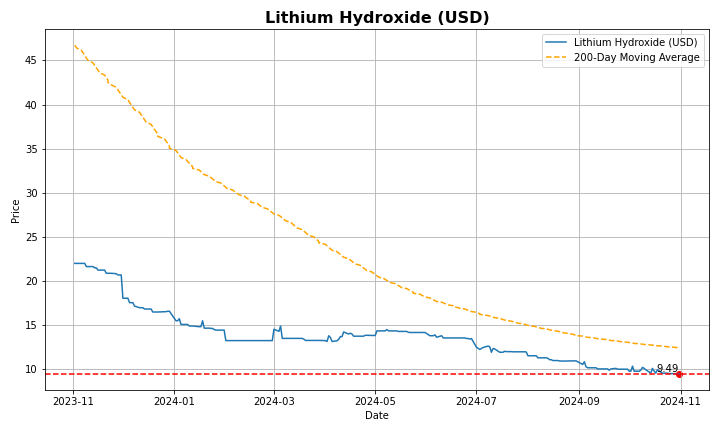

Lithium decreased 24,000 CNY/T or 24.87% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, Lithium reached an all time high of 5750000 in December of 2022.

Soybean futures dipped below $10 per bushel, nearing a two-week low, amid abundant supplies from a record U.S. crop. The USDA's latest report indicated that U.S. farmers are harvesting soybeans at the fastest rate in over a decade, reaching 89% completion as of Sunday, just shy of the 91% expected by analysts. Meanwhile, in Brazil, improved weather helped speed up soybean planting, which reached 36% of the anticipated area by October 24, according to AgRural, an 18-point jump from the previous week.

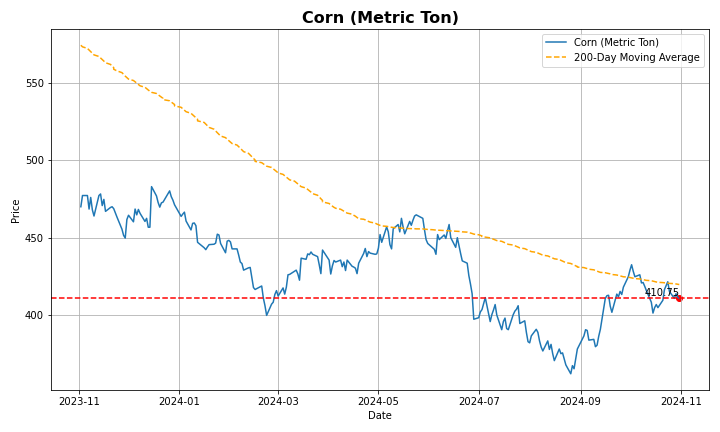

Corn futures rose to $4.20 per bushel in October, reaching a two-week high amid strong demand and supply concerns. Export demand remained robust, underscored by a USDA sale announcement of 3.9 million bushels for the current marketing year. The weekly EIA Petroleum Status report indicated that ethanol production reached 1.081 million barrels per day for the week ending October 23, an increase of 39,000 bpd from the previous week, while stocks declined by 52,000 barrels to 22.223 million. Current estimates show that corn bushels used for ethanol production are slightly below the USDA's target of 5.45 billion bushels for 2024-25, however, ethanol production typically peaks in the summer when driving demand is highest. Additionally, supply disruptions in Ukraine and the Middle East further impact the market, with concerns over exports from the Black Sea region contributing to global supply constraints and subsequent price increases.

WTI crude oil futures rose toward $71 per barrel on Friday, advancing for the third consecutive session, as market attention shifted back to the Middle East conflict. This change was prompted by a report suggesting that Iran may be preparing to launch an attack on Israel from Iraqi territory in the coming days, with media sources indicating that the anticipated attack could involve drones and ballistic missiles. Investors remained on edge, especially following Israel's military chief's warning that a "very hard" strike on Iran would follow any further missile attacks. Oil prices were also bolstered by expectations that OPEC+ might postpone the planned increase in oil production scheduled for December by a month or longer. Additionally, China, the world’s top crude importer, saw manufacturing return to growth in October, according to both private and official surveys, indicating that stimulus measures are starting to take effect. Still, oil is set to record a weekly decline.

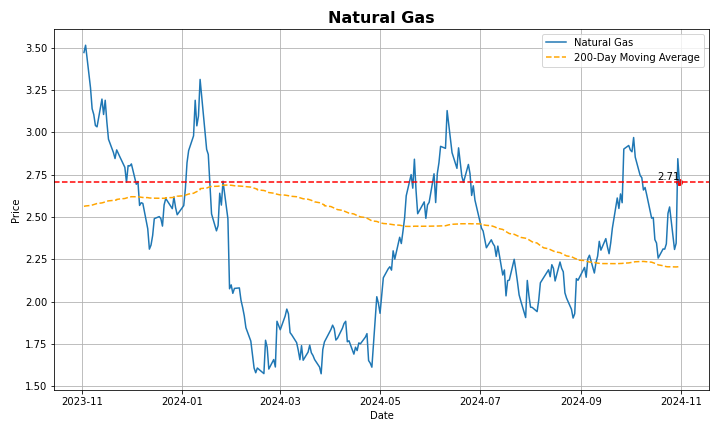

US natural gas futures fell to below $2.75/MMBtu, declining sharply from the over four-month-high of $3.1 amid lower risk premiums and evidence of ample domestic supply. Shifting perceptions on supply risks from the Middle East triggered declines in natural gas futures among major trading hubs, largely due to Israel’s choice of striking Iran’s oil infrastructure and Tehran’s refrain from further retaliation so far. This compounded data from Wood Mackenzie suggesting that US production rose to 103 bcf per day in late October, near record highs. This was in line with the ample increase in reserves during the fourth week of the month, with EIA data pointing to a 78 bcf build. In the meantime, expectations of more moderate cold weather in the Lower 48 states limited demand for gas-intensive heating, also pressuring prices.

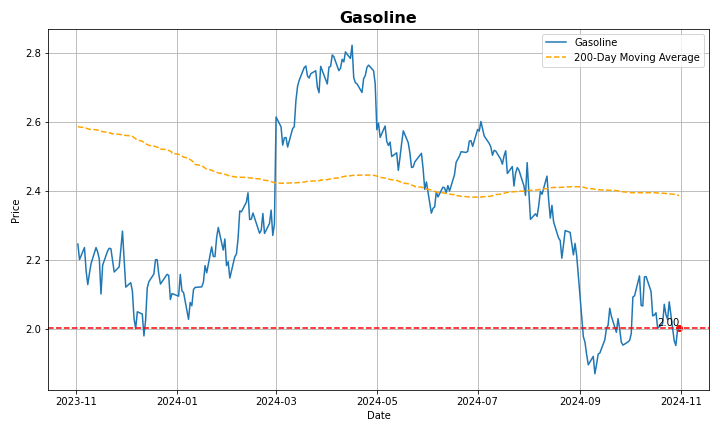

US gasoline futures fell below $2 per gallon, a four-week low, as Israel’s recent strikes on Iran avoided critical infrastructure like crude and nuclear facilities, reducing immediate supply concerns. The restrained nature of the strikes alleviated market fears of major disruptions. As a result, oil prices slumped, with WTI crude oil futures down 6% around 67.5 per barrel. Additionally, US gasoline stockpiles rose by 900,000 barrels for the week ending October 18, defying forecasts of a 1.6 million barrel decline, further pressuring prices.

Silver prices rose by 0.5% on Friday, reaching $33 per ounce, as week U.S. payrolls data boosted the appeal of safe heaven assets and brought back the possiblity of speed up in interest rate cuts in the US. The US economy added only 12K jobs in October, compared to market expectations of 113K and September's downwardly revised 223K as employment have been impacted by Hurricanes Helene and Milton and strikes at Boeing. Still, silver prices are expected to finish the week at least 2% lower as economic data from Eurozone, combined with the UK’s new government budget, drove up borrowing costs and shook expectations of imminent rate cuts.

Copper climbed to around $4.35 per pound on Friday, attempting to break out of a sideways trading range as strong manufacturing activity data bolstered demand expectations in China, the top consumer of the metal. A private survey revealed that factory activity in China turned expansionary in October, following a series of stimulus measures implemented by Beijing to stimulate growth. This report also confirmed official data released the previous day, indicating the first manufacturing expansion in six months. Investors are now looking ahead to the upcoming National People’s Congress, scheduled for next week, where potential announcements regarding fiscal support measures are anticipated. Meanwhile, Chilean miner Codelco, the world's largest copper producer, reported a rebound in its copper production, generating 338,000 tons in the third quarter.

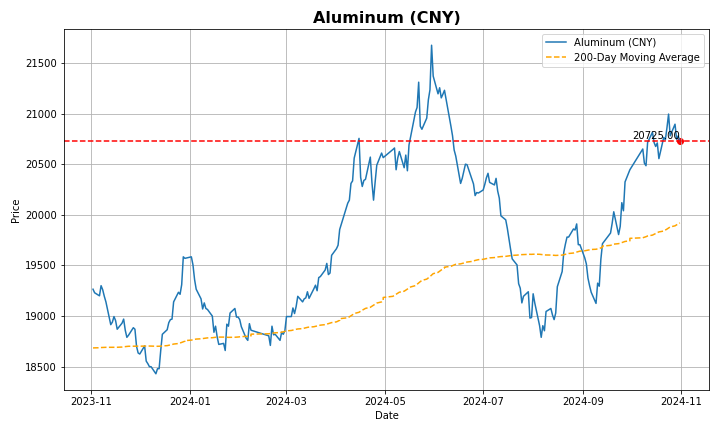

Aluminum increased 240 USD/Tonne or 10.07% since the beginning of 2024, according to trading on a contract for difference (CFD) that tracks the benchmark market for this commodity. Historically, Aluminum reached an all time high of 4103 in March of 2022.

Nickel futures dropped to $15,980 per tonne, reaching a six-week low, with analysts suggesting continued downward pressure due to a significant market surplus and the discovery of nickel at the Wedei prospect in Papua New Guinea. According to the Australian Office of the Chief Economist (AOCE), recent production cuts have failed to lift prices and expects weak demand to keep nickel prices soft through the remainder of 2024. Additionally, rising inventories highlight the oversupply issue, with stockpiles at major exchanges increasing by 90% since the start of the year, driven by production growth in China and Indonesia outpacing demand. Meanwhile, Indonesia, the world’s largest nickel producer aims to manage nickel ore supply and demand to support prices, according to the country's mining minister.

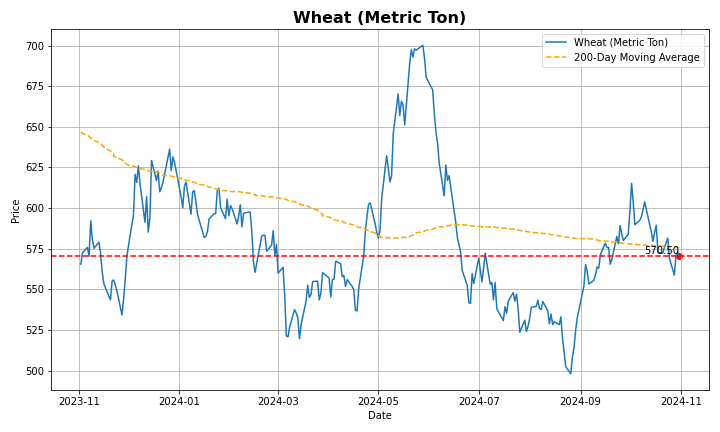

Wheat futures fell to $5.7 per bushel, marking a one-month low, as rain was predicted for dry wheat regions in southern Russia and the central US, though drought remained a concern. Early in the month, the USDA raised its global wheat supply outlook. Despite lowering its 2024/25 production estimate, the USDA increased its ending-stocks forecast to 257.72 million metric tons, exceeding expectations by 1.6 million tons. The International Grains Council (IGC) also maintained its 2024/25 global wheat production estimate at 798 million metric tons. On the bullish side, Russia, the top exporter, has set a de facto price floor by asking exporters not to sell below a minimum price, while also increasing export duties.

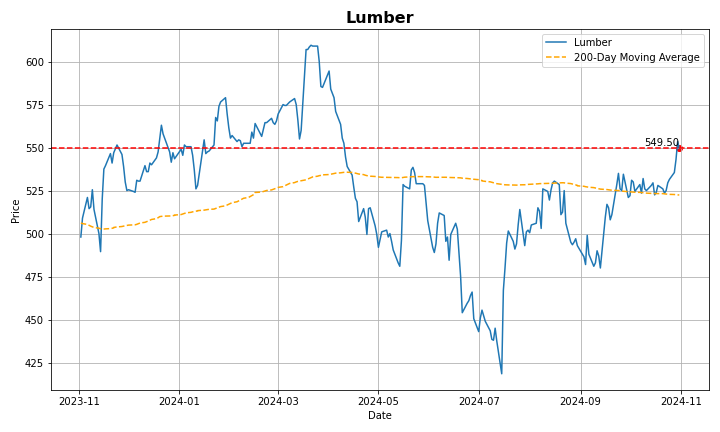

Lumber prices rose to $550 per thousand board feet in October, an over six-month high as optimistic US economic data lifted the demand outlook for construction materials. US GDP grew 2.8% in Q3, underscoring consumer resilience, while single-family home sales reached a 16-month high and pending home sales saw their largest jump since January 2023. Meanwhile, supply constraints in the southern part of the US drove wood mills to hike prices. Globally, limited access to cheap wood exacerbates the supply crunch in the US. Climate-related infestations in Canada and Europe once boosted affordable wood supplies, but now, reductions in logging in Europe, Russia’s export ban, and increased conservation efforts in North America are tightening the log supply, impacting major markets like China.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

COMMITTED TO SUCCESS

We value the partnership we have with our clients, our employees and our regulators. We see ourselves as partners and that approach has helped us become one of Canada’s leading independent investment dealers.

Ventum Financial Corp. is a licensed broker-dealer operating in all provinces and territories of Canada. We are proud members of the Canadian Investment Regulatory Organization and participate in the Canadian Investor Protection Fund. It is important to note that the content of our website is not intended, and should not be construed, as a solicitation of customers or business in any jurisdiction where we are not registered as a dealer in securities. Our commitment is to operate within the regulatory framework to ensure transparency, protection, and adherence to industry standards.