Weekly Commodities Report - November 22, 2024

This week, the

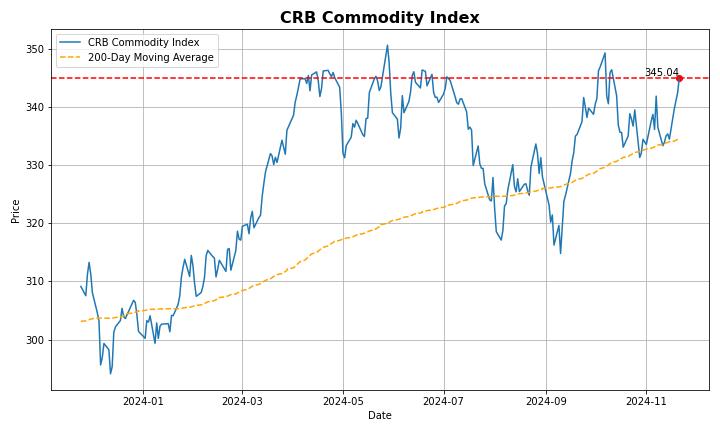

CRB Commodity Index has seen notable fluctuations, reflecting broader market trends. The index fell to 336 points, down from a recent high of 341 points, primarily due to a decline in energy prices, with WTI crude oil dropping below $70 per barrel amid concerns over demand from China.

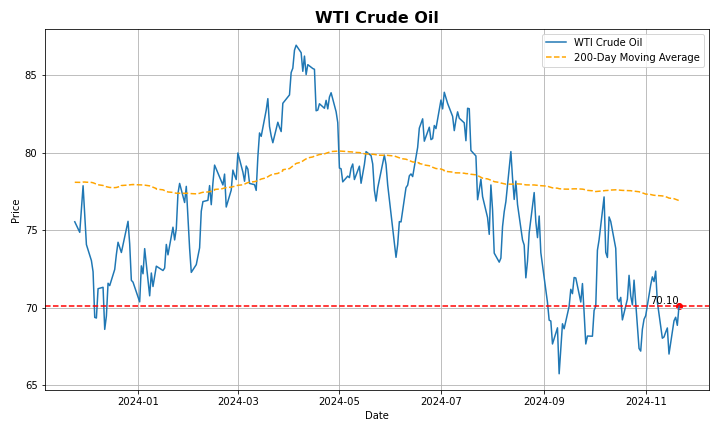

WTI crude oil futures slipped below $70 per barrel on Friday but remained on track for a weekly gain of nearly 4.3%, marking the best performance in two months, driven by escalating tensions between Russia and Ukraine. Earlier this week, Ukraine fired its second Western-supplied missile into Russia, while Kyiv’s air force reported that Russia launched its first intercontinental ballistic missile at Ukraine on Thursday in response to the attack. Markets are nowturning their attention to the OPEC+ meeting on December 1st, amid speculation that output increases may again be postponed. Meanwhile, China unveiled measures to boost foreign trade, with expectations of increased energy product imports. However, weaker-than-expected flash PMI data for the Eurozone highlighted deteriorating business conditions in the region during November.

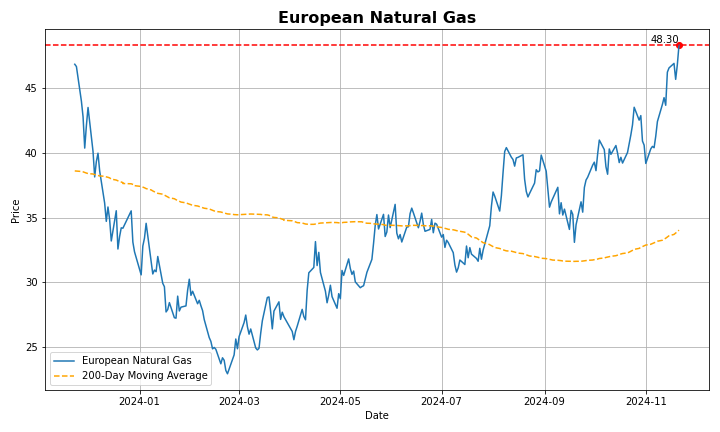

European natural gas futures eased to below €47.5 per megawatt-hour, tracking the pullback in other gas benchmarks to ease from a one-year high of €48.7 as the outlook of higher LNG export capacity from the US limited risks from supply disruptions from Russia. Russian gas exports to Europe via Ukraine were stable through the week despite ongoing contract disagreements between Gazprom and the Austrian OMV, which caused flows to temporarily be halted on Saturday. Still, the outlook of supply to Europe remained uncertain in coming weeks as data from EUstream indicated that low requests through Austria and Slovakia remained below levels from before the supply halt, lifting prices. This took place as flows through Ukraine are due to end by the end of December due to attritions in the Russia-Ukraine war.

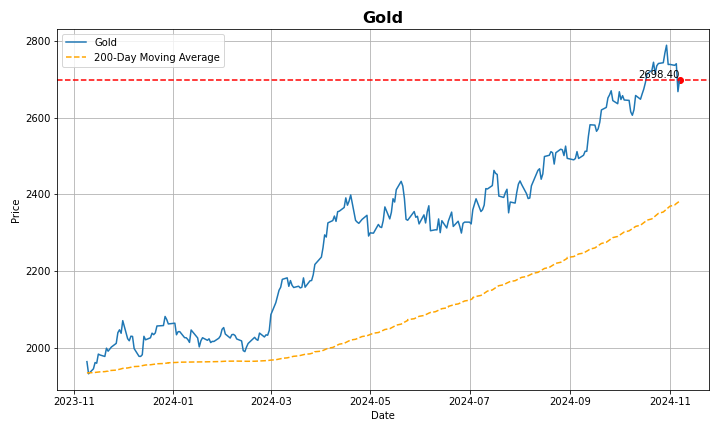

Gold climbed $2,680 per ounce on Friday, rising for the fifth straight run, and on track to gain nearly 5% this week, as investors turned to safe-haven assets amid increasing geopolitical risks. Earlier this week, Ukraine launched its second Western-supplied missile into Russia, while Kyiv’s air force reported that Russia fired its first intercontinental ballistic missile at Ukraine on Thursday in retaliation. Meanwhile, markets continued to assess the Federal Reserve’s monetary policy outlook after US jobless claims unexpectedly fell, adding to speculation about a slower pace of Fed rate cuts. Traders also weighed remarks from Fed Bank of Chicago President Goolsbee, who suggested that interest rates could move "a fair bit lower" and expressed confidence that inflation is easing toward the target. Most of the market still expects a 25bps rate cut in December, which would lower the opportunity cost of holding non-interest-bearing gold.

Steel rebar futures were above CNY 3,300 per tonne in November, the highest in over one month, as markets reassessed the impact of China’s economic aid on ferrous metal demand. New infrastructure investment in China rose by 4.3% in the first 10 months of the year, raising the possibility that monetary and fiscal support measures from Beijing may be lifting economic activity. Beijing passed a $1.4 trillion debt package for local governments to swap out hidden debt and lower their financing costs to stimulate the economy, following a batch of slashes in lending and liquidity rates by the PBoC. In turn, steel production in China rose to 81.9 million tons in October, despite low orders from domestic consumers. Consequently, Chinese mills have flooded export markets despite growing trade barriers by other governments, with exports in the period rising to 11.2 million tons, the second-highest on record.

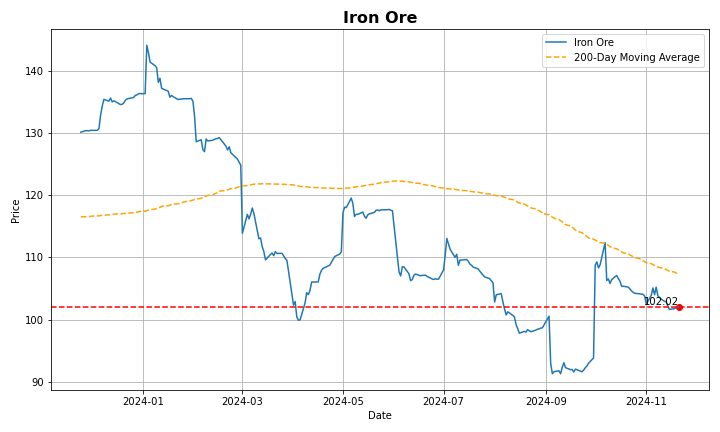

Iron ore for cargoes with 62% iron ore content held steady since touching a one-month-and-a-half low of $102 in mid-November as markets assessed the outlook of ferrous metal demand in China and whether trade barriers will prevent Chinese steel producers from exporting goods next year. Steel production in China rose to 81.9 million tons in October to spur bets that the series of monetary stimulus measures by the PBoC could have positively impacted demand for housing and manufacturing. In turn, China exported 11.2 tons of steel in the period, the second highest on record, as mills adapted to high domestic capacity by sourcing clients from abroad. Still, the rising momentum of protectionist policies and growing accusations of dumping by China threatened how the world’s top producer relies on foreign markets for sales targets, pressuring iron demand.

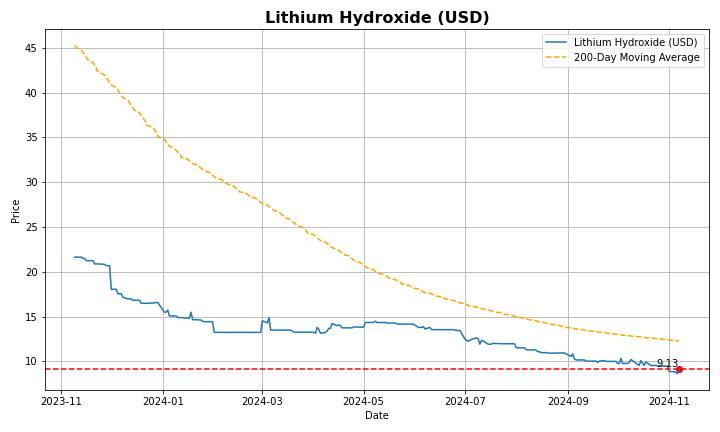

Lithium carbonated rose to CNY 79,000 per tonne after having traded near the three-year low of CNY 71,000 through late October, benefiting from supply curbs and an uptick in demand. The Chinese government enacted subsidies allowing people to trade older cars for electric vehicles in their latest push to support the sector, raising expectations that battery manufacturers may soon begin restocking lithium inputs. Despite relatively high stocks from a historicalstandpoint, battery manufacturers also reportedly raised purchasing activity amid risks of a trade war after Trump assumes office next year in the US. In turn, the plunge in prices during the year drove multiple mines in Australia and China to close or cut costs, resulting in 190 tons of lithium mine curtailments since 2023.

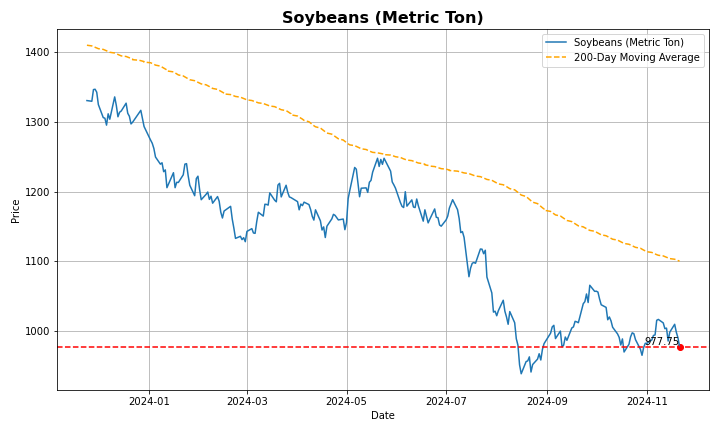

Soybean futures fell below $10 per bushel from a one-month high of $10.3, pressured by weaker biofuel demand under the incoming Trump administration and expectations of reduced Chinese imports. China, the top soybean importer, is projected to cut imports by 9.5% to 98.8 million metric tons by September 2025, following pre-election stockpiling amid trade concerns. Meanwhile, Russian wheat exports slowed due to weak demand and new export regulations to curb domestic price hikes.

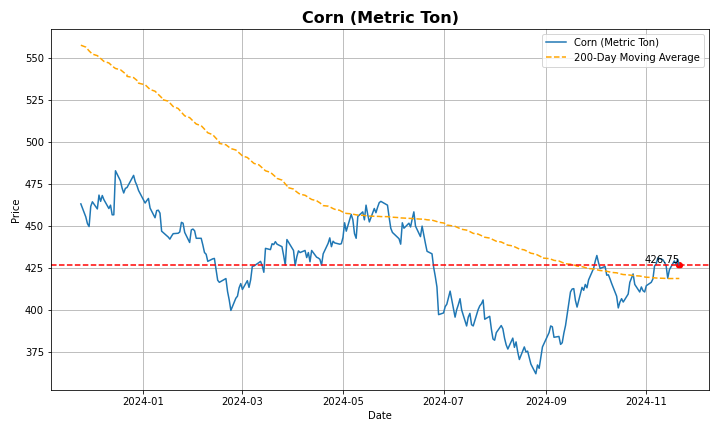

Corn futures rose to $4.20 per bushel, reaching a two-week high amid strong demand and supply concerns. Export demand remained robust, underscored by a USDA sale announcement of 3.9 million bushels for the current marketing year. The weekly EIA Petroleum Status report indicated that ethanol production reached 1.081 million barrels per day for the week ending October 23, an increase of 39,000 bpd from the previous week, while stocks declined by 52,000 barrels to 22.223 million. Current estimates show that corn bushels used for ethanol production are slightly below the USDA's target of 5.45 billion bushels for 2024-25, however, ethanol production typically peaks in the summer when driving demand is highest. Additionally, supply disruptions in Ukraine and the Middle East further impact the market, with concerns over exports from the Black Sea region contributing to global supply constraints and subsequent price increases.

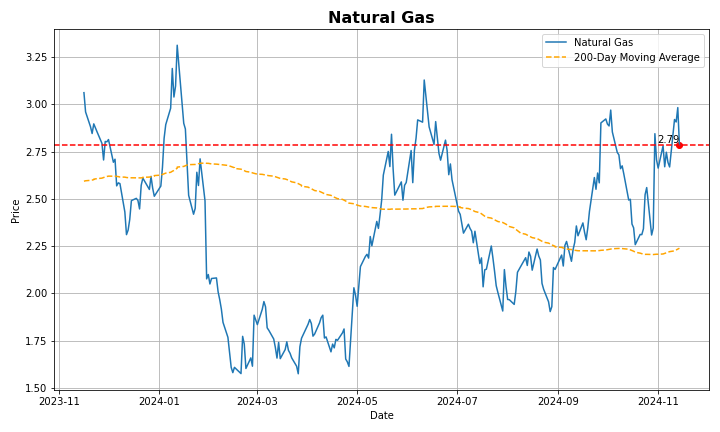

US natural gas futures fell to $3.2/MMBtu after touching a one-year high of $3.35 on November 21st amid an ample output next year. The EIA noted that US drillers are expected to raise output for the first time since the pandemic next year amid higher export capacity and global demand for US LNG. Still, prices remained nearly 20% higher in November as forecasts of colder weather expedited expectations on the start of storage withdrawing season. Data from the EIA showed that gas storage fell by 3 billion cubic feet on the week ending November 15th instead of expectations of a 5 billion cubic feet build, as relatively low prices in the prior week drove producers to cut output. In turn, the most recent forecasts pointed to colder-than-usual temperatures on the West Coast and most of the nation besides the Gulf Coast. In turn, supply concerns in Europe ahead of the turn of the year drove LNG feed gas flows to rise to a 10-month high, limiting domestic supply.

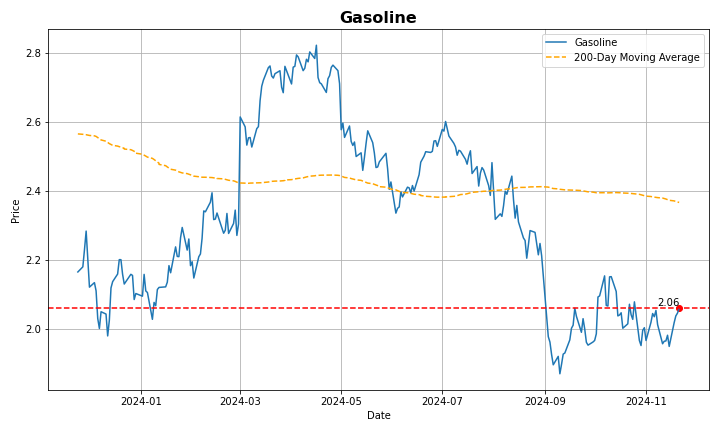

US gasoline futures settled around $2.05 per gallon, a two-week high as investors were evaluating mixed supply signals and the impact of geopolitical tensions on oil prices. The API recently noted a 2.48-million-barrel decline in gasoline inventories, supporting gasoline prices. However, EIA data reported a 2.05-million-barrel build in gasoline stockpiles for the week ending November 15th, surpassing the forecasted 1.62-million-barrel increase and easing concerns about supply constraints. Meanwhile, U.S. crude inventories rose by 545,000 barrels, surpassing forecasts and aligning with projections of a potential 2024 surplus driven by weakening demand in China and record-high production, adding downward pressure to crude prices.

Silver prices rose above $31 per ounce on Friday, rebounding after two consecutive days of declines, supported by increased safe-haven demand amid escalating tensions in the Russia-Ukraine conflict. Russian President Vladimir Putin warned on Thursday that the conflict is escalating toward a global confrontation, citing Ukraine’s use of US and British-supplied weapons to target Russia. He added that Russia had retaliated by deploying a new hypersonic medium-rangeballistic missile against a Ukrainian military facility, with the possibility of further strikes. Meanwhile, investors continued to assess the outlook for US Federal Reserve monetary policy in light of the latest economic data and central bank statements. Markets are currently pricing in a 60% chance that the Fed will cut rates by 25 basis points in December, with some traders anticipating a temporary pause.

Copper futures fell below $4.10 per pound on Friday, extending losses from the previous session as the dollar continued to strengthen. This was driven by expectations that US president-elect Donald Trump’s policies, particularly on tariffs, immigration, and taxes, could fuel inflation and limit the Federal Reserve’s capacity to lower borrowing costs. Concerns over insufficient stimulus measures from China, the world’s top copper consumer, also weighed on thedemand outlook. Investors are now awaiting China’s decision on its one-year medium-term lending facility rate next week, looking for potential additional policy support. Meanwhile, copper spot treatment and refining charges in China showed signs of improvement as smelters scaled back production after several years of rapid expansion. Copper inventories in the country have also been declining, currently sitting below August levels, with seven days' worth of supply readily available.

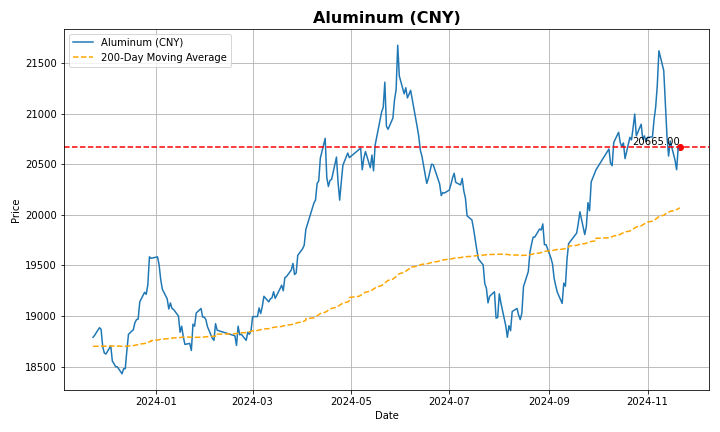

Aluminum futures rose to $2,675, the highest since reaching the five-month high of $2,710 on November 7th amid lower supply from major producers, while markets continued to assess the impact of Chinese stimulus on manufacturing demand. China announced it will end tax rebates on exports of semi-manufactured aluminum products in December, removing around five million tonnes of supply from the international market, according to market players’ estimates. In turn, bauxite prices approached a record high as Guinea blocked Emirates Global Aluminum’s exports from the country. The halt from the world’s top miner added to lower bauxite output from Australia and Jamaica, squeezing Chinese smelters out of their supply and reducing ore inventory to its lowest since 2015.

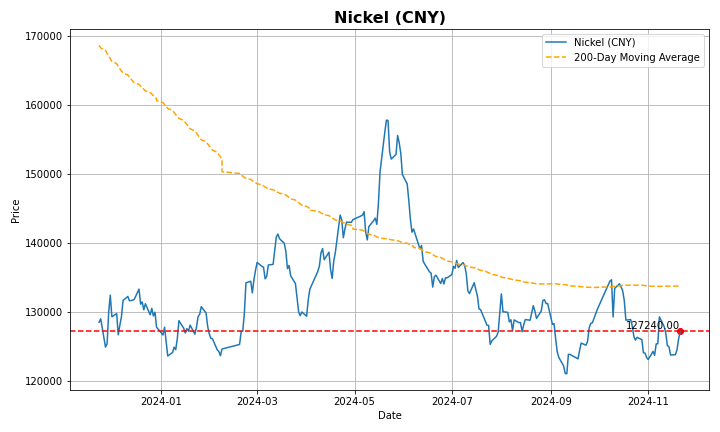

Nickel futures rebounded to around $15,750 per tonne from a 4-year low, fueled by concerns over Indonesia, the world’s largest nickel producer, tightening its mining policies. Reports indicate that approved mining quotas could decline by up to 27% by 2026, and the government plans to reduce license fees for low-grade nickel ore (less than 1.5% nickel content) used in battery production. This policy could restrict nickel availability for industries like stainless steel manufacturing. Additionally, nickel ore imports to Indonesia surged 50-fold year-on-year to over 9.3 million tons between January and October 2024, reflecting efforts to preserve domestic reserves. Officials have repeatedly warned of dwindling nickel stocks, emphasizing the need to prioritize domestic industries and stabilize prices, according to the mining minister.

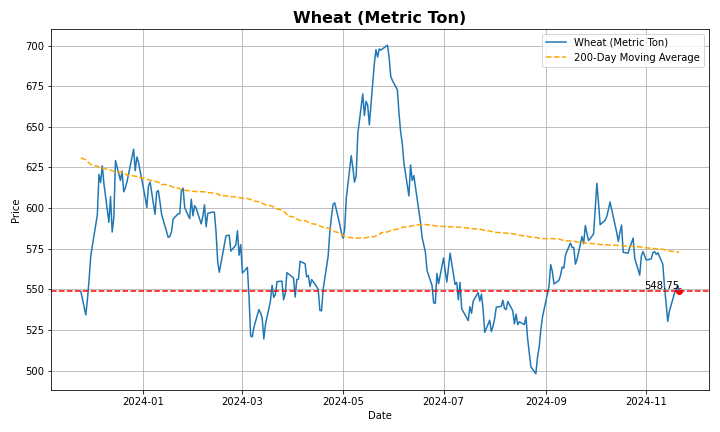

Wheat futures climbed to around $5.50 per bushel, rebounding from a 10-week low, as concerns over global supply and potential export disruptions mounted amid escalating Ukraine-Russia tensions. The International Grains Council (IGC) lowered its 2024/25 global wheat production forecast by 2 million metric tons to 796 million tons, citing tighter supply expectations. Geopolitical risks added further pressure, with Ukraine launching British Storm Shadow cruise missilesinto Russia for the first time, following its use of U.S. ATACMS missiles earlier in the week. In response, Russia reportedly fired an intercontinental ballistic missile, intensifying fears of conflict escalation between the key Black Sea grain exporters.

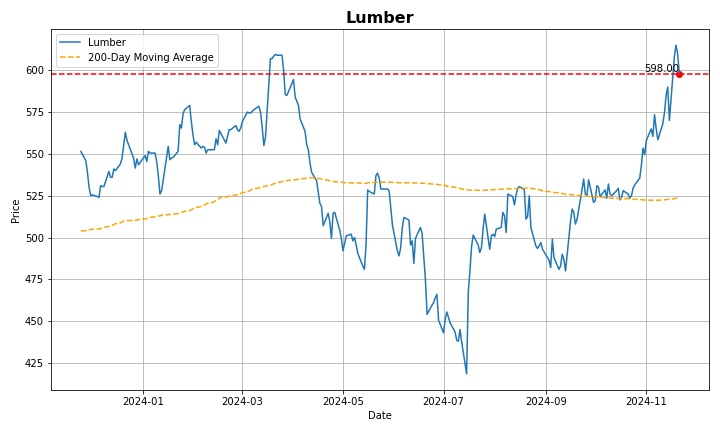

Lumber prices fell to $600 per thousand board feet after reaching an eight-month high of $615 in mid-November, reflecting a softened demand outlook for construction materials. US building permits extended their downturn in October dropping by a monthly 0.6%, from the previous month’s 3.1% decline. Housing starts in the U.S. also fell 3.1% in October, below expectations, with the broader trend showing continued challenges, with rising new home inventory and mortgage rates nearing 7%. Rising mortgage rates, now at 6.84%, are further dampening new construction activity, reducing demand for building materials, and potentially driving prices down as competition among developers decreases. This rise aligns with Fed Funds futures reflecting a growing market shift, with fewer investors expecting a rate cut next month, as persistent inflation and signs of economic strength reinforce the case for a hawkish Federal Reserve stance.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

COMMITTED TO SUCCESS

We value the partnership we have with our clients, our employees and our regulators. We see ourselves as partners and that approach has helped us become one of Canada’s leading independent investment dealers.

Ventum Financial Corp. is a licensed broker-dealer operating in all provinces and territories of Canada. We are proud members of the Canadian Investment Regulatory Organization and participate in the Canadian Investor Protection Fund. It is important to note that the content of our website is not intended, and should not be construed, as a solicitation of customers or business in any jurisdiction where we are not registered as a dealer in securities. Our commitment is to operate within the regulatory framework to ensure transparency, protection, and adherence to industry standards.