Weekly Commodities Report - November 15, 2024

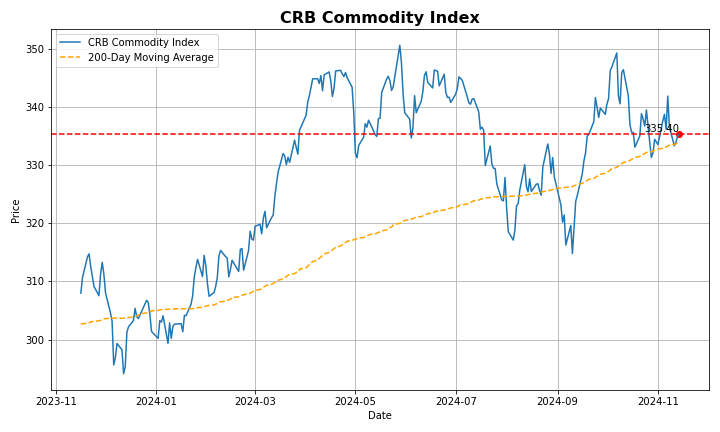

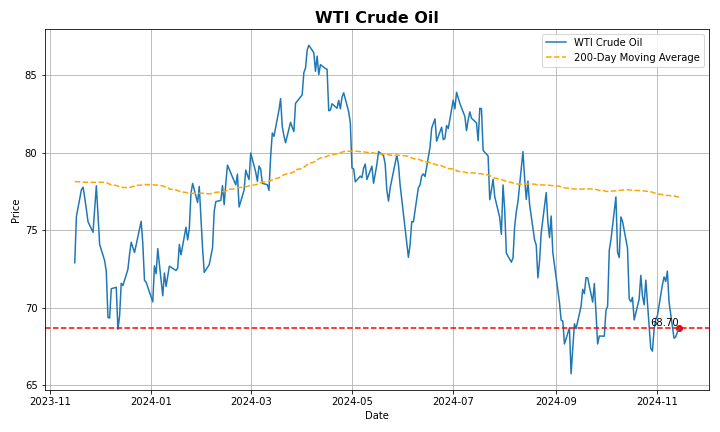

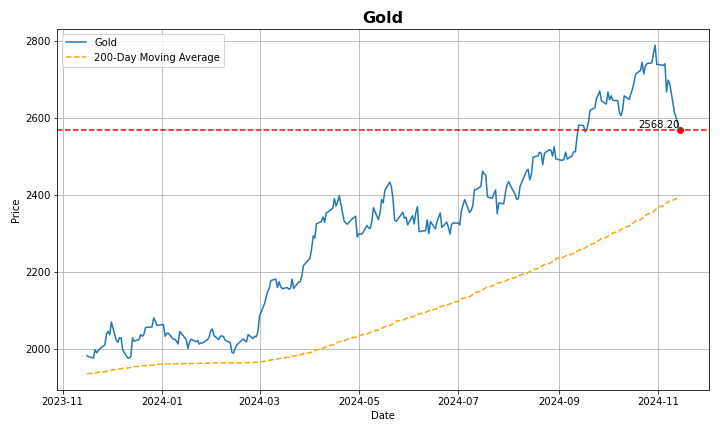

The CRB Commodity Index fell to 336 points from a one-month high of 341 following Donald Trump’s US election victory. WTI crude dropped below $70 per barrel, pressured by China’s subdued demand outlook. In contrast, U.S. natural gas futures surged over 6% due to storm Rafael's impact on Gulf of Mexico production. Meanwhile, Gold slid below $2,670 per ounce as markets anticipated U.S. inflation data and Federal Reserve speeches, assessing interest rate path under Trump’s presidency. Moreover, Silver fell to $31.3 per ounce amid concerns over limited Chinese stimulus and a higher U.S. rate outlook. Among grains, soybean futures climbed above $10 per bushel, driven by fears of new U.S.-China trade barriers. Meanwhile, wheat futures dipped to $5.6 per bushel following a lackluster USDA report with marginal changes.

WTI crude oil futures declined 2.4% to settle at $67 per barrel on Friday, booking a weekly loss of 5%, pressure by concerns over China’s waning demand and stronger US dollar. China’s crude processing dropped 4.6% in October, reflecting slower factory output and persistent demand issues. Additionally, the IEA and OPEC both revised down their global demand growth forecasts, with the IEA predicting a 1 million barrel per day supply surplus in 2025. OPEC also cut its 2023 and 2025 demand outlooks, citing weakness in key markets like China and India. Further weighing on prices is the stronger US dollar, which surged to a 2-year high, reducing the appeal of dollar-priced commodities. Data from the US Energy Information Administration showed that US crude inventories rose by 2.1 million barrels last week, exceeding expectations of a 1.9 million-barrel rise.

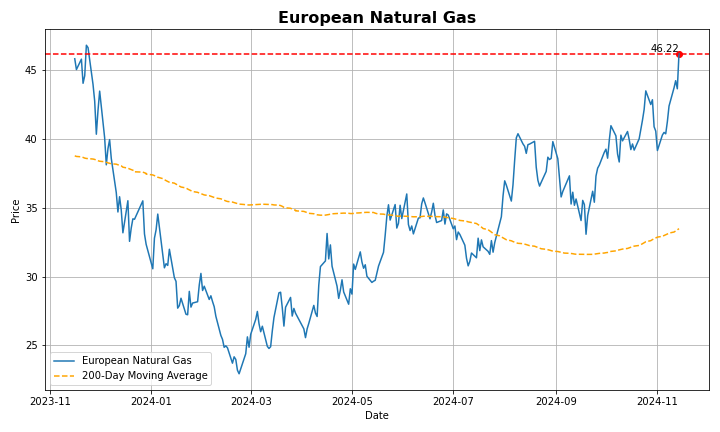

European natural gas futures have been trading around €45 per megawatt-hour, close to their highest level since November 2023, as colder weather increases demand. The drop in temperatures, combined with weak wind power output, has pushed up gas consumption for electricity. Forecasts show temperatures staying in the low single digits until late December. Gas storage withdrawals have been ongoing since November 3, with European reserves at 93.04% full. Concerns over a potential end to the Russia-Ukraine gas transit deal also add to market uncertainty. Despite this, gas supplies from Norway and LNG cargoes remain steady. Slovakia's SPP is taking steps to secure its supply, including a pilot deal with Azerbaijan's SOCAR, in case Ukrainian transit ends.

Gold traded around $2,560 per ounce on Friday, heading for its worst weekly performance since June 2021 driven by a strong US dollar and reduced expectations for Federal Reserve rate cuts, which weakened the appeal of non-interest-bearing gold. On Thursday, Federal Reserve Chair Powell indicated that there was no immediate need to lower interest rates, pointing to a resilient economy, a robust labor market, and persistent inflation. Powell’s stance aligns with other Fed officials advocating for a cautious approach to monetary policy adjustments. Following his remarks, market confidence in a December rate cut diminished, with traders now assigning a 58% probability, down from 80% prior to the speech. Additionally, investors believe that Trump’s incoming administration could push for higher trade tariffs, tax cuts, and increased deficit spending, which may drive inflation higher, further limiting the Fed's ability to reduce borrowing costs.

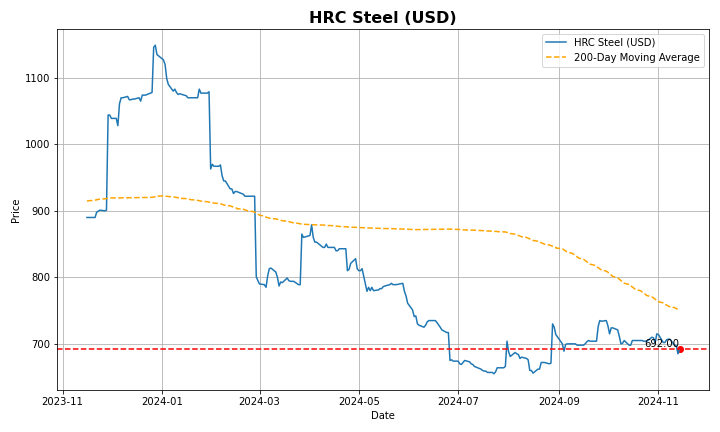

Steel rebar futures fell to CNY 3,180 per tonne in November, the lowest in one-and-a-half months, as fresh evidence of high supply pressed against a pessimistic outlook for demand. New data showed that steel production in China rose for the first time in four months to 81.9 million tons in October, despite low orders from domestic consumers. Consequently, Chinese mills have flooded export markets despite growing trade barriers by other governments, with exports in the period rising to 11.2 million tons, the second-highest on record. In turn, Beijing passed a $1.4 trillion debt package for local governments to swap out hidden debt and lower their financing costs to stimulate the economy, but the lack of new direct stimulus flows limited hopes that demand would rise enough to spur new manufacturing and construction activity. The low demand for housing and property investment in China jeopardizes the health of major Chinese developers, among the largest steel consumers in the world.

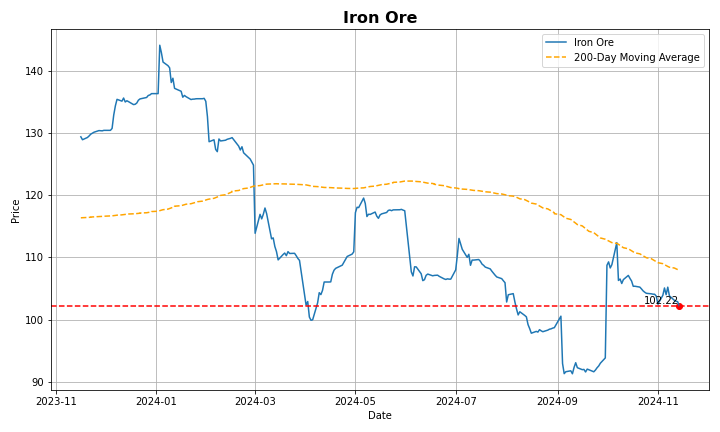

Iron ore prices for cargoes with 62% iron content slipped toward $102 per tonne, weighed down by persistent weakness in China’s property sector, which is a key driver of the country’s steel consumption. Data revealed that property investment in China dropped by 10.3% in the first 10 months of the year, while new home prices in October saw their largest decline in over nine years. Earlier this week, China’s finance ministry unveiled tax incentives for home and land transactions in a bid to support the struggling property sector, but the move failed to spark investor optimism. On the supply side, ANZ reported that iron ore shipments from Australia’s key terminal, Port Holland, reached 45.6 million tonnes in October, bringing the year-to-date total to 472.3 million tonnes—its highest level in four years. Meanwhile, an industry report highlighted that iron ore stockpiles at Chinese ports have been rising, driven by passive restocking from portside traders.

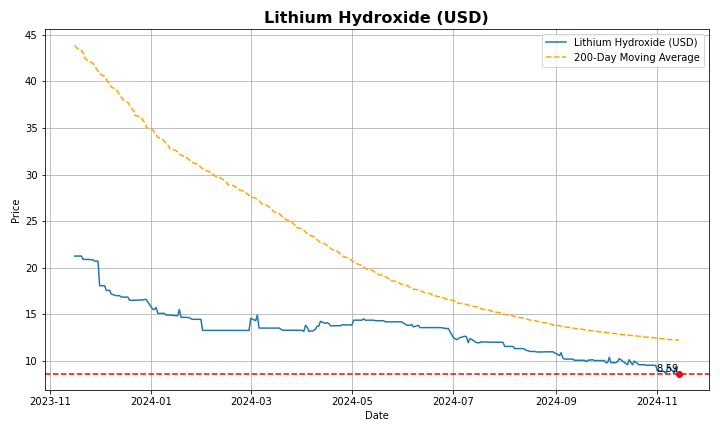

Lithium carbonate prices have stabilized since hitting a three-year low of CNY 71,500 per tonne in late October, driven by overcapacity in China’s electric vehicle (EV) battery sector. Producers reduced input prices across the supply chain as government subsidies fueled a surge in EV battery oversupply. This oversupply caused lithium carbonate prices to drop 23% year-to-date, following an 80% plunge in 2023. Despite the surplus, global supply is projected to rise by nearly 50% this year, as producers pursue new projects in anticipation of future market equilibrium. Chile announced plans to double output over the next decade, while China expanded its presence in Africa to secure battery metals. Additionally, Rio Tinto entered the lithium market with a $6.7 billion acquisition of U.S.-based Arcadium Lithium. Weighing further on prices, the EU imposed tariffs of 17% to 36.3% on EVs manufactured in China.

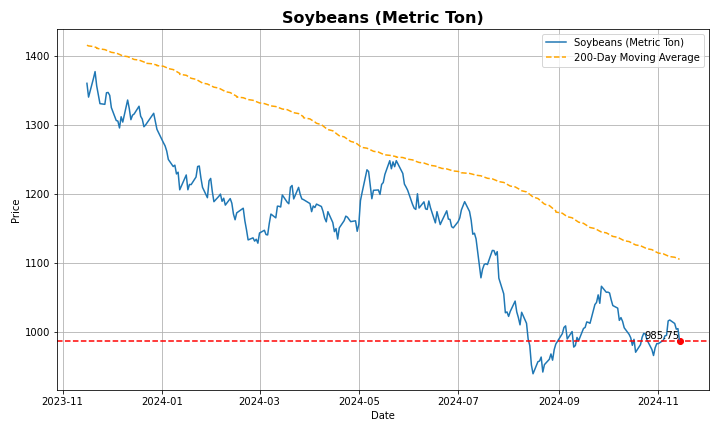

Soybean futures fell below $10 per bushel from a one-month high of $10.3, on expectations of lower demand amid unfavorable environment for biofuel industry under new Trum administration. President-elect Donald Trump’s nominee for the U.S. Environmental Protection Agency (EPA) head, Lee Zeldin is expected to weaken the Renewable Fuel Standard Program that requires transportation fuel sold in the United States to contain a minimum volume of renewable fuels. Additionally, China, the world’s top soybean importer, is expected to cut its imports by 9.5% for the marketing year ending September 2025, lowering demand from 109.4 million metric tons to 98.8 million tons. Chinese buyers have been stockpiling ahead of the U.S. election, anticipating that trade tensions with the U.S. may worsen under Trump’s return. Meanwhile, Russian wheat exports have also slowed, as demand remains weak and a new export regulation is introduced to curb domestic price hikes.

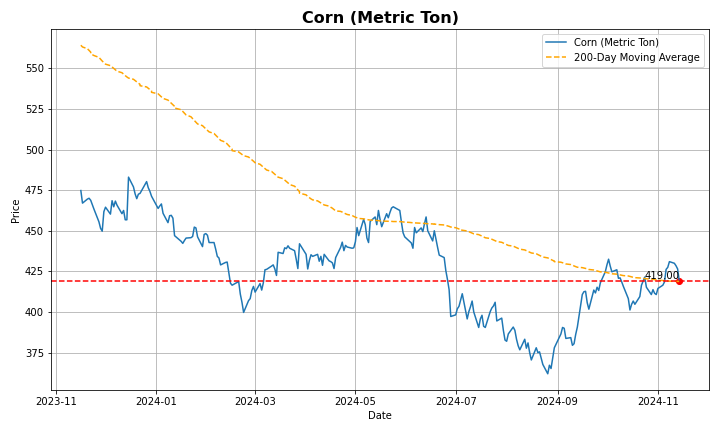

Corn futures held around $4.30 per bushel, close to the one-month high of $4.31 seen November 8th, amid expectations of reduced supplies in the U.S. The USDA's November WASDE report lowered U.S. corn yield to 183.1 bushels per acre, down from October's 183.8 bushels, reducing total production by 60 million bushels to 15.143 billion for the 2024/25 marketing year. This adjustment reflects the impact of late-season dryness in the Midwest, which affected yields. Although the USDA also reduced its ending stocks forecast for 2024/25 to 1.9 billion bushels, the stocks remain relatively comfortable compared to historical levels. Furthermore, the global supply situation is tightening, with reduced production forecasts for major producers, such as Brazil and Ukraine, adding to upward pressure on prices. However, trade uncertainties and the potential for tariffs under the new U.S. administration tempered market expectations for demand.

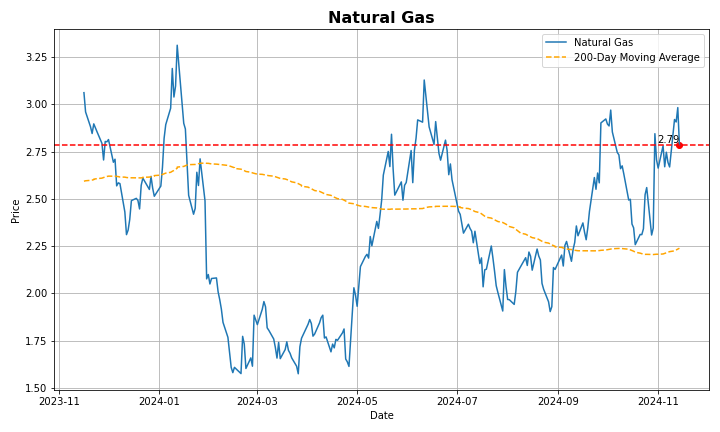

US natural gas futures US natural gas futures fell toward $2.8/MMBtu after the EIA's storage build report showed supply remains robust. While US utilities added 42 billion cubic feet of natural gas into storage last week, slightly below the expected 43 bcf build, gas in storage is now 6.1% above the seasonal norm. This marks the fourth consecutive week of above-average storage builds, a trend not observed since October 2022. While heating demand is expected to increase later in November as colder weather sets in, forecasts indicate warmer-than-usual conditions through November 20, with temperatures nearing average from November 21-27. Production has also dropped, with average output in the Lower 48 states at 100.0 bcfd so far in November, down from 101.3 bcfd in October. The recent decline, which saw production hit a nine-month low of 98.3 bcfd on Tuesday, was partly due to disruptions from Hurricane Rafael impacting the Gulf of Mexico.

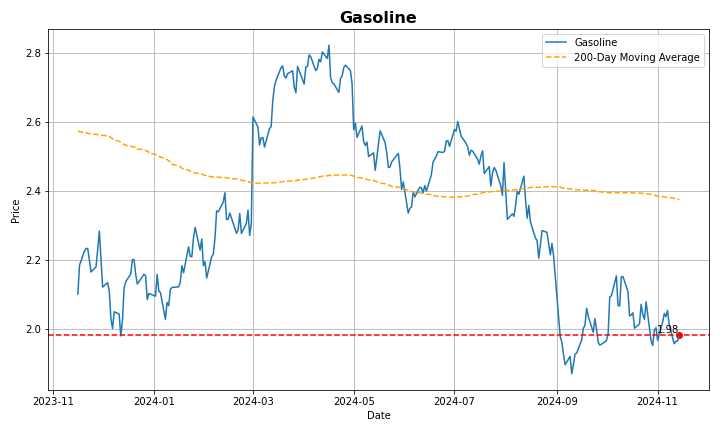

US gasoline futures held around $2 per gallon, pressured by falling oil prices and reduced seasonal demand as colder weather sets in. Gasoline prices largely follow crude oil trends, which remain below $70 per barrel due to record-high US oil production and weak demand from China's slowing economy. In August 2024, US oil output reached an unprecedented 13.4 million barrels per day. Despite this, US gasoline inventories dropped by 4.4 million barrels last week, according to the Energy Information Administration, contrary to analysts' expectations of a 600,000-barrel increase. The total stockpile of 206.9 million barrels is the lowest seen since November 2022.

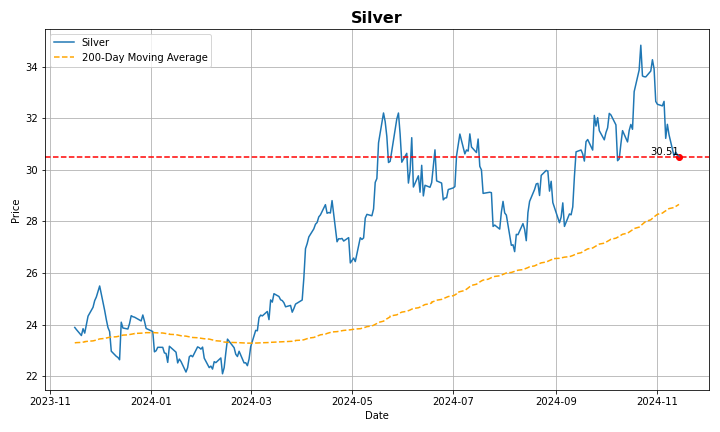

Silver prices stabilized around $30.30 per ounce on Friday but were still on track to post a fourth consecutive weekly decline, as a strengthening US dollar continued to weigh on the precious metal. The dollar’s rally was driven by expectations of fewer Federal Reserve rate cuts, following comments from Fed Chair Jerome Powell on Thursday. Powell indicated that the central bank is in no rush to lower rates, citing a strong economy, a solid labor market, and persistent inflation. In response, markets sharply reduced the probability of a quarter-point rate cut at the Fed's December meeting, with the odds dropping to around 59%, down from 82.5% the previous day. Silver also faced additional pressure from Donald Trump’s election victory, as markets anticipated inflationary policies and a more aggressive stance toward China, which could dampen demand for the metal. Meanwhile, mixed economic data from China further clouded the demand outlook in the world’s top consumer of metals.

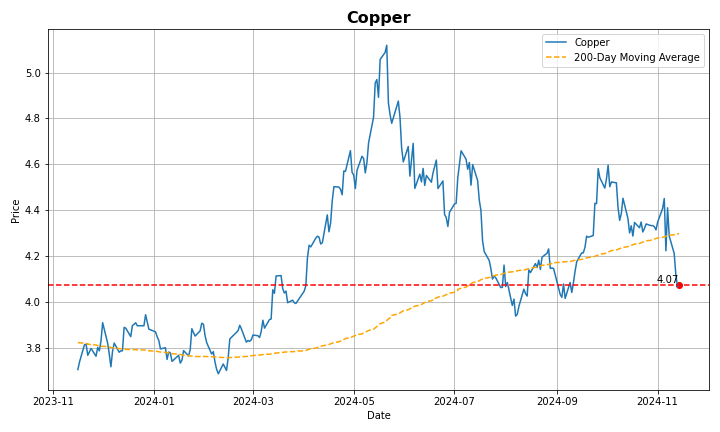

Copper futures stabilized around $4.08 per pound on Friday but were still on track for their worst weekly performance in four months, weighed down by persistent demand concerns and a strengthening US dollar. Investors were disappointed by Beijing’s latest support measures aimed at stabilizing the economy, despite the finance ministry unveiling tax incentives for home and land transactions on Wednesday. Eagle Metal International, a major copper importer in China, emphasized that more robust economic stimulus is needed to bolster copper demand in the country. Adding to the pressure, Chinese economic data for October came in mixed, further clouding the demand outlook in the world's top metals consumer. Meanwhile, the US dollar continued to rally after Federal Reserve Chair Jerome Powell signaled that the central bank is in no hurry to cut interest rates, citing the strength of the US economy.

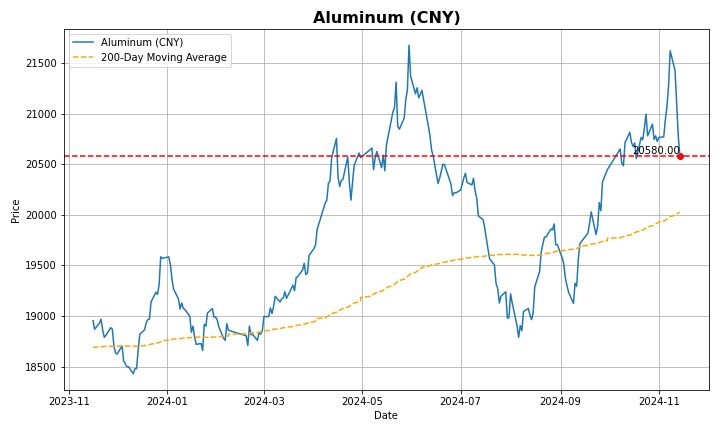

Aluminum futures fell to $2,625 per tonne from the five-month high of $2,710 touched on November 8th and tracking the decline in other base metals after China refrained from delivering targeted stimulus injections. China announced a $1.4 trillion package for local governments to swap off-balance sheet debt with Beijing and aid their access to better financing, but refrained from targeting flows to specifically stimulate consumption, driving markets to pare expectations of more aggressive measures that would aid manufacturing demand. Still, aluminum continued to outperform other base metals in the year as a supply crisis for alumina lifted inputs for producers. In the meantime, bauxite prices approached a record high as Guinea blocked Emirates Global Aluminum’s exports from the country. The halt from the world’s top miner added to lower bauxite output from Australia and Jamaica, squeezing Chinese smelters out of their supply and reducing ore inventory to its lowest since 2015.

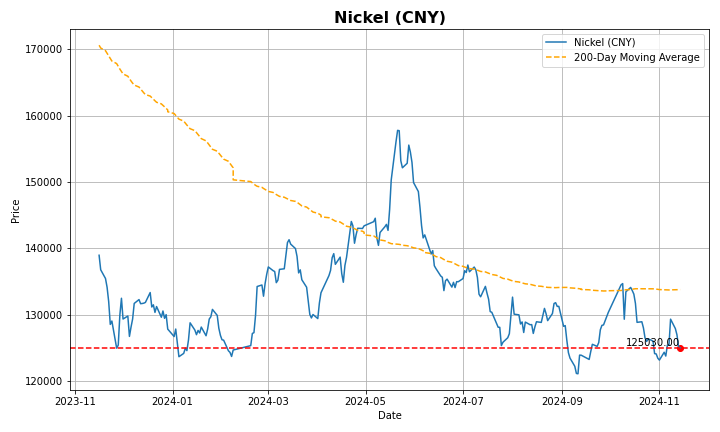

Nickel futures dropped below $15,800 per ton, marking a 2-week low, following declines in other base metals, as the market reacted to a lack of strong stimulus from China. Despite the government announcing a CNY 10 trillion debt swap package to help local governments manage debt and access cheaper loans, investors were disappointed by the limited impact on manufacturing, which dampened expectations for industrial demand, including nickel. Still, nickel prices remain above the October low of $15,730 due to supply concerns from Indonesia, the world’s largest nickel supplier. Indonesia is facing challenges with issuing mining licenses, and many smelters are turning to imports from the Philippines. Additionally, Indonesia plans to expand its export bans, including nickel ore, which could further tighten global supply.

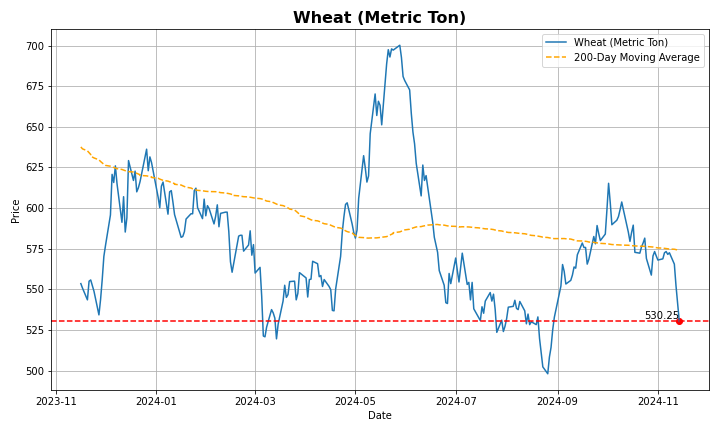

Wheat futures slipped below $5.4 per bushel, marking a 10-week low as the U.S. dollar surged to its strongest level since May, while rain in U.S. cropping areas improved the supply outlook. The Commodity Weather Group forecast significant moisture for U.S. wheat regions affected by dryness, while rainfall in the Black Sea, a major wheat export hub facing drought conditions, is expected to support next year’s crop. The USDA reported that 44% of U.S. winter wheat is rated good to excellent, a 3-point improvement following recent rains. Meanwhile, Russia, the world’s leading wheat exporter, has shipped grain at near-record levels despite low prices and domestic restrictions, reaching 45% of its estimated 60 million-ton export capacity this season. In contrast, EU wheat exports dropped 30% year-over-year to 8.34 million tons by November 10.

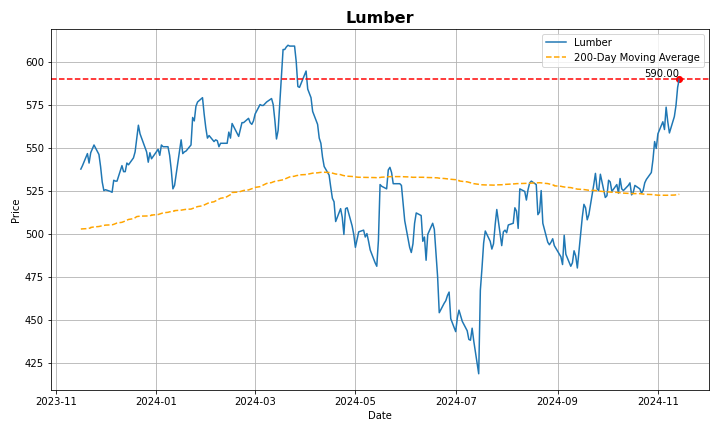

Lumber prices surged to $610 per thousand board feet, marking an eight-month high amid concerns of supply and evidence of steady demand. The outlook on supply out of Canada took a hit after Canfor’s mill shut down and Western Forest Products curtailed output, reducing North American lumber capacity by over 3 billion board feet in 2024. The developments added to supply pressured driven by infestations in North America and export restrictions out of Russia. On the demand front, Canadian building permits soared by 11.5% from the previous month in September, well above expectations of a 1.7% increase.

Source: tradingeconomics.com, LSEG Workspace, Ventum Financial

© 2018-2023 Refinitiv. All rights reserved. Republication or redistribution of Refinitiv content, including by framing or similar means, is prohibited without the prior written consent of Refinitiv. Refinitiv and the Refinitiv logo are trademarks of Refinitiv and its affiliated companies .Ventum Financial Corp.

www.ventumfinancial.com

Participants of all Canadian Marketplaces. Members: Canadian Investment Regulatory Organization, Canadian Investor Protection Fund and AdvantageBC International Business Centre - Vancouver. Estimates and projections contained herein are our own and are based on assumptions which. we believe to be reasonable. Information presented herein, while obtained from sources we believe to be reliable, is not guaranteed either as to accuracy or completeness, nor in providing it does Ventum Financial Corp. assume any responsibility or liability. This information is given as of the date appearing on this report, and Ventum Financial Corp. assumes no obligation to update the information or advise on further developments relating to securities. Ventum Financial Corp. and its affiliates, as well as their respective partners, directors, shareholders, and employees may have a position in the securities mentioned herein and may make purchases and/or sales from time to time. Ventum Financial Corp. may act, or may have acted in the past, as a financial advisor, fiscal agent or underwriter for certain of the companies mentioned herein and may receive, or may have received, a remuneration for their services from those companies. This report is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities and is intended for distribution only in those jurisdictions where Ventum Financial Corp. is registered as an advisor or a dealer in securities. Any distribution or dissemination of this report in any other jurisdiction is strictly prohibited. For further disclosure information, reader is referred to the disclosure section of our website.

COMMITTED TO SUCCESS

We value the partnership we have with our clients, our employees and our regulators. We see ourselves as partners and that approach has helped us become one of Canada’s leading independent investment dealers.

Ventum Financial Corp. is a licensed broker-dealer operating in all provinces and territories of Canada. We are proud members of the Canadian Investment Regulatory Organization and participate in the Canadian Investor Protection Fund. It is important to note that the content of our website is not intended, and should not be construed, as a solicitation of customers or business in any jurisdiction where we are not registered as a dealer in securities. Our commitment is to operate within the regulatory framework to ensure transparency, protection, and adherence to industry standards.